Gold, Silver, Oil: Why this explosive cocktail threatens Bitcoin?

Gold, silver, and now oil prices are soaring. This inflation surge could stall the Fed & hurt Bitcoin. Read our analysis.

Gold, silver, and now oil prices are soaring. This inflation surge could stall the Fed & hurt Bitcoin. Read our analysis.

The commodities market is boiling over. After gold and silver recently tested new highs, it’s now black gold’s turn to embark on a marked upward trend. This synchronized movement is no coincidence: it often signals institutional investors hedging against geopolitical and monetary uncertainty.

However, for the crypto market, this dynamic is a double-edged sword. While Bitcoin has sometimes played the role of digital gold, it remains today strongly correlated with risk-on assets. Seeing oil soar is generally a warning signal for tech assets and cryptocurrencies, as it drains available liquidity toward more defensive sectors.

The mechanics are simple but brutal for the bulls. Expensive oil directly fuels inflation (CPI). If inflation picks up again, the Federal Reserve (Fed) will have its hands tied and won’t be able to cut its benchmark rates as quickly as the market had hoped. Yet Bitcoin and altcoins thrive on cheap liquidity and low rates.

If the Fed is forced to toughen its stance or postpone its rate cuts (pivot), the dollar (DXY) is likely to strengthen. Historically, a strong DXY exerts immediate selling pressure on BTC. Instead of the hoped-for bull run, we could witness a prolonged consolidation phase, or even a severe correction if bond yields follow oil’s trend.

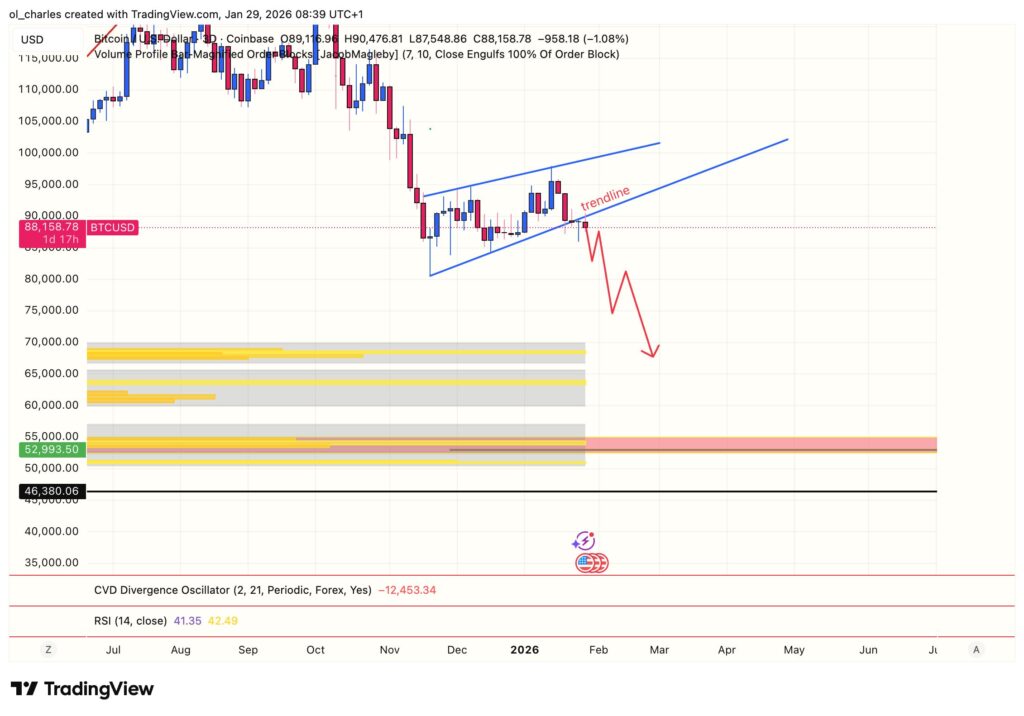

The crypto market is showing signs of nervousness in the face of these macroeconomic indicators. BTC is currently testing critical support levels and volatility could intensify in the coming days. Most notably, it failed to conquer $90,000 and its bullish trendline. All of this after the FOMC, which has generally marked a local top for several months now.

This potential retracement could continue down to $50,000 in the coming months. As long as $91,000 is not reclaimed, the bearish trend will intensify. And for now, gold doesn’t seem ready to stop.

Gold could reach $10,000 within 6 to 12 months, while some forecast silver at over $500. According to Finneko, this trend is historic and “a paradigm shift” is taking place. In his view, precious metals will be the big winners:

“When a pillar of global financing becomes unstable, leverage tends to contract and two things happen simultaneously: forced selling on certain assets and forced buying of protection on others. Historically, precious metals are often among the beneficiaries.”

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.