Hyperliquid (HYPE) : The High-Speed DEX Redefining DeFi Trading in 2026

Discover how Hyperliquid revolutionizes perpetual futures trading with its high-performance Layer-1 blockchain, unique community approach, and innovative features.

Discover how Hyperliquid revolutionizes perpetual futures trading with its high-performance Layer-1 blockchain, unique community approach, and innovative features.

Hyperliquid isn’t just another DEX in the saturated DeFi ecosystem. It’s a high-performance Layer-1 blockchain specifically designed to create a fully on-chain open financial system. This fundamentally different approach immediately sets it apart from the competition.

What if you could trade with the efficiency of a CEX while maintaining complete control of your funds? That’s exactly what Hyperliquid offers. Unlike platforms like dYdX or Perpetual Protocol built on existing blockchains (Ethereum, Solana, etc.), Hyperliquid made the bold choice to develop its own blockchain infrastructure. This strategic decision isn’t trivial: it allows optimization of every aspect of the architecture to meet the specific requirements of perpetual futures contract trading.

“Hyperliquid represents the natural evolution of decentralized exchanges, combining DeFi security with the performance of centralized platforms.”

The fundamental concept driving Hyperliquid is based on the seamless integration of liquidity, user applications, and trading activity into a unified system. This holistic approach aims to encompass all aspects of decentralized finance while providing a user experience comparable to centralized platforms in terms of speed and efficiency.

The true revolution of Hyperliquid lies in its ability to bridge the technological gap that has until now separated DEXs from CEXs. Here are the pillars of its value proposition :

In the current cryptocurrency landscape, Hyperliquid also stands out for its strategic positioning. While many projects focus on specific niches, Hyperliquid adopts a more global vision by seeking to fundamentally transform how digital assets are exchanged.

This ambition translates into rapid growth and significant adoption, as evidenced by its market capitalization ranging between $4.19 and $4.79 billion as of April 1, 2025. Placing its HYPE token between 27th and 32nd place among all cryptocurrencies.

Hyperliquid’s blockchain architecture forms the foundation of its value proposition and largely explains its exceptional performance. This custom infrastructure relies on three main components that work in synergy to deliver an optimal trading experience.

At the heart of the system is HyperCore, a fully on-chain perpetual and spot order book system capable of processing up to 200,000 orders per second. This impressive capacity shatters the usual standards of traditional blockchains and approaches the performance of the most advanced centralized financial systems.

Did you know ? Hyperliquid can process up to 200,000 transactions per second, nearly 100 times more than the Ethereum blockchain.

One of the most remarkable features of HyperCore is its ability to execute every transaction, cancellation, and liquidation with complete transparency and finality in a single block, thus eliminating uncertainties related to multiple confirmations that often affect transactions on other blockchains.

The consensus mechanism securing this architecture is called HyperBFT, inspired by the Hotstuff protocol and its successors. This system guarantees :

HyperBFT uses a proof of stake mechanism to secure the network, where HYPE holders can participate in staking to contribute to network security while receiving rewards.

Complementing HyperCore, Hyperliquid has developed HyperEVM, an integrated Ethereum Virtual Machine (EVM) that allows developers to build smart contracts while benefiting from HyperBFT’s security and HyperCore’s liquidity.

This compatibility with the Ethereum ecosystem facilitates adoption by developers already familiar with this environment, while offering significantly superior performance. It’s a strategic bridge between the established Ethereum ecosystem and Hyperliquid’s advanced capabilities.

Several technical innovations distinguish Hyperliquid from its competitors :

This combination of advanced technical features allows Hyperliquid to offer an experience comparable to centralized exchanges while preserving the fundamental advantages of decentralization.

How can we explain that a platform launched less than 3 years ago already dominates 78.8% of the DEX futures market ? Hyperliquid’s figures tell a story of explosive growth that’s already making the industry’s centralized giants tremble. Let’s examine the statistics that illustrate this platform’s remarkable adoption.

Hyperliquid has established itself as the undisputed leader in decentralized futures contract exchanges :

This dominant position in the DEX futures segment illustrates the platform’s strong adoption by traders and investors, and shows that Hyperliquid has found exceptional product-market fit.

According to Hyperliquid’s official statistics, the platform has experienced remarkable adoption in a short time :

These figures are particularly impressive considering that the platform was launched in late 2022 and its token was only distributed in late 2024.

