Dogecoin analysis: Can DOGE bounce back or will it crash further?

Dogecoin (DOGE) shows signs of accumulation. Will the $0.080 support hold? Get the latest DOGE price analysis and forecast.

Dogecoin (DOGE) shows signs of accumulation. Will the $0.080 support hold? Get the latest DOGE price analysis and forecast.

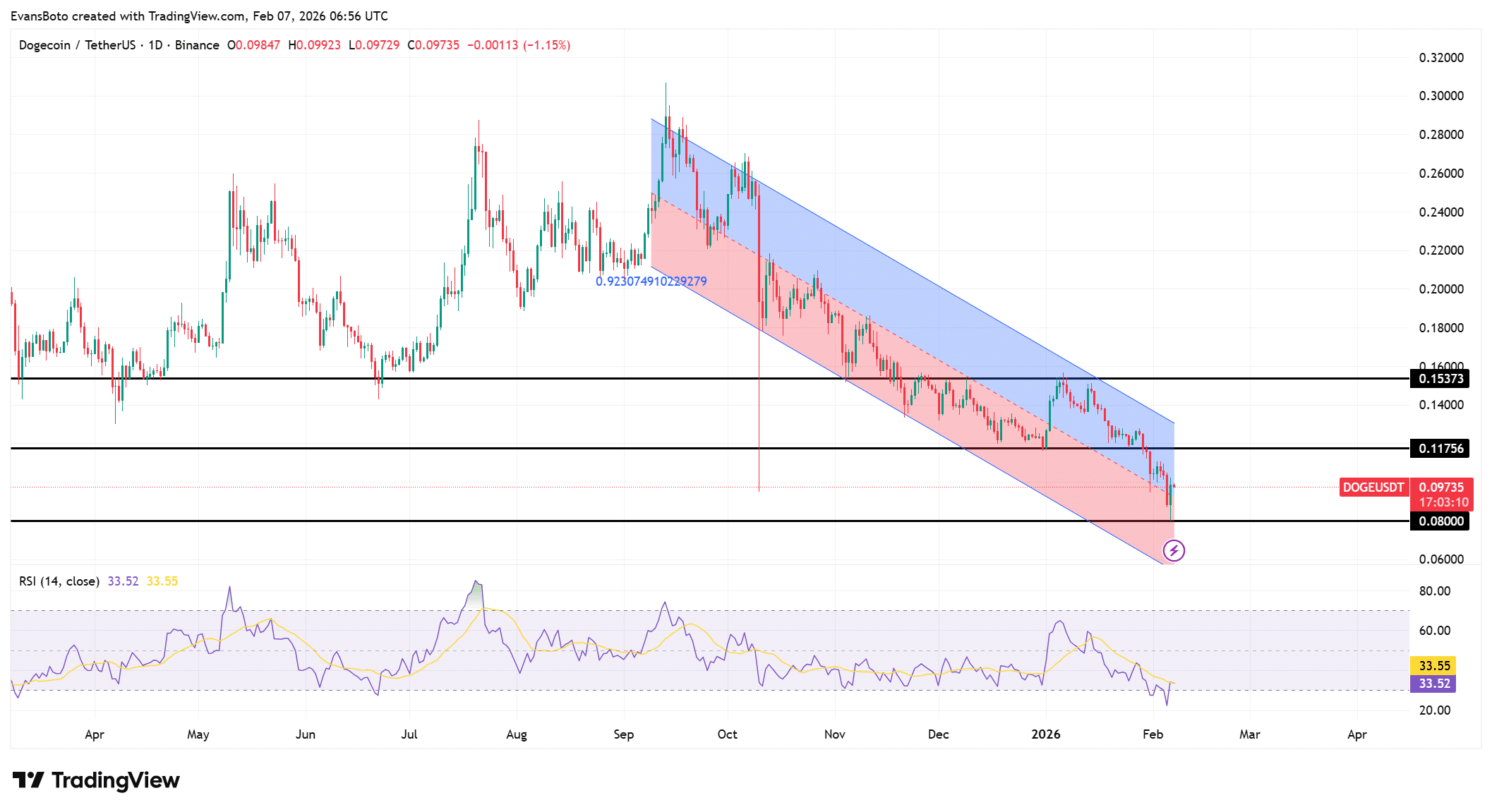

After weeks of correction, Dogecoin appears to be regaining some color. At the time of writing, the memecoin is trading around $0.096, posting a gain of approximately 6% over the last 24 hours. This movement comes as the asset has been evolving for several months within a descending regression channel, a typically bearish structure that compresses the price.

However, this rebound should not be interpreted too quickly as an immediate bull run. For now, it’s a technical reaction on structural support. The market is breathing, but the underlying trend remains fragile as long as certain key levels are not reclaimed. Traders are anxiously watching the $0.080 zone, a true line of defense for the bulls, which has already stopped several sell-offs in the past.

