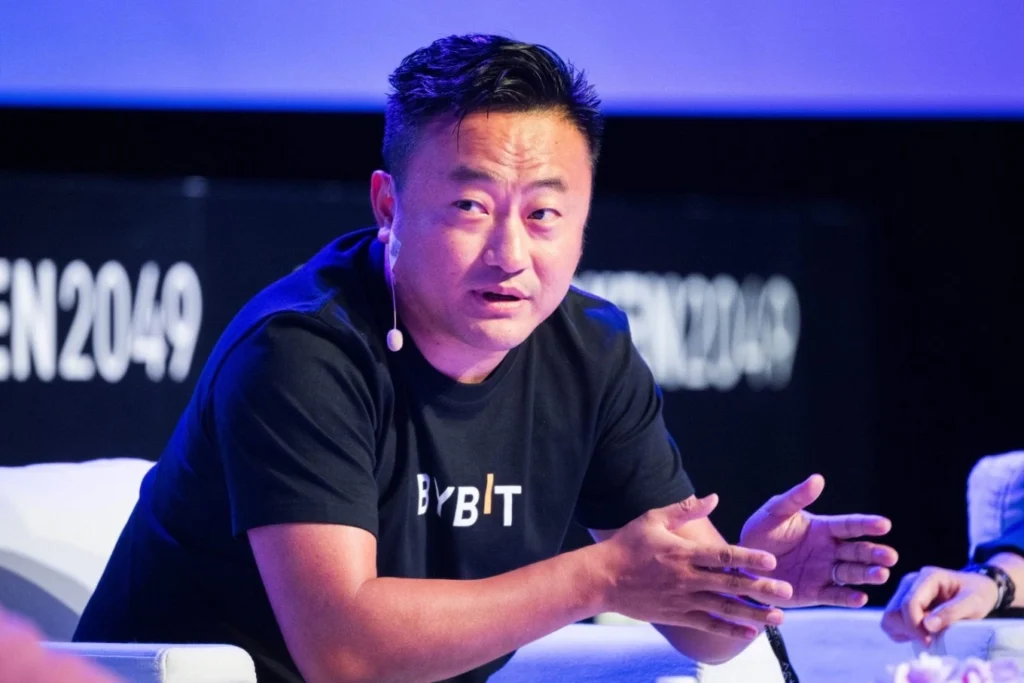

Who is Ben Zhou ?

Ben Zhou is the founder and CEO of Bybit, now considered the second largest cryptocurrency exchange in the world by trading volume. The Singapore-based platform brings together more than 74 million users across over 160 countries. In simple terms, approximately one in eight crypto enthusiasts worldwide uses Bybit.

Born in 1990 in Hangzhou (China), Ben Zhou grew up in an environment marked by relocations and cultural adaptation. At the age of 11, his family moved to New Zealand. This change taught him resilience and adaptability from an early age—qualities that would prove essential in his career and in managing crises in the crypto sector.

Ben Zhou and his family background

Ben Zhou’s parents instilled in him values of hard work and perseverance, while encouraging his passion for baseball, which he played through university. This sport taught him team spirit and discipline—qualities he now applies to managing Bybit and navigating major industry crises.

After completing his secondary education in New Zealand, he moved to the United States. In 2010, he earned a degree in economics from Earlham College. This education provided him with a solid understanding of financial markets and global economic mechanisms, forming the foundation of his strategic vision for Bybit.

What is Ben Zhou’s professional background ?

Ben Zhou’s career path demonstrates how expertise in traditional finance can be leveraged to build an innovative company like Bybit. His multicultural experience—in China, New Zealand, and the United States—gave him a global perspective. This openness helped him design a trading platform tailored for traders worldwide.

Ben Zhou at XM : 7 crucial years in Forex and CFDs

After his studies, Ben Zhou returned to China and joined XM, one of the world’s largest forex brokers and CFD providers. From 2010 to 2017, he held the position of General Manager for Greater China. This experience marked a major turning point in his career.

At XM, he developed expertise in sophisticated trading systems and learned to master the complex dynamics of international markets. He also gained an intuitive understanding of risk management strategies and recognized the importance of quality customer service in finance.

His immersion in CFDs (Contracts for Difference) proved decisive. These financial instruments, similar to crypto derivatives, foreshadowed the products he would later develop with Bybit.

