Is Bitcoin Primed to Hit $200,000 by Year’s End ?

Despite Bitcoin hitting a new record in July, the question remains : can it break the $200,000 mark by the year-end ? On-chain indicators look positive, but market demand remains the crucial factor.

Despite Bitcoin hitting a new record in July, the question remains : can it break the $200,000 mark by the year-end ? On-chain indicators look positive, but market demand remains the crucial factor.

After establishing a new peak at $123,400 in July, Bitcoin subsequently experienced a 7% correction, falling back to $111,900. However, several encouraging on-chain signals, ranging from sustained exchange outflows to low miner balances, suggest a possible climb toward $200,000 by the end of the year. Let’s take a closer look at these key indicators.

Stablecoin reserves on Binance remain high, suggesting the presence of capital waiting to re-enter the market. This dynamic could stimulate demand as we approach Q4.

Positive Bitcoin outflows have continued since mid-April, signaling strong accumulation by holders. This reduction in available supply could favor future price appreciation.

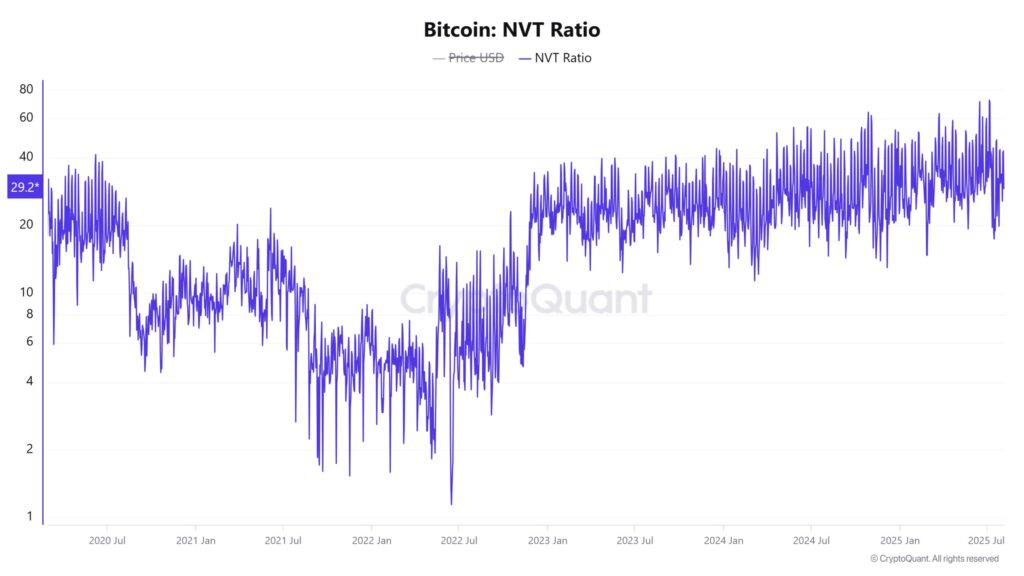

Bitcoin’s NVT ratio has fallen by more than 32%, indicating a better balance between network value and actual transaction volume. Historically, such declines have preceded bullish phases.

