Ethereum Holds Strong Amid Market Downturn : Key Level to Watch Out for

Ethereum displays remarkable resilience amidst the cryptocurrency storm. However, breaking through the $4,500 level remains a significant obstacle for a sustained recovery.

Ethereum displays remarkable resilience amidst the cryptocurrency storm. However, breaking through the $4,500 level remains a significant obstacle for a sustained recovery.

While the cryptocurrency market experiences a difficult consolidation phase, Ethereum has managed to maintain relative stability. Unlike many other altcoins, the second-largest cryptocurrency by market capitalization has withstood the downward pressure. However, the absolute reversal threshold has not yet been reached. This point is crucial for triggering a more significant trend change.

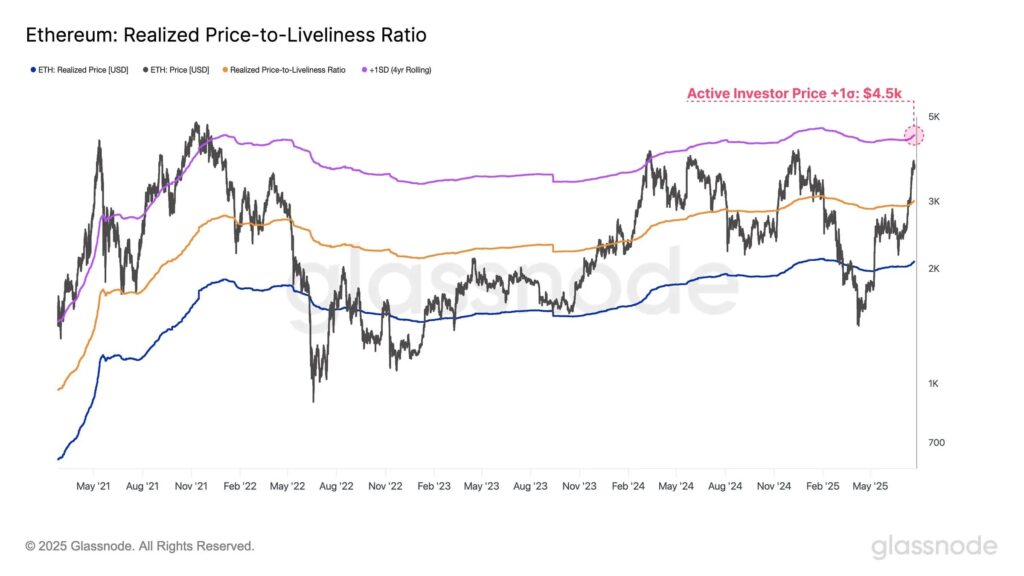

Indeed, analysis of Ethereum’s Price to Liveliness Ratio shows that the upward resistance currently sits around $4,500. This level has already played a major role during previous market cycles, acting as an insurmountable barrier in March 2020 and during the 2020-2021 rally.

Historically, breakouts above $4,500 have signaled market euphoria and increased structural instability. This price represents a critical structural pivot for Ethereum, a level to watch closely in the coming weeks.

The progression of Ethereum is also influenced by the concentration of active addresses. Nearly half of these belong to investors currently in profit. While this might seem positive, it raises short-term concerns.

These investors are more likely to take profits, which could generate increased selling pressure on Ethereum. This could slow down the momentum of the altcoin, preventing it from recording significant gains in the near future.

Despite these challenges, Ethereum currently remains well-positioned above its support at $3,587. If this level holds, the altcoin could target $4,000 initially, before challenging the crucial resistance zone between $4,100 and $4,500. However, intensified selling pressure, particularly from profit-taking, could push it back down to $3,000, invalidating the bullish thesis.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.