Bitcoin Google searches surge: Is retail investing back?

Bitcoin search interest is soaring! Could this be a sign of retail investors returning to the crypto market? Find out what the data says.

Bitcoin search interest is soaring! Could this be a sign of retail investors returning to the crypto market? Find out what the data says.

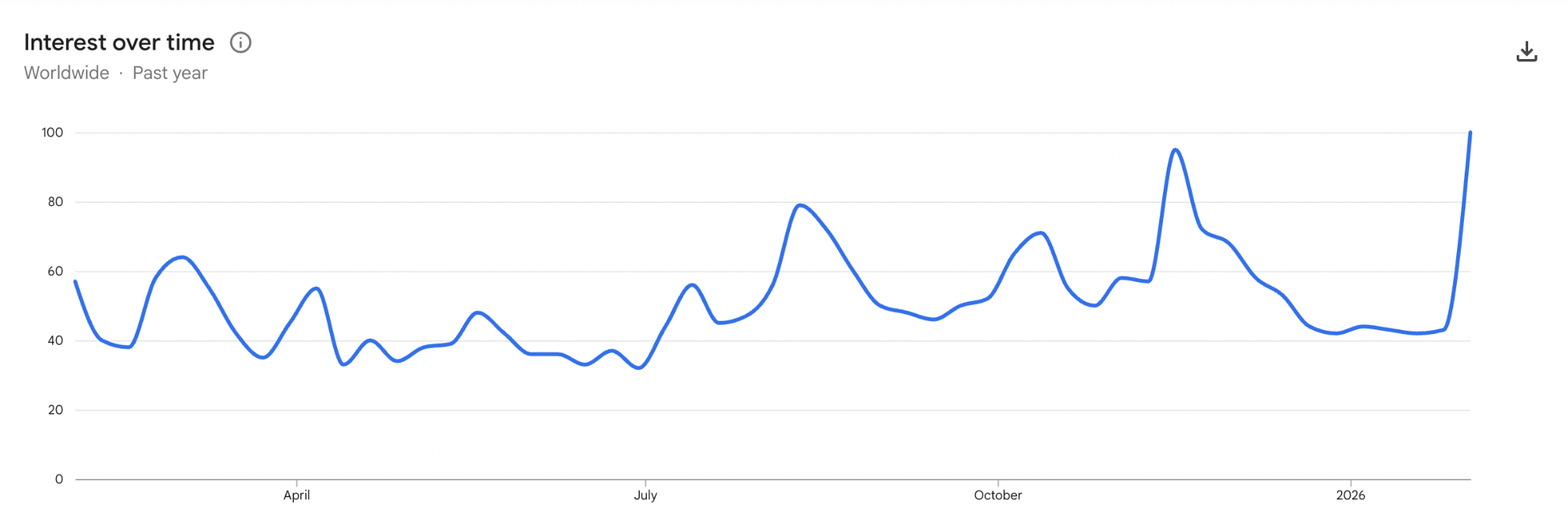

It is a metric that analysts monitor closely. Google search volume is often considered the thermometer of market sentiment for the general public. After a period of flat calm, interest in the king of cryptocurrencies is recording a vertical rise, coinciding perfectly with recent price volatility.

Historically, such an explosion in queries often precedes massive price movements. When the general public starts typing “Bitcoin” into their search bars, it usually means that FOMO (Fear Of Missing Out) is starting to set in. Unlike institutional players who accumulate in silence via OTC desks or ETFs, the Smart Money, retail investors react to media noise and brutal price variations, whether it be a severe correction or an imminent breakout.

For André Dragosch, Head of Research at Bitwise in Europe, there is no room for doubt: “Retail is coming back.” This statement comes as the market was desperately seeking a growth driver following institutional accumulation. While whales have supported the price until now, the influx of retail capital is often the fuel needed to chase a new ATH (All-Time High).

This return of retail liquidity could change the order book dynamics. Until now, the market was dominated by technical movements and institutional flows. The arrival of new entrants, attracted by recent BTC swings, could increase buying pressure and absorb the supply available on exchanges, potentially creating a supply shock.

The question is now on everyone’s lips: will this surge in attention convert into concrete buy orders? If history repeats itself, the arrival of retail investors often marks the beginning of the most explosive phase, but also the most volatile, of a bull cycle. However, traders must remain vigilant: a spike in searches can also signal excessive euphoria, often conducive to a short-term retracement.

As Bitcoin tests key levels, the confirmation of this trend over the coming weeks will be decisive. If search volume holds up and trading volumes on mainstream platforms follow suit, we could witness a major acceleration. Is BTC ready to smash through its resistance and enter price discovery, or will sellers take advantage of this liquidity to distribute?

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.