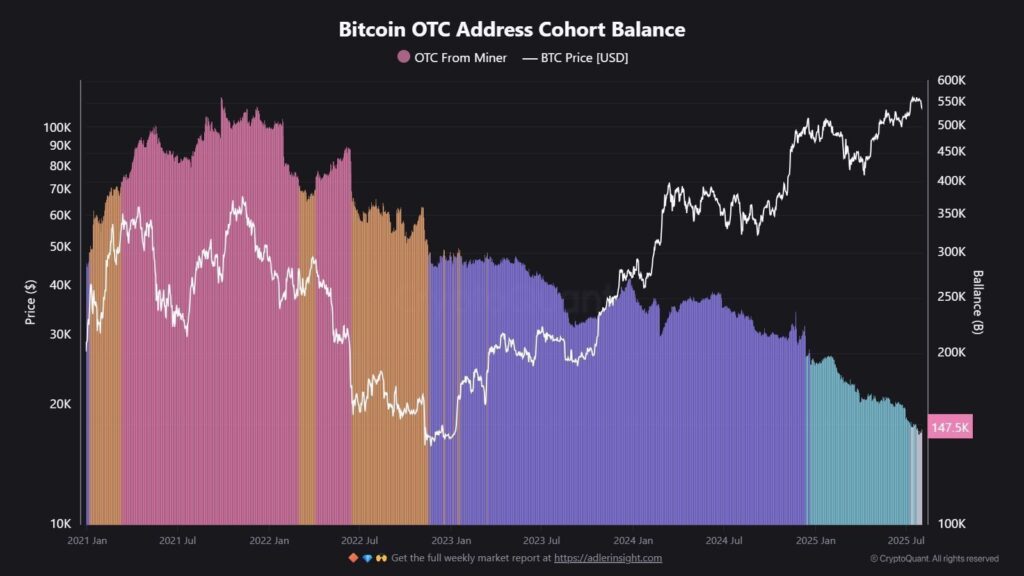

Additionally, miners’ OTC balances have fallen to their lowest level in years, demonstrating extreme caution in selling. This restraint could limit selling pressure.

After months of turbulence, Bitcoin’s weighted sentiment has turned positive again, reflecting cautious confidence among traders. This stabilization is an encouraging sign.

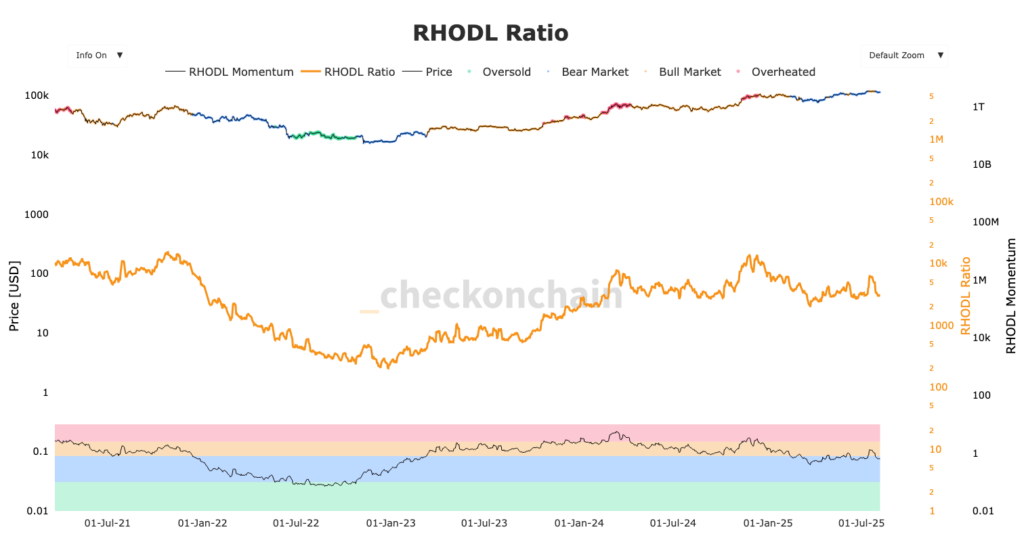

Nevertheless, the RHODL’s return to the bear market zone indicates demand is still weak currently.

According to Ki Young Ju, Michael Saylor is supporting the BTC price while whales have sold their holdings. Nevertheless, some are wondering what might happen in the coming months as Saylor approaches the end of his cash reserves.

Although on-chain signals are favorable, Bitcoin’s future trajectory will depend on market demand and sentiment. If Q4 seasonality and Binance’s stablecoin reserves materialize, Bitcoin could resume its ascent toward $200,000. Otherwise, market saturation and hesitant sentiment could slow the rally.

Moreover, analysts point to a peak of $150,000 in the coming months. Reaching $200,000 will require explosive growth and massive adoption.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.