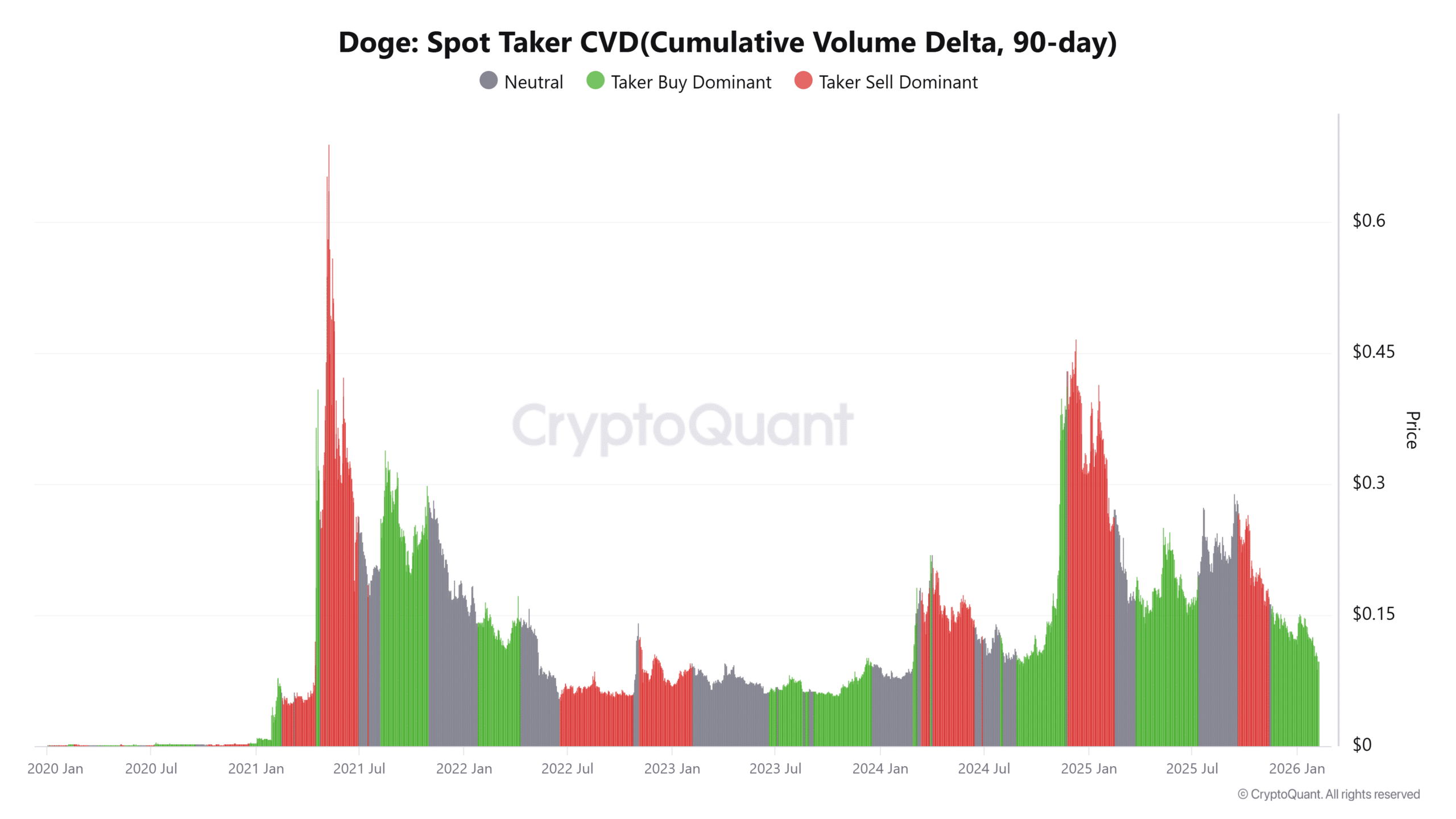

It’s behind the scenes where things become interesting. Order flow analysis shows that the Spot Taker CVD (Cumulative Volume Delta) remains dominated by buyers. Concretely, this means that demand is absorbing available supply without causing the price to explode: this is the very definition of an accumulation phase.

Unlike panic movements where CVD plunges, here, buyers are calmly intervening on dips (buy the dip). Additionally, a TD Sequential buy signal appeared on the daily chart near $0.095. This type of signal often suggests an exhaustion of selling pressure and could signal a pause in the bearish trend, or even a tactical short-term reversal.

Despite these positive signals, Dogecoin is not yet out of the woods. To validate a sustainable recovery and hope for a breakout, the price must imperatively break the major resistance at $0.117. This level has systematically rejected all upward attempts since November. As long as DOGE remains below this threshold, the risk of a new leg down persists.

If the bulls manage to break through this obstacle, the next target sits around $0.153, aligned with the top of the descending channel. Conversely, if the current support gives way under seller pressure, a return to the critical zone of $0.080 seems inevitable, potentially offering one last entry opportunity before a more severe capitulation.

The situation is tense but hope is rekindling. With indicators signaling accumulation and seller exhaustion, Dogecoin could be preparing an explosive move. The question remains whether volume will be sufficient to transform this technical rebound into a genuine bullish trend.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.