Cardano drops out of crypto Top 10: Should you sell or buy ADA?

Cardano (ADA) falls from the Top 10 & hits 3-year lows. Is it time to buy the dip or sell? Get a complete analysis of ADA's price action.

Cardano (ADA) falls from the Top 10 & hits 3-year lows. Is it time to buy the dip or sell? Get a complete analysis of ADA's price action.

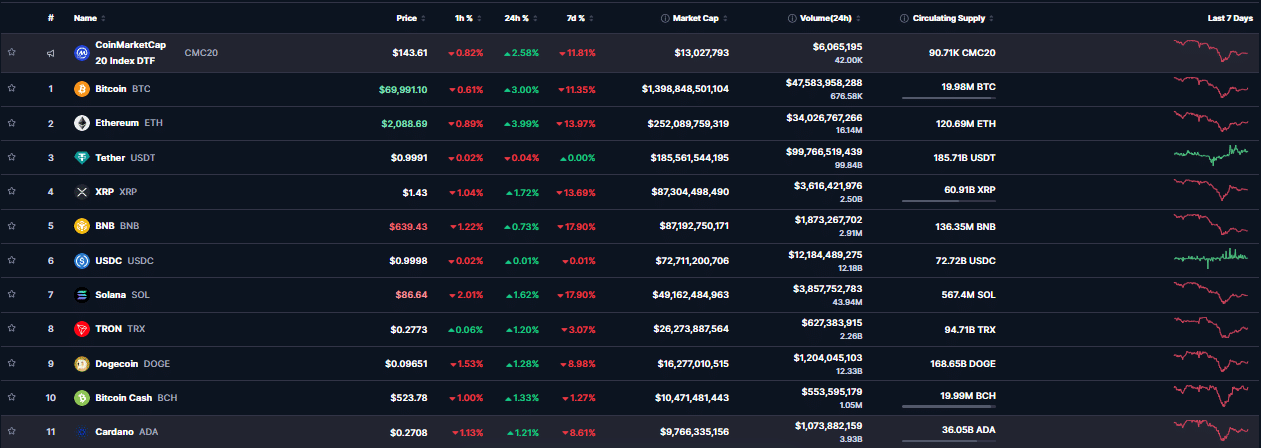

The collapse of Cardano (ADA) marks a brutal turning point. Ejected from the Top 10 market capitalizations, overtaken by Bitcoin Cash and new players like Hyperliquid, the token now trades around $0.27. Erasing several months of chart construction and reviving memories of the 2022 crash.

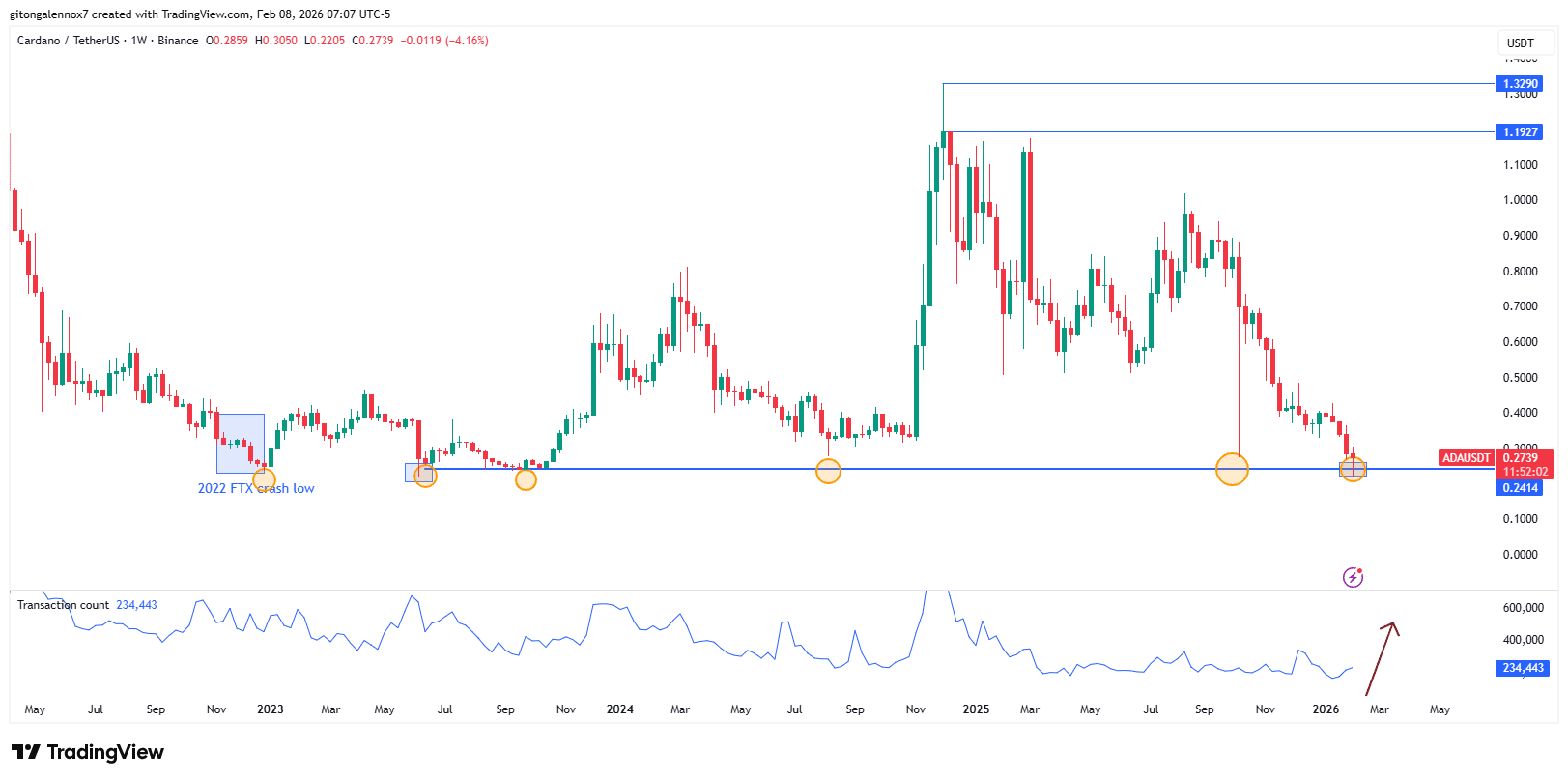

From a technical perspective, the situation is critical. ADA is evolving within a heavy bearish structure, after breaking several major support levels. The return to 2023 lows is accompanied by a spectacular drop in Open Interest (-79%). A clear signal of speculator flight and massive liquidations.

The market sentiment is extremely degraded. Even Charles Hoskinson is cited in discussions, with rumors of significant unrealized losses, fueling a climate of FUD. A break below the psychological threshold of $0.25 would open the door to another leg down toward still unexplored territories.

Despite this hemorrhage, on-chain data reveals an opposite reading from smart money. Grayscale has strengthened ADA exposure in its Smart Contract Fund, increasing from 18.50% to 19.55%, suggesting a strategic accumulation zone at current levels.

The whales, particularly those holding between 10 and 100 million ADA, have accumulated nearly $40 million during the drop. This price/accumulation divergence is historically associated with bottom zones, where major players take advantage of retail panic to position themselves long-term.

However, no guarantee of immediate rebound exists. ADA could enter a prolonged consolidation phase, testing the patience of remaining holders. The $0.26 – $0.27 levels will be decisive: either a break toward $0.20, or a technical bounce with volume, the first signal of a possible Cardano resurrection by 2026.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.