Litecoin crash: Can whales save LTC?

Litecoin dips 6.5%! Are whales accumulating LTC? Explore the technical analysis: Is a rebound coming, or will prices fall further?

Litecoin dips 6.5%! Are whales accumulating LTC? Explore the technical analysis: Is a rebound coming, or will prices fall further?

The recent drop in Litecoin is part of a broader movement driven by Bitcoin, which lost its key support at $94,000 to slide toward the $92,000 zone. As often happens, this BTC breakdown triggered a wave of selling across altcoins, dragging LTC into a brutal retracement of -6.54% in a single session. This is not a Litecoin-specific issue, but rather a classic correlation effect in a market under stress.

This pullback comes in an already fragile context for Litecoin, still marked by recent uncertainties related to crypto ecosystem security. Retail investors quickly succumbed to panic, liquidating their positions at the first signs of market weakness. This retail capitulation amplified volatility and reinforced short-term selling pressure.

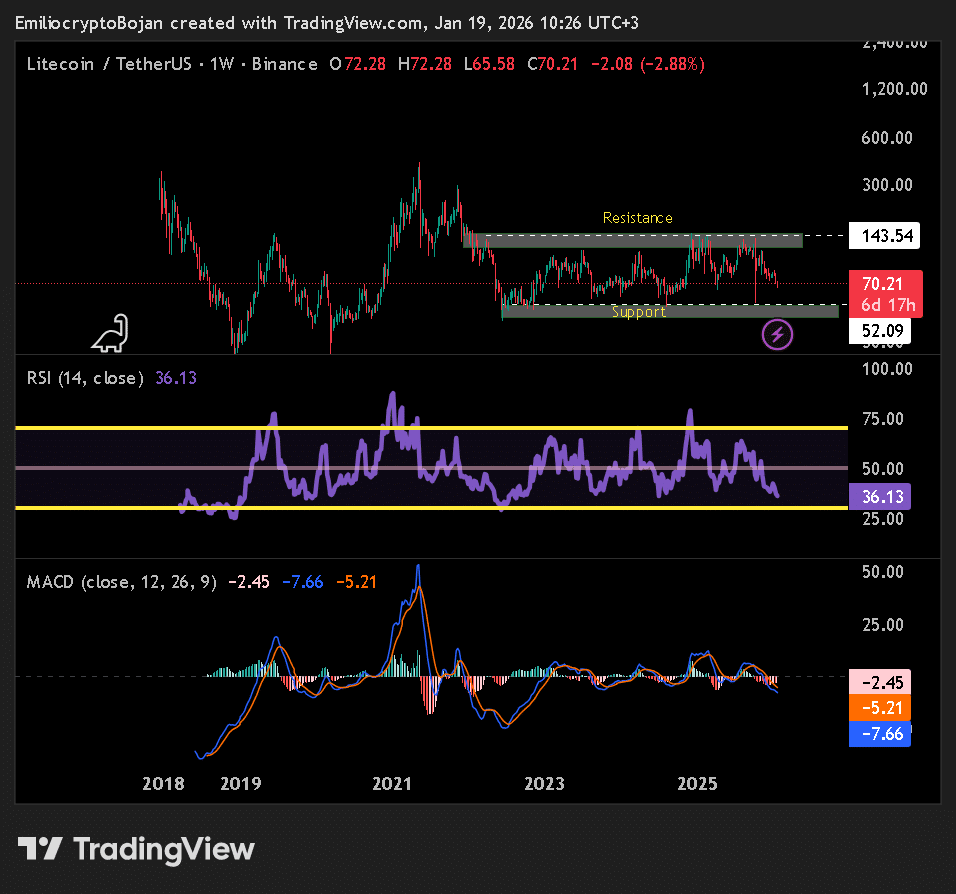

Despite this, Litecoin is currently attempting to stabilize around a major psychological level, close to $70.30. The absence of an immediate bounce shows that bulls still lack conviction, but this level remains crucial. Defending it could serve as a foundation for a healthier consolidation phase after the purge.

While the price drops, on-chain data tells a different story. Litecoin ETFs recorded approximately $2 million in inflows last week, a subtle but revealing signal of ongoing institutional interest. In a nervous market context, this resilience suggests that certain players view current levels as attractive.

Meanwhile, whale activity has intensified significantly. Large-scale spot market purchases recall phases of accumulation during fear, often observed near reversal zones. This behavior contrasts sharply with retail behavior and fuels the idea that smart money is anticipating a rebound once selling pressure is exhausted.

From a technical perspective, Litecoin stands at a decisive crossroads. If the $70 support holds and Bitcoin stabilizes, a rebound scenario toward $80 becomes credible. Conversely, renewed BTC weakness could trigger a bearish breakdown and exploration of lower levels. This divergence between bearish price action and bullish fundamentals makes the current situation a key moment, where the risk/reward ratio becomes particularly interesting… But still risky.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.