Bitcoin miners exodus to AI: A real threat to BTC?

Bitcoin's hashrate dips! Miners are pivoting to AI. Discover the potential impact on BTC and the future of crypto. Read now!

Bitcoin's hashrate dips! Miners are pivoting to AI. Discover the potential impact on BTC and the future of crypto. Read now!

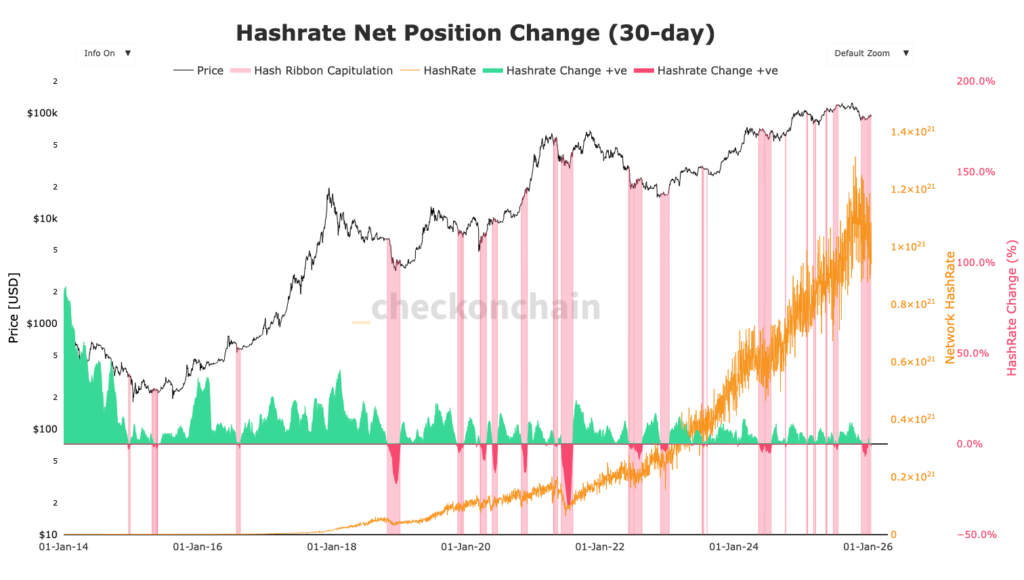

It’s an on-chain metric that analysts watch like a hawk: the computing power of the Bitcoin network, or hashrate, has just experienced a notable correction. For the first time since mid-September, the indicator has slipped below 1,000 exahashes per second (EH/s). While the price of BTC often dictates market sentiment, the hashrate is the true pulse of the blockchain’s security and fundamental health.

This decline is far from trivial. Historically, a drop in hashrate often signals that the least profitable miners are unplugging their machines, unable to keep pace with energy costs or token price stagnation. This is known as miner capitulation. However, the current situation presents an anomaly: it’s not just downward price pressure forcing this shutdown, but a financial opportunity elsewhere.

The network remains extremely secure, but this downward trend could lead to a downward adjustment in mining difficulty in the coming days. For investors, this is a double-edged signal: it may indicate a local bottom, but it also reflects a certain disaffection with the current economic model of pure Bitcoin mining.

Why continue securing the Bitcoin blockchain for reduced margins when artificial intelligence offers massive returns? That’s the question shaking the mining industry. The sector is witnessing a genuine strategic pivot: more and more mining farms are reallocating their energy resources and infrastructure toward high-performance computing (HPC) dedicated to AI.

This phenomenon, dubbed the “AI Shift”, is reshuffling the deck. Industry giants with enormous electrical capacity prefer to rent their computing power to tech companies developing AI models rather than mining BTC. It’s a pragmatic decision: Bitcoin‘s volatility versus the constant and lucrative demand for AI. This creates selling pressure on Bitcoin’s hashrate, although it may strengthen the treasury of publicly traded mining companies.

This movement could permanently transform the market structure. If Bitcoin mining becomes a secondary activity for these giants, network decentralization could paradoxically improve, leaving more room for smaller players, or conversely, weaken security in the short term. For now, the market interprets this as a transitional phase, but Bears could use it to pressure the price.

History has often shown us: price follows hashrate, but sometimes with a lag. When miners capitulate and sell their BTC reserves to finance their transition (here toward AI) or cover their costs, it creates immediate selling pressure on the order books. If Bitcoin fails to hold its current support levels, the door is open to increased volatility.

However, there is a Bullish scenario. Major hashrate lows have often marked ideal entry points for long-term investors. The “Hash Ribbons” indicator, very popular among traders, could soon send a buy signal if the trend reverses. If miners stop selling their BTC because they find profitability through AI, structural selling pressure could decrease drastically in the medium term.

The market therefore remains in a zone of uncertainty. Traders must monitor volumes: if BTC’s price holds despite the hashrate decline, it will demonstrate strong demand resilience. Conversely, a break of technical supports accompanied by this power decline would be a validated Bearish signal.

The correlation between the hashrate decline and the pivot toward AI is now undeniable. As we navigate this turbulent zone, the crucial question for the coming weeks is how institutions will react. Will they see this difficulty decrease as an opportunity to accumulate, or as a sign of structural weakness?

The 1,000 EH/s threshold will act as a psychological barometer. A quick return above this level would reassure markets and could catalyze a new rally. On the other hand, if the flight to AI accelerates without compensation from new entrants, Bitcoin may have to test much lower liquidity zones to find equilibrium. The ball is now in the buyers’ court.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.