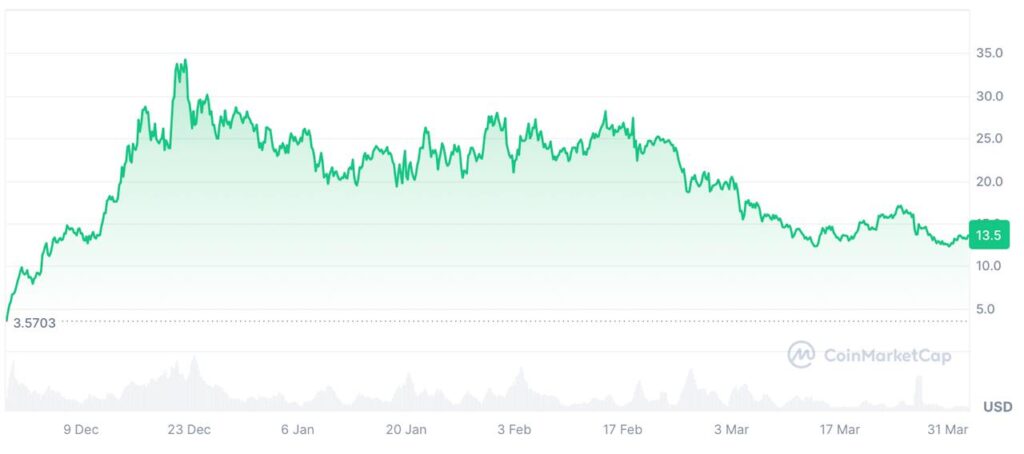

The journey of HYPE’s price since its launch demonstrates sustained interest in the project:

Did you know? The HYPE token experienced growth of over 500% in less than a month after its launch in late 2024.

Several key events marked this evolution :

The HYPE token presents a balanced tokenomics profile :

The initial distribution via an airdrop representing 31% of the total supply constitutes a particularly fair and community-oriented approach, creating a base of user-owners aligned with the project’s long-term interests.

The team behind Hyperliquid, known as Hyperliquid Labs, constitutes one of the project’s major assets. Composed of highly qualified professionals from prestigious institutions and leading companies, it brings diverse and complementary expertise that has played a crucial role in the platform’s development and success.

At the head of this team is Jeff Yan, co-founder and CEO of Hyperliquid. His background is impressive :

Alongside him, Iliensinc, also a Harvard graduate, brings complementary expertise in finance and blockchain technology. A classmate of Jeff, he collaborated with him in the field of market making before co-founding Hyperliquid.

Did you know? The Hyperliquid team chose to self-fund entirely, refusing any venture capital investment to stay aligned with the interests of its community.

What truly distinguishes Hyperliquid Labs in the crypto ecosystem is its self-funding approach. Unlike the vast majority of projects that raise funds from venture capital investors, the team chose to remain entirely self-funded.

This strategic decision presents several major advantages :

According to some sources, the team has never paid themselves salaries, demonstrating total commitment to the project and absolute confidence in its long-term potential.

The vision and philosophy guiding the Hyperliquid team are clearly defined and consistent :

This philosophy is reflected in the team’s strategic decisions, notably their choice to distribute a significant portion of tokens via a community airdrop rather than favoring institutional investors.

The extended Hyperliquid team includes experts from prestigious academic institutions such as Harvard, Caltech, MIT, and renowned companies like Citadel, Hudson River Trading, and Nuro.

This concentration of talent in mathematics, computer science, quantitative finance, and blockchain technology has enabled Hyperliquid to develop innovative technical solutions that push the boundaries of what was previously possible in DeFi.

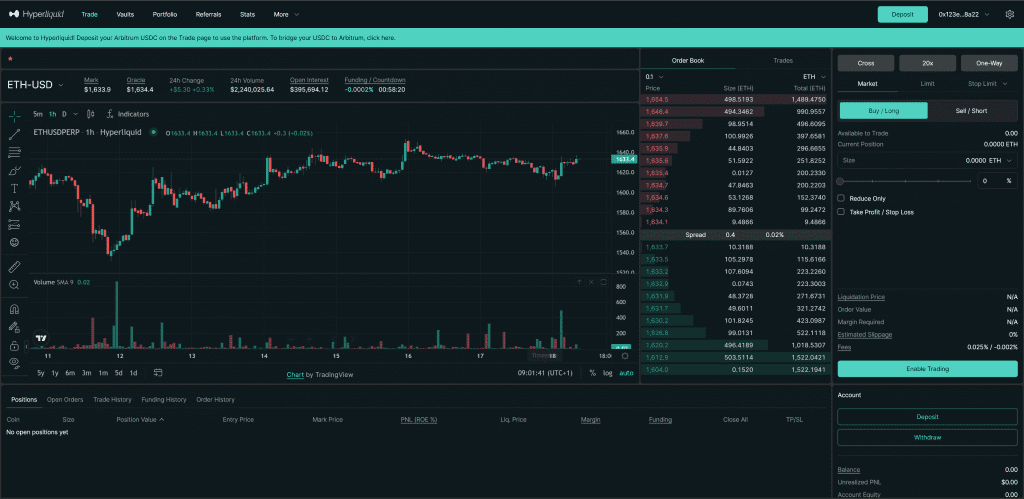

Why are professional traders massively migrating to Hyperliquid in 2025? Hyperliquid stands out with a set of advanced features that meet the needs of the most demanding traders while remaining accessible to new users. These technical and functional characteristics form the core of the platform’s value proposition.

