Bitcoin: Peter Brandt’s red alert and a potential crash to $62,000?

Peter Brandt's Bitcoin warning: Is a crash to $62,000 imminent? Explore the on-chain data and analysis behind the bearish outlook.

Peter Brandt's Bitcoin warning: Is a crash to $62,000 imminent? Explore the on-chain data and analysis behind the bearish outlook.

The technical situation for Bitcoin is deteriorating rapidly. After failing to maintain its higher levels, the price has buckled under the pressure of a widespread risk-off sentiment. Expert Peter Brandt, followed for his often accurate predictions, has identified alarming technical signals suggesting that the correction is far from over.

According to his analysis, BTC could collapse to the $58,000 to $62,000 zone. This bearish scenario is based on the breakdown of critical price structures and a chart configuration reminiscent of previous crashes. For traders, the loss of the current psychological support would open the door to a deeper capitulation, erasing a large portion of recent gains.

Beyond technical analysis, network fundamentals are also sending distress signals. On-chain data reveals that long-term holders and whales have begun aggressively liquidating their positions. This massive selling movement is intensifying bearish pressure and preventing any significant rebound for now.

The macroeconomic context isn’t helping: fears related to Greenland tariffs have injected an additional dose of uncertainty, pushing institutional investors to reduce their risk exposure. With selling volumes intensifying, the market appears to be validating the scenario of a return to much lower price levels, testing the resilience of HODLers.

As the specter of $62,000 looms over the market, the crucial question is whether buyers will step in before impact. If the $90,000 zone gives way definitively, the fall could accelerate.

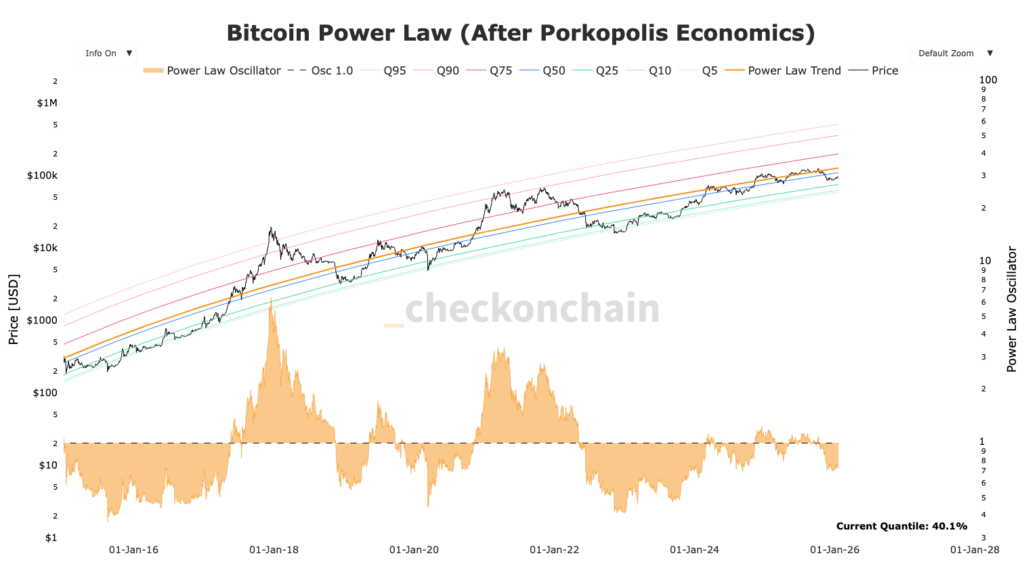

Furthermore, $58,000 corresponds to the low of the Power Law curve and also to the 200 WMA moving average. In other words, a drop to this level would be a generational opportunity to buy Bitcoin.

Is this the time to sell to protect your capital or to place low buy orders to take advantage of the next bull run? The answer in the coming months.

According to trader Killa, Bitcoin will drop below $60,000 by May. He even reveals a pattern similar to 2022, just before a brutal BTC crash. Things could therefore accelerate in the coming weeks. And the $85,000 support will be decisive in keeping hopes alive for a major BTC rebound in 2026.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.