How High Will Bitcoin Price Bounce Back ?

Bitcoin appears poised for an upward trend, driven by a favourable macro environment and renewed investor interest. Will this rally sustain or fade quickly ? Analysis of technical and fundamental signals.

Bitcoin appears poised for an upward trend, driven by a favourable macro environment and renewed investor interest. Will this rally sustain or fade quickly ? Analysis of technical and fundamental signals.

Bitcoin has experienced a spectacular rebound to $109,700, close to its all-time high. However, numerous data points suggest that professional traders remain cautious. They seem unconvinced by the current market momentum.

Source: laevitas.ch

Bitcoin crossed the $109,000 mark on Wednesday. It had briefly tested support at $105,200 earlier in the day. This rise comes amid record monetary expansion in the eurozone. Signs of weakness in the U.S. job market are also notable.

Despite this impressive rally, traders remain cautious and unconvinced, according to Bitcoin derivative metrics. This reserved attitude is leading some investors to question the solidity of this recovery.

While it’s difficult to identify a single trigger, the record surge in money supply (M2) in the eurozone in April likely played a major role in Bitcoin’s rebound. Data released Monday revealed a 2.7% increase year-over-year, aligning with the expansionary trajectory of the U.S. monetary base. Meanwhile, ADP figures showed a decline of 33,000 private jobs in the United States in June.

Source: laevitas.ch

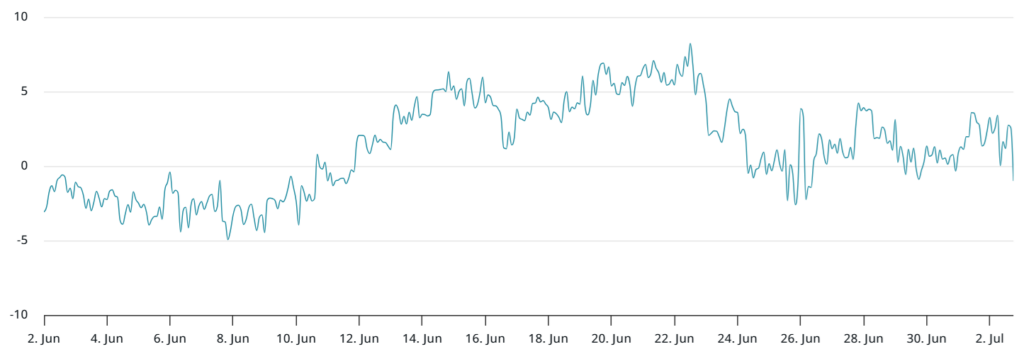

Some market participants attribute the low demand for long positions on Bitcoin to increased fears of economic recession, particularly in the face of escalating global trade wars. U.S. President Donald Trump has threatened to increase tariffs on Japanese products by more than 30% if no agreement is reached by July 9.

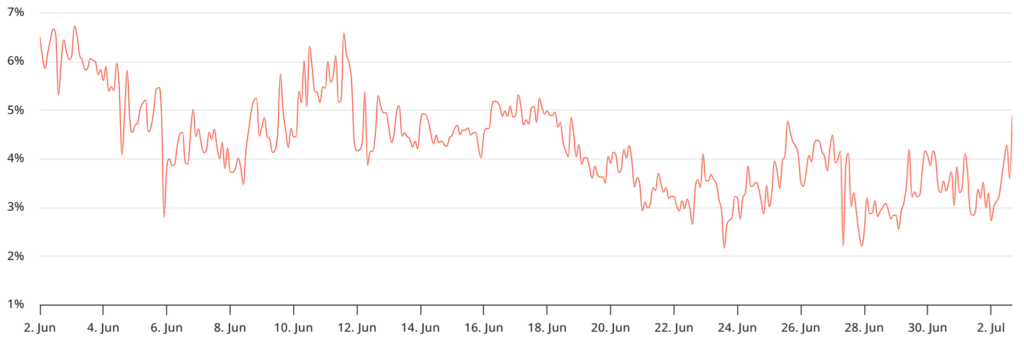

To assess whether the lack of enthusiasm is limited to futures contracts, it’s worth examining the Bitcoin options markets. If traders were anticipating a significant downturn, the 25% delta skew (the price difference between call and put options) should exceed 6%.

However, this indicator remains at 0%, unchanged for two days, suggesting that traders perceive balanced risks on both sides. While this reflects mixed sentiment at the $109,000 level, it’s still an improvement compared to the bearish positioning observed on June 22.

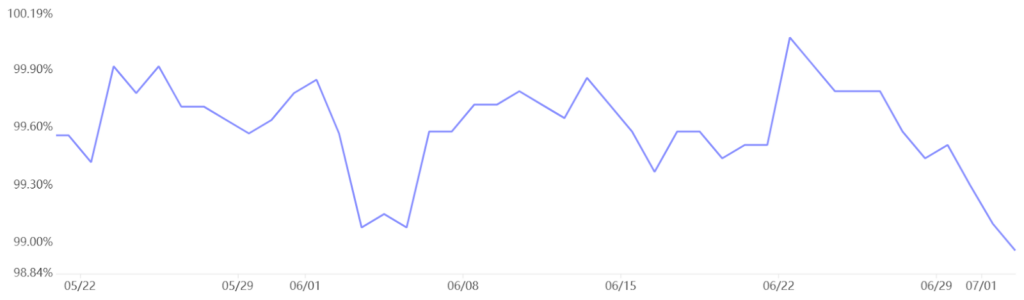

Meanwhile, the sharp decline in the stablecoin premium in China indicates falling demand for cryptocurrencies in the country. The discount of Tether relative to the U.S. dollar typically signals fear and a willingness to exit crypto markets. This 1% discount is the largest since mid-May, reflecting a lack of confidence in Bitcoin’s recent gains.

Traders appear increasingly concerned about the consequences of the ongoing trade war, particularly following net outflows of $342 million from spot Bitcoin ETFs on Tuesday. This moderate activity in the derivatives market reflects broader macroeconomic uncertainty, pushing investors toward caution despite Bitcoin’s rebound.

The coming weeks will be decisive in determining whether Bitcoin can maintain this renewed momentum or potentially face a trend reversal in the face of geopolitical tensions.

Passionate about the crypto world, he explores the blockchain ecosystem to extract the most essential insights. With his expertise in SEO and web writing, he transforms news and technical analysis into clear, engaging, and impactful content. His goal? To help investors better understand the opportunities and challenges of the crypto market.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.