Bitcoin: Why are BTC rallies failing?

Bitcoin's price is struggling to maintain gains. Low liquidity and losses on 22% of supply. Discover why analysts are urging caution.

Bitcoin's price is struggling to maintain gains. Low liquidity and losses on 22% of supply. Discover why analysts are urging caution.

Currently, Bitcoin (BTC) is trading around $87,500, showing a slight decline over the past 24 hours. Despite repeated attempts to reignite momentum, the king of cryptos remains stuck in a zone of uncertainty. According to a recent analysis by Glassnode, relayed by Cointelegraph, these price movements are likely to be short-lived as long as liquidity doesn’t make its grand return to the market.

The major problem identified by analysts is the absence of bid-side liquidity. In simple terms, there aren’t enough buyers to support a sustained rally. Technical breakouts, which usually trigger massive buying waves, end up running out of steam due to lack of follow-through, turning rallies into bull traps.

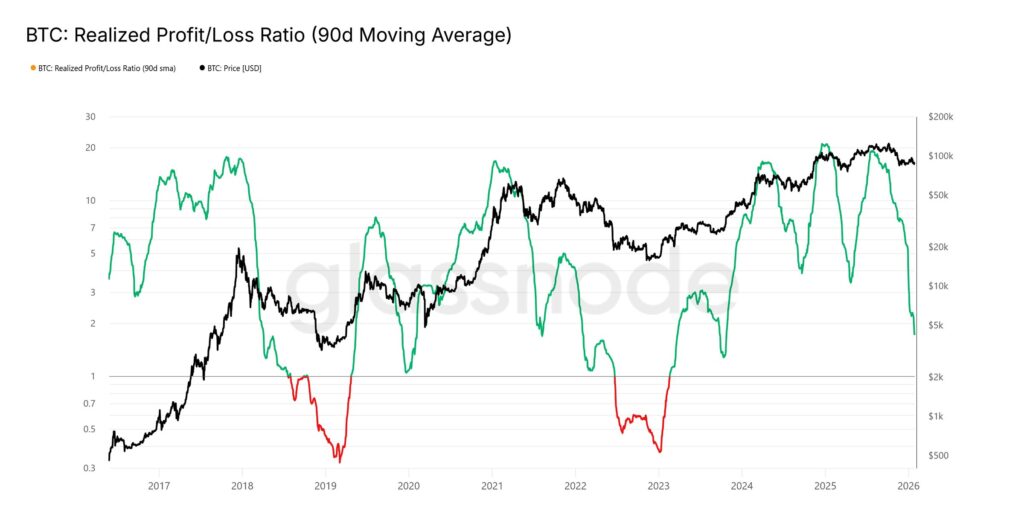

Glassnode highlights a key indicator to monitor market health: the Realized Profit/Loss Ratio (90-day moving average). Historically, for a genuine bull run to take hold, this ratio must remain above 5. This level signals massive capital inflows and healthy asset rotation into Bitcoin. However, current data suggests we’re still far from this critical threshold, leaving the market vulnerable to sudden corrections.

The other alarming data point concerns holder profitability. Currently, more than 22% of the total Bitcoin supply is held at a loss. This is a high level of financial stress, comparable to the market lows observed in the first quarter of 2022 or during the 2018 bear market. This situation places holders in a fragile psychological position: at the slightest shock, fear could trigger a wave of panic selling.

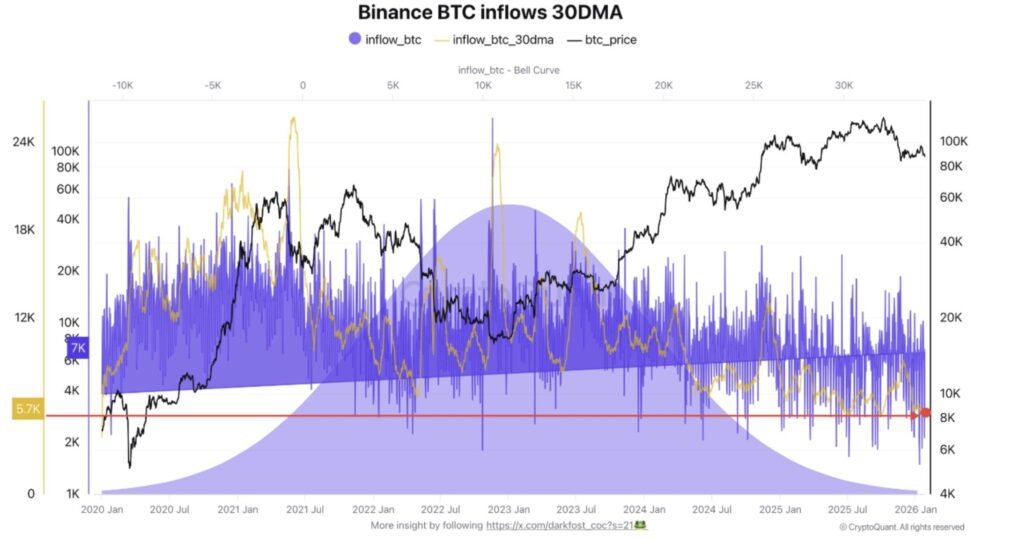

However, it’s not all doom and gloom. The bulls have so far managed to defend a crucial support zone located between $80,700 and $83,400. As long as this fortress holds, hope for a rebound remains. Moreover, BTC inflows to Binance remain close to their 2020 lows. While this indicates a lack of new capital entering, it also means that immediate selling pressure (people sending their BTC to exchanges to sell) remains contained for now.

Despite this mixed picture, the derivatives market offers a glimmer of hope in the short term, or at least a target. Data from Futures contracts suggests a possible liquidity hunt toward $93,500. This level could act as a magnet for price, attracting Bitcoin to liquidate short positions before deciding on the next major direction.

The scenario is therefore binary. If Bitcoin manages to reclaim this level and the realized profit ratio climbs, the uptrend could resume. Conversely, if the $80,700 support gives way under the weight of supply at a loss, the risk of a more severe correction would become imminent. Traders must therefore watch these levels like a hawk, as volatility could strike without warning.

The current situation demands caution. The market is in a waiting phase, caught between solid support and an absence of bullish catalysts. For investors, the key lies in the return of volumes and improvement in on-chain metrics. Bitcoin has proven its resilience in the past, but without fuel (liquidity), even the most beautiful rocket cannot take off.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.