One of Hyperliquid’s major innovations is the complete elimination of gas fees for transactions. In most blockchains, particularly Ethereum, users must pay gas fees for each transaction, which can represent a significant cost, especially during network congestion periods.

By removing these fees, Hyperliquid considerably reduces the total cost of trading and eliminates a significant barrier to the mass adoption of DeFi solutions. This feature is particularly appreciated by active traders who execute numerous transactions and market makers who frequently place and cancel orders.

Hyperliquid offers leverage of up to 50x, allowing traders to maximize their market exposure with limited capital. This feature, generally reserved for centralized platforms, is now available in a decentralized and transparent environment.

⚠️ Warning : Leverage amplifies both gains and losses. Never trade with money you cannot afford to lose.

While leverage amplifies both potential gains and losses, it offers experienced traders a powerful tool to execute sophisticated strategies and capitalize on short-term market movements.

Hyperliquid has introduced two innovative token standards that enrich its ecosystem :

These technical innovations contribute to creating a smoother and more efficient trading environment, particularly for new tokens and emerging projects.

Hyperliquid’s vault system enables deep on-chain liquidity and automated trading strategies. These vaults function as programmable liquidity pools that can execute predefined strategies, offering new possibilities for traders and liquidity providers.

The auction mechanism for token deployment constitutes a unique approach in the crypto ecosystem. This process uses an auction system to determine gas fees during the launch of new tokens, creating an efficient market mechanism that reflects the real demand for these new assets.

Scale orders allow users to set up sophisticated trading strategies by automatically placing multiple orders at different price levels. This feature, generally reserved for professional trading platforms, is particularly useful for market makers and traders who want to optimize their entry or exit of significant positions.

Good to know : Use Hyperliquid’s scale orders to optimize your average entry price when opening large positions.

Hyperliquid also supports trading of memecoins and pre-launch tokens, positioning the platform as a preferred hub for emerging assets and innovative projects.

Hyperliquid’s competitive fee structure also contributes to its attractiveness :

The buyback and burn mechanism allocates a portion of the revenue generated by the platform to buying back and destroying HYPE tokens, creating deflationary pressure that can support the token’s value in the long term.

Hyperliquid offers a diverse range of use cases that address the varied needs of participants in the cryptocurrency market. Here’s how you can benefit from this innovative platform today.

Hyperliquid’s primary use case is perpetual futures contract trading in a fully decentralized environment. If you’re an active trader, here are the key advantages you can leverage :

To get started, simply connect your compatible wallet, deposit assets via HyBridge, and you’re ready to trade.

Hyperliquid has become a platform of choice for launching and trading new tokens, particularly in the memecoin sector. If you’re a developer or an early-stage investor, you can :

This functionality is particularly relevant in the current context where memecoins and emerging tokens continue to generate significant interest in the crypto community.

Social and competitive trading represents an innovative use case developed by Hyperliquid. PVP.Trade, a Telegram bot integrated with the ecosystem, allows you to :

Good to know : Follow high-performing traders via PVP.Trade to observe their strategies before developing your own.

This social dimension of trading responds to a growing trend in the financial industry, where community aspects and peer learning are gaining importance.

HyBridge, Hyperliquid’s cross-chain bridging tool, facilitates interoperability between different blockchains. You can use it to :

In an increasingly fragmented crypto ecosystem across different blockchains, this interoperability capability constitutes a significant competitive advantage and a practical use case for users.

The competitive landscape in which Hyperliquid operates is complex and constantly evolving. Understanding how it positions itself against direct rivals and centralized giants (CEXs) helps to better grasp its unique value proposition.

Among Hyperliquid’s direct competitors in the perpetual futures DEX segment, several platforms stand out :

| Platform | Strengths | Limitations |

| Jupiter | Liquidity aggregation, execution optimization | Performance limited by the underlying blockchain |

| ApeX | Intuitive interface, social features | Fewer trading pairs, lower liquidity |

| Drift | Innovative mechanisms against liquidations | Limited leverage effect (up to 20x) |

| dYdX | Cosmos-based blockchain, first generation | Less smooth user experience, higher fees |

Despite the quality of these competitors, Hyperliquid maintains several decisive competitive advantages :

Against centralized giants like Binance, Kraken, or Bybit, Hyperliquid adopts a clear differentiation strategy :

Although CEXs retain certain advantages (notably in terms of global liquidity and diversity of trading pairs), Hyperliquid is rapidly closing the performance gap that traditionally existed between centralized and decentralized solutions.

