Whales Dumping Fartcoin : Will Prices Plunge Below $0.90 ?

Recent whale movements in Fartcoin could signal the end of its current cycle. Will they pivot to SPX, BONK, and PENGU ? The future of Fartcoin hangs in the balance.

Recent whale movements in Fartcoin could signal the end of its current cycle. Will they pivot to SPX, BONK, and PENGU ? The future of Fartcoin hangs in the balance.

After attempting a breakthrough a week ago, Fartcoin suffered a massive rejection at $1.27. The price remained bearish for six consecutive days, falling to $1.04. This drop coincides with the announcement of the TGE for the PUMP token on the Pump.fun platform.

This “sell the news” event didn’t only affect Fartcoin, as SOL and other memecoins like BONK and SPX experienced similar declines. However, Fartcoin has struggled the most to recover.

This prolonged decline naturally created panic among major holders. According to Lookonchain, a whale who spent 4.53 million USDC to purchase Fartcoin three days ago liquidated their entire position for just 3.9 million dollars, suffering a loss of $631,000.

Meanwhile, another whale sold 1.59 million Fartcoin for $1.71 million and immediately turned to new bets on cryptocurrencies like USELESS, SPX, BONK and PENGU. This reinvestment in other tokens sends a strong signal: some whales no longer trust Fartcoin’s short-term potential.

Whales weren’t the only ones fleeing. According to Coinalyze, Fartcoin recorded a negative Buy-Sell Delta for six consecutive days. At the time of writing, Fartcoin’s Buy Volume stood at $2.2 million while Sell Volume was approximately $2.35 million, resulting in a negative Delta of $129,000.

Additionally, data from Santiment confirmed that the Weighted Sentiment around Fartcoin remained in the red for five consecutive days. Investors appear to be losing confidence in this cryptocurrency.

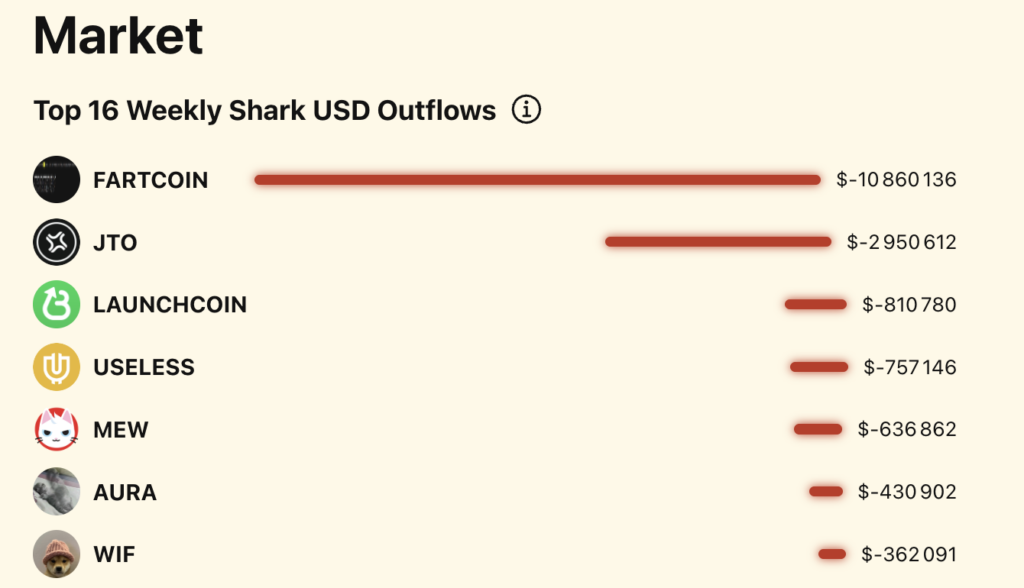

Indeed, according to Sun.flow, Fartcoin dominates outflow data across all holder categories, from “sharks” to small holders.

However, yesterday FARTCOIN was the token most purchased by whales.

The token faces strong selling pressure from both whales and retail investors. However, the memecoin has maintained its position above its 20 and 100-day moving averages and is currently heading toward the 50-day MA. Whale accumulation during widespread fear is making an impact.

Its 4H RSI nearly reached the oversold zone and now sits at 55, in neutral territory.

If the asset manages to break through the current resistance at $1.15 and stays above it, it could quickly reach its previous high of $1.6 in the coming days, as the daily Volume Profile indicates a clear path for a rapid rise. This represents a potential increase of 40% from its current price.

If sellers maintain control, there is a risk of breaking the $1.00 support level and falling to $0.938.

Here’s a guide to investing in Fartcoin right now on BitMart before a potential 40% increase :

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.