Are 76% of Binance’s top traders bullish on XRP? Should you follow?

76% of Binance's top traders are bullish on XRP. Could this signal a price surge? Discover the latest XRP analysis and potential targets.

76% of Binance's top traders are bullish on XRP. Could this signal a price surge? Discover the latest XRP analysis and potential targets.

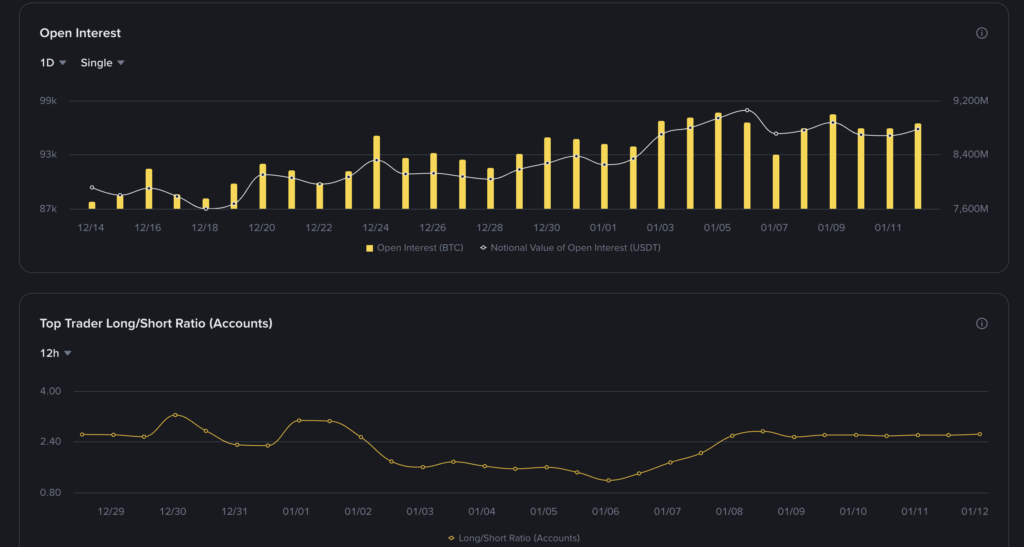

On-chain data is unequivocal: the top-performing traders on Binance have radically shifted their stance on XRP. According to the latest metrics, these sophisticated investors are now 300% more bullish than before. In concrete terms, this translates to massive buyer dominance, with 76% Long positions opened on the pair.

This Long/Short ratio is often interpreted as a leading indicator of future price direction. When “Smart Money” positions itself so aggressively on the buy side, it often precedes an intense volatility move. Unlike retail investors who may succumb to FOMO, these traders are potentially anticipating a major announcement or a key technical breakout.

However, such a concentration of bullish positions carries risks. If the market were to reverse sharply for a correction, it could trigger a cascade of liquidations, exacerbating the drop. But for now, momentum clearly appears to favor the bulls.

The major technical target is $3 by the end of January. To reach this level, XRP must confirm its breakout above 2 bearish order blocks on the daily chart. This is a difficult task to accomplish even if Binance traders remain bullish. Much higher volumes will be needed to break through these major resistance zones.

The crypto market is currently showing signs of recovery, as indicated by the increase in OI on the token, and XRP has historically proven its ability to deliver performance uncorrelated with Bitcoin.

Nevertheless, a retest of support at $1.95 remains most likely. And this will be crucial to maintain hopes for a new rally toward $2.56 and beyond.

The optimism of Binance traders is a powerful signal, but it doesn’t guarantee the absence of traps. In such a speculative market, a Bull Trap remains possible to ensnare latecomers before a genuine surge. Technical indicators like the RSI will need to be closely monitored to avoid buying a local top.

As January nears its end, the window of opportunity is narrowing. Will XRP manage to transform this derivatives enthusiasm into a genuine spot price rally, or will we witness a mere flash in the pan before a return to the current range?

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.