Discovering cryptocurrencies and the birth of Bybit

In 2016, a friend introduced Ben Zhou to blockchain and the then-nascent world of cryptocurrencies. Attracted by their potential, he quickly became interested in trading these digital assets. The following year, as crypto prices soared, he noticed that the general public still knew little about this industry.

To raise awareness and educate people, he created a YouTube channel and used WeChat to share his analyses. His community grew to nearly 20,000 subscribers in just a few months. Armed with this experience and the skills acquired at XM, he co-founded Bybit in March 2018. His goal was clear : to offer a platform specializing in crypto derivatives with high standards for service and innovation.

The story of Bybit and its creation : How Ben Zhou revolutionized crypto trading

In March 2018, Ben Zhou founded Bybit, a platform dedicated to cryptocurrency derivatives trading. From its launch, Bybit distinguished itself with a simple promise : to offer a smooth trading experience with an intuitive interface and responsive customer service. While many exchanges focused solely on technology, Ben Zhou chose to integrate the human dimension and reliability as pillars for growth.

In less than seven years, Bybit established itself as one of the industry’s global leaders. By 2025, the platform boasts over 74 million users across 160 countries. This success reflects not only Ben Zhou’s strategic vision but also his ability to anticipate the needs of international traders. Bybit is no longer simply a crypto exchange; it has become a global benchmark for digital trading.

The growth of Bybit (2019 to present)

Since 2019, Bybit has experienced impressive growth. That year, the platform already captured 10% of global Bitcoin volume and organized the “BTC Brawl” tournament. In 2020, it exceeded $4 billion in daily volume, cementing its position among the leaders in crypto trading.

In 2021, Bybit surpassed 15 million users and signed a strategic partnership with Red Bull Racing. That same year, it launched its native token, BitDAO (BIT). Governed by its community, it offers benefits to holders and quickly became one of the most influential projects in decentralized finance (DeFi).

The progress continued. In 2024, Bybit innovated with bbSOL, the first Liquid Staking Token backed by an exchange. This product confirmed its commitment to being a pioneering player in the industry, capable of combining security, innovation, and new blockchain uses.

By 2025, Bybit exceeded 74 million users and established itself as an essential global platform. Its growth reflects both Ben Zhou’s vision and the company’s ability to anticipate the expectations of traders, whether retail or institutional.

Bybit TradFi 2025 : Expansion into CFDs and traditional markets

In 2025, Ben Zhou launched Bybit TradFi, an initiative marking a strategic turning point for the platform. The objective is to integrate traditional financial markets into the Bybit ecosystem and offer users broader access to investment opportunities.

With Bybit TradFi, traders can now exchange gold, precious metals, tokenized stocks like Apple or Tesla, as well as stock indices and traditional forex. This diversification positions Bybit at the frontier between decentralized finance and traditional finance.

Ben Zhou also announced that Bybit would obtain a European license for CFDs within six months. This expansion draws directly on his seven years of expertise in forex and CFDs at XM. In parallel, the platform has deployed a wealth management offering that already exceeds $150 million in assets under management. Clients benefit from personalized portfolios and solutions tailored to wealthy investors.

With TradFi, Bybit is no longer limited to crypto trading. The platform has become a complete financial infrastructure, capable of meeting the needs of both individuals and institutional investors.

Bybit Hack 2025 : Exemplary crisis management

On February 21, 2025, Bybit suffered the largest hack in cryptocurrency history. More than $1.5 billion was stolen by the Lazarus group from North Korea. This event could have permanently shaken the platform.

Ben Zhou’s response stood out for its speed and transparency. Less than 30 minutes after the attack, he published an initial communication on X (Twitter). An hour later, he launched a two-hour livestream to explain the situation in real-time. Within just 12 hours, Bybit fully restored withdrawals, processing more than 350,000 requests.

The results of this management were remarkable : recovery of 88% of stolen funds (about $1.23 billion out of $1.4 billion), maintenance of a 1 : 1 proof of reserves, and validation of solvency through an independent audit. Far from destroying trust, this crisis demonstrated Bybit’s maturity and Ben Zhou’s leadership in a sector still often perceived as risky.

This episode transformed a potential disaster into a case study in crisis management, strengthening Bybit’s reputation as an exchange capable of facing the most extreme challenges.

Bybit in 2025 : Return to the European market

In 2025, Bybit returned to Europe with the launch of Bybit.eu. The platform now complies with MiCAR (Markets in Crypto-Assets Regulation). This return was crucial : the exchange had to withdraw from certain countries, including France. French users had lost access to the platform overnight due to lack of compliance with local regulations.

