Is Bitcoin’s Bull Run Already Under Threat ?

Bitcoin is showing signs of exhaustion in its uptrend. The mass selling by whales and late entry of retail investors are ominous indicators for potential turbulence ahead.

Bitcoin is showing signs of exhaustion in its uptrend. The mass selling by whales and late entry of retail investors are ominous indicators for potential turbulence ahead.

Since July 14, Bitcoin has been oscillating between a resistance at $123,000 and a support at $117,600, reflecting uncertainty about its trajectory. This stagnation could signal the end of the bullish cycle.

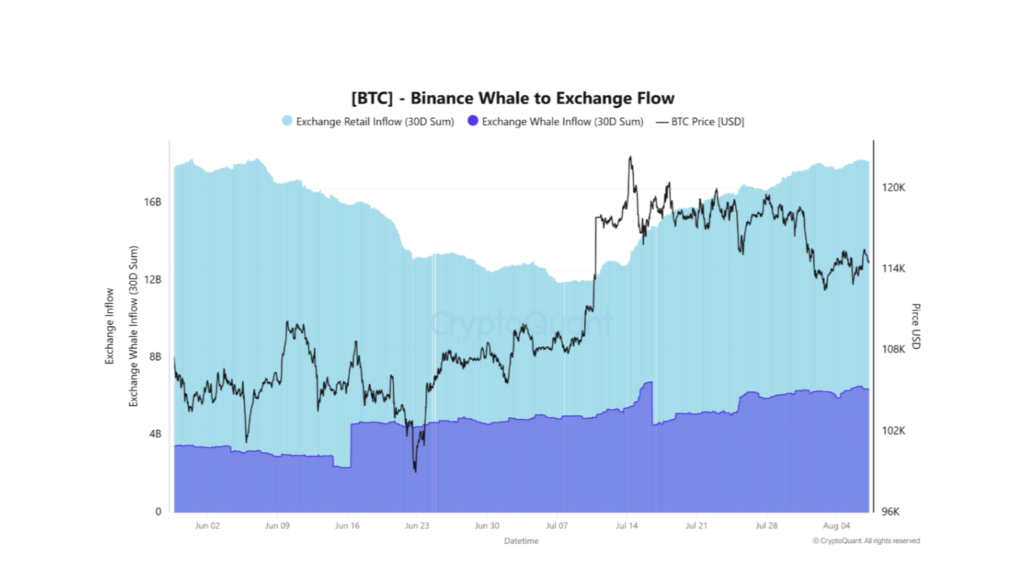

According to analysts, whales have transferred between $4 and $5 billion in bitcoin to Binance since late July, a classic sign of a distribution phase. This operation suggests that large holders are preparing to sell, potentially weakening the bullish momentum and increasing downward pressure.

Meanwhile, investments from retail investors have increased significantly, despite BTC’s weakness. Usually a positive sign, this influx concerns Arab Chain. A phase of late buying can cause losses in case of a correction. The market shows whales selling to enthusiastic retail investors. This suggests a possible exhaustion of the bull run.

Continued massive selling could break the support at $117,600, risking a fall toward $113,000. Conversely, renewed buying would allow BTC to break through the resistance and target $126,300. However, the current trend leans more toward a weakening of the bullish movement.

The massive transfer from whales to platforms and the late arrival of small investors indicate that the Bitcoin bull cycle may be losing steam. Investors should remain vigilant for a potential rapid reversal in the coming weeks.

Here’s a guide to obtaining Bitcoin in August :

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.