Why Bitcoin isn’t exploding Yet: Market analysis & outlook

Bitcoin's price struggles to break out. Strong dollar, Fed policy, and selling pressure are key factors. Should you buy the dip? Find out now.

Bitcoin's price struggles to break out. Strong dollar, Fed policy, and selling pressure are key factors. Should you buy the dip? Find out now.

Over the past few days, Bitcoin (BTC) price action has been painting a frustrating scenario for the Bulls. We’re witnessing short-lived rallies, often triggered by opportunistic buying at key support levels, but they’re severely lacking follow-through. As soon as the price attempts to break local resistance, volume collapses, giving way to immediate rejection.

This phenomenon, well-known to technical analysts, resembles successive Fakeouts. The market creates the illusion of recovery, attracting retail traders who fear FOMO, before turning brutally. This dynamic traps leveraged long positions, fueling a cascade of liquidations that prevents any sustainable construction of a bullish trend.

Indeed, each rise is merely a correction within a broader bearish structure. Currently in a new range, Bitcoin should oscillate and “chop” over the coming weeks before experiencing a highly probable correction end and capitulation in the coming weeks. Likely between $54,000 and $47,000.

While the technical chart is concerning, it’s primarily the macro-economic context that deprives the market of its essential fuel: liquidity. The recent strengthening of the dollar (DXY) acts as a powerful headwind for risk assets. Historically, a strong inverse correlation exists: when the dollar soars, Bitcoin tends to correct or move sideways in a tight Range.

Moreover, signals sent by the Federal Reserve (Fed) remain resolutely Hawkish. Hope for rapid monetary easing is fading, which keeps bond yields at attractive levels. For institutional investors, this reduces risk appetite. Why expose yourself to crypto market volatility when risk-free products offer stable returns?

The market therefore lacks the monetary “fuel” necessary to power a real bull run. Without a massive influx of Stablecoins or a change in tone from central banks, it’s difficult to imagine Bitcoin smashing through its major resistance levels in the short term. The Whales seem to have understood this, adopting a wait-and-see posture rather than aggressive accumulation.

Additionally, traders are largely betting on gold’s outperformance in the coming months. Fear of quantum attacks also weighs in the balance.

While rebound potential remains intact on paper, the current configuration suggests the market needs an external catalyst to emerge from its lethargy.

On-chain indicators show that Long Term Holders are maintaining their positions, which limits the risk of total collapse. However, the absence of new entrants (Retail) leaves the field open to high-frequency trading algorithms that exploit sideways volatility. For now, caution is warranted: as long as volume doesn’t validate a clean breakout, the risk of correction toward lower liquidity zones remains high.

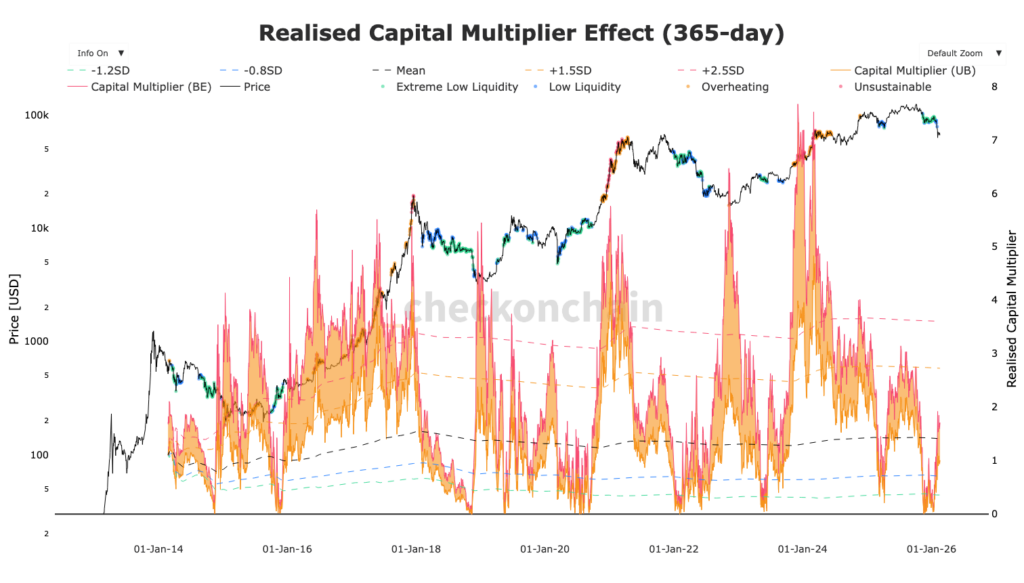

Nevertheless, the Bitcoin Capital Multiplier Effect indicates that liquidity is more present than when BTC was trading in the $85,000 range at the end of last year. Even if a substantial short-term rebound seems compromised, liquidity is already less skittish and this could indicate that a bottom is approaching.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.