Bitcoin below $90k: Why the crypto market is crashing today?

Bitcoin dives below $90k! Discover why the crypto market is plummeting today. Get expert analysis on the crash, price predictions, and what's next.

Bitcoin dives below $90k! Discover why the crypto market is plummeting today. Get expert analysis on the crash, price predictions, and what's next.

The day is blood red across the entire ecosystem. Bitcoin (BTC), the market’s barometer, has shed nearly 3% to drop below the psychological threshold of $88,000. This movement acted as a massive sell signal for the rest of the sector, triggering a wave of red across traders’ dashboards.

But the pain is even more acute on the altcoin side. Ethereum (ETH), the leader in smart contracts, suffered a severe 6% correction, breaking its major support at $3,000. A drop that undermines confidence in DeFi and NFTs in the short term. Other heavyweights like XRP, Solana (SOL), TRON, and Monero were not spared, recording average losses of 4%.

This massive retracement movement comes as investor sentiment has turned to extreme caution with Trump’s new tariffs. The Fear & Greed Index, which was flirting with euphoria in recent weeks, is showing signs of nervousness. Selling volumes are accelerating, suggesting that “weak hands” are capitulating in the face of selling pressure.

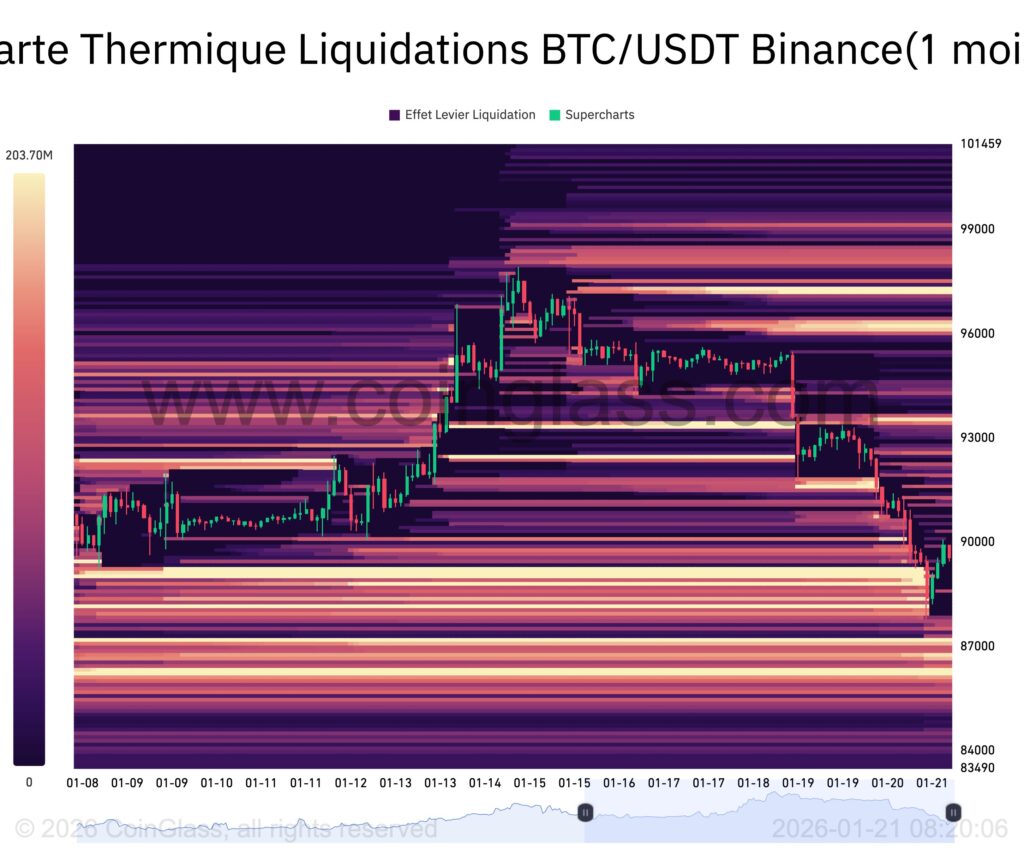

The price drop is only the tip of the iceberg. Behind the scenes, it’s the derivatives market that has ignited the powder keg. A cascade of liquidations has hit traders overexposed to the upside (Long squeeze). When Bitcoin lost the $90,000 level earlier this week, thousands of leveraged positions were automatically liquidated, creating a snowball effect that pushed the price down to $88,000. In total, more than $1 billion has been liquidated in the last 24 hours.

This cleanup of Open Interest is often necessary to cleanse the market after an intense rally phase. However, the violence of the movement on Ethereum is concerning. Losing $3,000 opens the door to tests of lower support levels, potentially toward $2,800 if buyers don’t quickly step up to defend the zone.

On-chain data also shows whale movements toward exchanges, a potential sign of profit-taking or hedging in the face of current macroeconomic uncertainty. The market appears to be in “risk-off” mode, waiting for a catalyst to choose its next direction.

The question burning on every investor’s lips this morning is simple: is this the time to buy the dip? Historically, 20 to 30% corrections during a Bull run are not only common, but healthy.

According to Killa, as long as Bitcoin doesn’t fall below MicroStrategy’s average purchase price of $75,000, the drop isn’t over. Moreover, BTC has always fallen below the 2Y-SMA during bear markets. This is currently at $85,000. The question then is how far could it drop below this moving average?

While the market holds its breath, one thing is certain: volatility is back, and it offers as many opportunities as risks for savvy traders.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.