Hyperliquid’s dominance in the DEX futures segment (78.8% market share) is explained by a unique combination of technical and community factors :

Technical differentiators :

Community differentiators :

This unique combination creates a virtuous circle where technical excellence attracts users, who in turn strengthen the platform’s liquidity and adoption.

Despite its promising outlook and impressive growth, Hyperliquid faces several significant risks and challenges that any potential investor or user should carefully evaluate.

In March 2025, Hyperliquid experienced a major security incident that resulted in a $170 million outflow of funds in 24 hours. This mechanism exploitation raised legitimate questions about the security of the platform’s smart contracts.

Warning : Despite security improvements, the March 2025 incident reminds us that even the most sophisticated protocols involve risks.

This event reminds us that even the most sophisticated protocols are not immune to vulnerabilities, especially in a field as complex as decentralized perpetual futures contracts.

Following this incident, the team :

Although these measures enhance security, the inherent risk in smart contracts remains a factor to seriously consider.

The regulatory framework surrounding cryptocurrencies and DeFi continues to evolve rapidly, with varying approaches across jurisdictions. Several regulatory risks weigh on Hyperliquid :

These regulatory risks could limit Hyperliquid’s geographical expansion and fragment its user base, potentially affecting liquidity and long-term adoption.

A significant portion of activity on Hyperliquid is related to the memecoin sector, which is particularly volatile and unpredictable. This sectoral concentration creates a vulnerability :

To mitigate this risk, Hyperliquid will need to diversify its use cases and attract traders interested in other segments of the crypto market.

Although the platform presents itself as decentralized, certain aspects of Hyperliquid retain residual centralization :

Other points of attention include :

These risks and challenges highlight the importance of a cautious and informed approach for potential Hyperliquid investors and users.

Hyperliquid’s future looks both promising and challenging, with an ambitious roadmap that could significantly transform the platform’s ecosystem and its positioning in the broader decentralized finance landscape.

Among the planned technological developments, the expansion of HyperEVM is at the top of the list. This evolution will include :

The launch of Hyperlend represents one of the most anticipated extensions of the ecosystem. This decentralized lending protocol, announced in December 2024, will complement existing trading features by enabling :

These developments are part of Hyperliquid’s broader vision to create a complete and high-performing decentralized financial ecosystem.

The evolution toward more decentralized governance constitutes a crucial development axis for Hyperliquid’s future. Planned steps include :

This transition to more participatory governance could strengthen community engagement and project legitimacy in the crypto ecosystem, while reducing risks related to residual centralization.

Institutional adoption represents a major opportunity for Hyperliquid’s future growth. Several factors favor this trend :

This institutional adoption could bring not only additional volumes but also increased legitimacy in the broader financial ecosystem.

Price predictions for the HYPE token are generally optimistic, though variable depending on sources :

These predictions depend on numerous factors, notably :

It’s important to note that these projections involve a significant margin of uncertainty and do not constitute investment advice.

After an in-depth analysis of Hyperliquid, its technology, team, adoption, and prospects, we can formulate a nuanced evaluation of this innovative project that has quickly made its mark on the cryptocurrency ecosystem.

Like any ambitious project, Hyperliquid has its advantages but also some disadvantages. Here’s a clear overview of its strengths and limitations to better form an opinion.

Major strengths :

Weaknesses to consider :

Léa is a member of the InvestX team, dedicated to guiding users through their learning journey. Passionate about cryptocurrencies, she closely follows market trends. On InvestX.fr, Léa writes articles to help readers decode the latest news and stay informed about the ever-evolving blockchain world.

Hyperliquid is built on its own Layer-1 blockchain designed for perpetual trading, with single-block finality and 200,000 TPS. Its fully on-chain order book, zero gas fees, and self-funding without VCs make it a radically different project in the DeFi ecosystem.

Simply connect a wallet like MetaMask, transfer funds via HyBridge, and explore the intuitive interface. Trading can be done with low leverage for a smooth start, while benefiting from a seamless environment and zero gas fees.

HYPE benefits from rapid adoption, a burn mechanism, and a strong positioning on DEX futures. However, the project remains exposed to risks related to security, regulation, and potential dilution. It is an asset to consider for diversification purposes.

The platform is user-friendly and offers comprehensive documentation, but its focus on leveraged perpetual trading makes it a more suitable environment for users already familiar with the fundamentals of crypto trading.

Favor moderate leverage, use stop-losses, and actively monitor your positions. Social trading via PVP.Trade can also offer inspiring strategies, provided you remain vigilant. Even without gas fees, each position must be carefully considered.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.