Michael Saylor hints at massive Bitcoin purchase: Can he avert a crash?

Michael Saylor's "Bigger Orange" sparks Bitcoin speculation! Is MicroStrategy planning another massive BTC purchase? Find out now.

Michael Saylor's "Bigger Orange" sparks Bitcoin speculation! Is MicroStrategy planning another massive BTC purchase? Find out now.

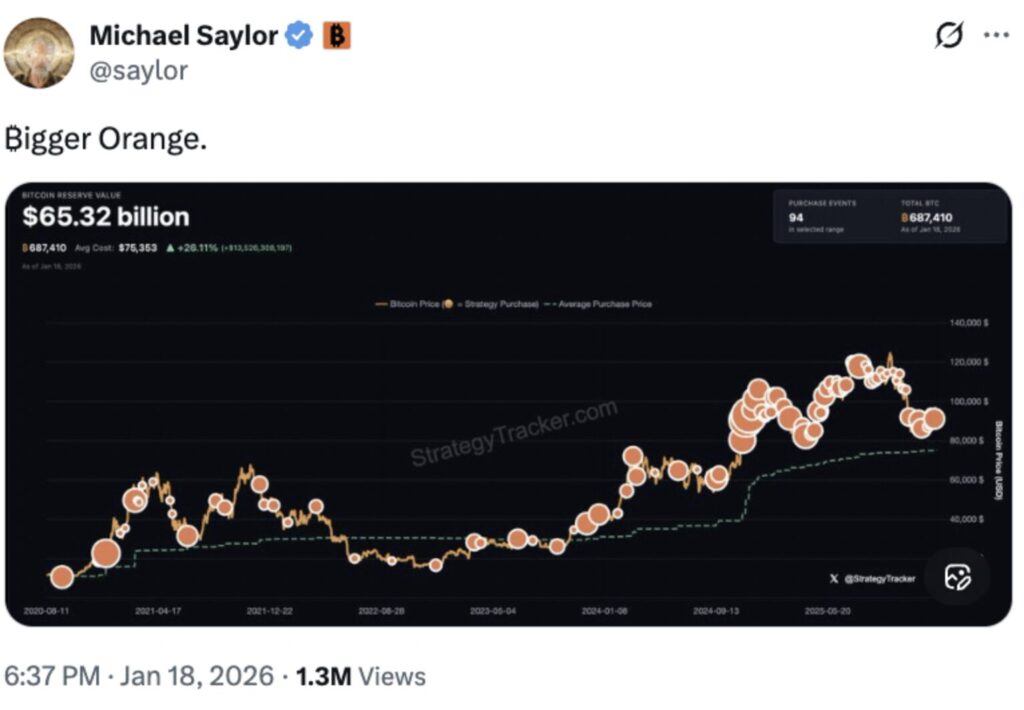

In the crypto ecosystem, few figures can influence market sentiment with a simple tweet. Michael Saylor is clearly one of them. With his cryptic message “Bigger Orange”, accompanied by an illustration suggesting a ramp-up in Bitcoin exposure, the founder of MicroStrategy sent a signal immediately interpreted as bullish by savvy investors.

This type of communication is never trivial. In the past, similar messages have often preceded official announcements to the SEC confirming the purchase of several thousand BTC. The market is therefore anticipating a new wave of accumulation, which was enough to shift social sentiment and revive risk appetite among traders.

In a context where Bitcoin is trading near key technical zones, this kind of signal acts as a reminder: MicroStrategy remains one of the most determined institutional players to accumulate for the long term, regardless of short-term fluctuations.

MicroStrategy’s strategy is now well known, but it continues to impress with its consistency. By combining financial leverage, convertible bond issuances and stock sales, the company manages to absorb a significant portion of the available supply on the market. Each new purchase contributes to creating a supply shock, by permanently removing BTC from circulation.

This mechanism takes on particular importance as liquid supply on exchanges is already at historic lows. Between the accumulation by ETFs, whale activity and MicroStrategy’s locked treasury, pressure on supply is gradually intensifying.

The central question is therefore no longer whether Michael Saylor will buy, but how much. If the announced volume exceeds expectations, this could act as a psychological floor for the Bitcoin price and serve as a catalyst for a new bullish phase. In this scenario, an attack on major resistance levels and a test of a new ATH in the coming weeks would no longer be speculation, but a structural dynamic fueled by institutional demand.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.