The new entity, Bybit EU GmbH, is based in Vienna (Austria). In late May 2025, it obtained a MiCAR license issued by the FMA, Austria’s financial market authority. This European passport now allows Bybit to operate legally in 29 countries and cover a market of more than 450 million inhabitants.

For Ben Zhou, this evolution goes beyond simple administrative regularization. It gives Bybit institutional legitimacy and strengthens user confidence. By complying with MiCAR, the platform sends a clear signal : more security, more transparency, and investor protection aligned with European standards.

What is Ben Zhou’s net worth ?

The evolution of Ben Zhou’s fortune reflects that of the cryptocurrency market. In 2022, it was estimated at $45.5 million, already a sign of Bybit’s initial success. Three years later, in 2025, his net worth reached approximately $2 billion, a more than 40-fold increase in record time.

This growth is largely explained by Bybit’s valuation, of which he owns a significant share. But his role as a crypto trading expert and his status as CEO also allow him to diversify his income through conferences, investments in blockchain and fintech, as well as stakes in DeFi and crypto security.

Today, Ben Zhou ranks among the wealthiest entrepreneurs in the industry, alongside Changpeng Zhao or the Winklevoss brothers. He also continues to give conferences to raise public awareness about opportunities in the cryptocurrency industry.

Ben Zhou and his mysterious investments

While Ben Zhou is transparent about the management of Bybit, his personal investments remain much more discreet. This opacity is intriguing in an industry where he advocates for transparency, and fuels numerous speculations.

He actively invests in the blockchain ecosystem, particularly in DeFi startups, crypto security solutions, and blockchain infrastructure. But one of the most persistent rumors concerns his alleged ties to ZoomEX, a crypto trading platform founded in 2021. ZoomEX claims to have more than 3 million users across 35 countries and offers over 600 trading pairs.

However, no official confirmation has ever been given by Ben Zhou or Bybit regarding his involvement. A potential involvement would raise questions about conflicts of interest with Bybit. The timing is also questionable : ZoomEX was created three years after Bybit, which would require a clear explanation of his motivations. To maintain his image as a transparent leader, Ben Zhou might need to more openly disclose his significant investments.

The vision of entrepreneur Ben Zhou : “Rewrite Your Success, Reshape The Standard”

During his mid-2025 keynote, Ben Zhou presented his vision under the theme “Rewrite Your Success, Reshape The Standard”. Three pillars structured his speech, followed by hundreds of thousands of viewers, revealing his ambitions for Bybit and the crypto industry.

The first pillar, Trust, is based on operational transparency, regular independent audits, and proactive communication with the community. The second, Liquidity, emphasizes trading efficiency, with partnerships with top market makers, product innovation, and openness to traditional markets.

The third pillar, Web3, translates his vision of a future where blockchain integrates with real-world uses. He advocates for collaboration between stakeholders and the development of concrete applications. This approach positions Bybit as a complete financial infrastructure, at the intersection of traditional and decentralized finance.

To share his announcements and statements, Ben Zhou actively uses social media. He has a Twitter/X account and a LinkedIn account, while Bybit’s YouTube channel remains highly followed.

On Twitter/X (@benbybit), he has over 100,000 followers. This account has become an important source of information for the crypto community. He regularly responds to messages and adopts a direct tone, far from overly institutional communication.

On LinkedIn, he publishes content aimed at a broader audience, including institutional investors and financial decision-makers. His posts cover his conferences, keynotes, and the evolution of Bybit. His live interventions, such as “Keynote with Ben,” attract hundreds of thousands of viewers and influence discussions about the future of decentralized finance.

Key takeaways about Ben Zhou

Ben Zhou perfectly illustrates the evolution of cryptocurrencies, from an experimental sector to a genuine financial industry. His journey, from General Manager at XM to CEO of Bybit, shows how experience in traditional finance can be applied to blockchain innovation.

His exemplary management of the 2025 crisis not only saved Bybit but also set a new standard of responsibility for the entire sector. With a fortune estimated at $2 billion and a platform serving more than 74 million users, he remains a key figure in decentralized finance.

As Bybit continues its expansion with TradFi and the crypto ecosystem matures, Ben Zhou, at just 35 years old, continues to shape the future of the sector. His influence extends far beyond Bybit and inspires a new generation of entrepreneurs.