Crypto watch: Top performers & losers this week – Polygon (POL) soars!

Crypto market analysis: Polygon (POL) surges, JASMY shows strength, & Zcash (ZEC) corrects. Stay updated on the week's top crypto performers!

Crypto market analysis: Polygon (POL) surges, JASMY shows strength, & Zcash (ZEC) corrects. Stay updated on the week's top crypto performers!

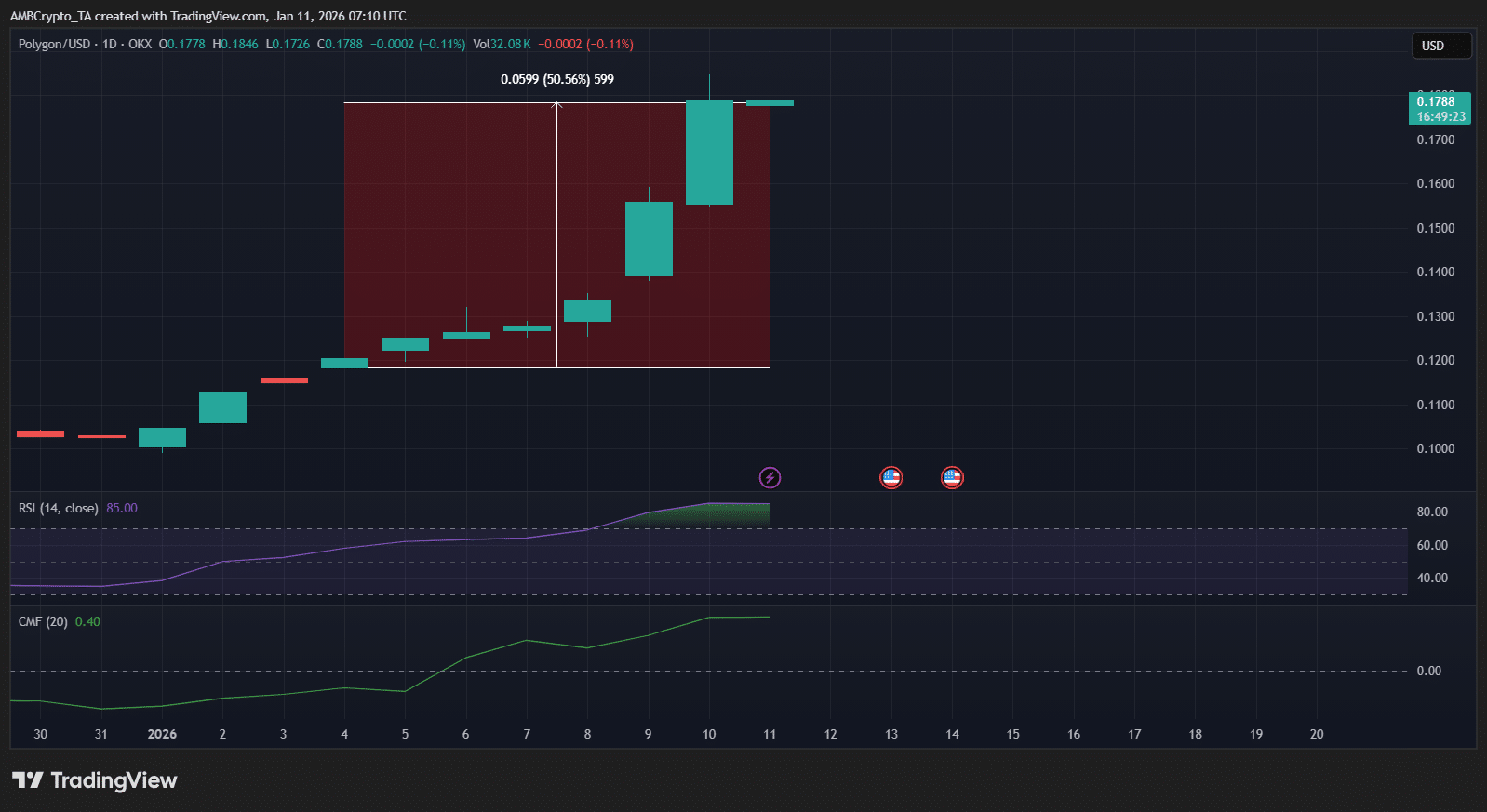

While the broader market slows down, Polygon (POL) stands out with a remarkable performance, posting nearly +50% over the week. This rally is supported by the announcement of the Open Money Stack framework, which served as a fundamental catalyst, boosting volumes and on-chain activity.

From a technical standpoint, the breakout is clear. Despite an RSI in overbought territory, capital flows remain solid, suggesting that investors are not yet taking profits. As long as on-chain momentum holds, the uptrend could continue.

Meanwhile, JasmyCoin (JASMY) confirms its speculative appeal. The token has moved from $0.0065 to $0.0095, driven by strong buying volumes. Currently in sideways consolidation, the structure remains bullish as long as support holds, suggesting a potential continuation of the move in January.

The mood is radically different for Zcash (ZEC), which has dropped approximately 26% after failing around $510. Uncertainties related to governance and internal tensions at the ECC have triggered strong selling pressure, with provisional support around $370.

The token is now trading in oversold territory, which could favor a technical bounce in the short term. However, caution remains warranted: a break of current support would open the door to a decline toward $313, while stabilization could attract contrarian investors.

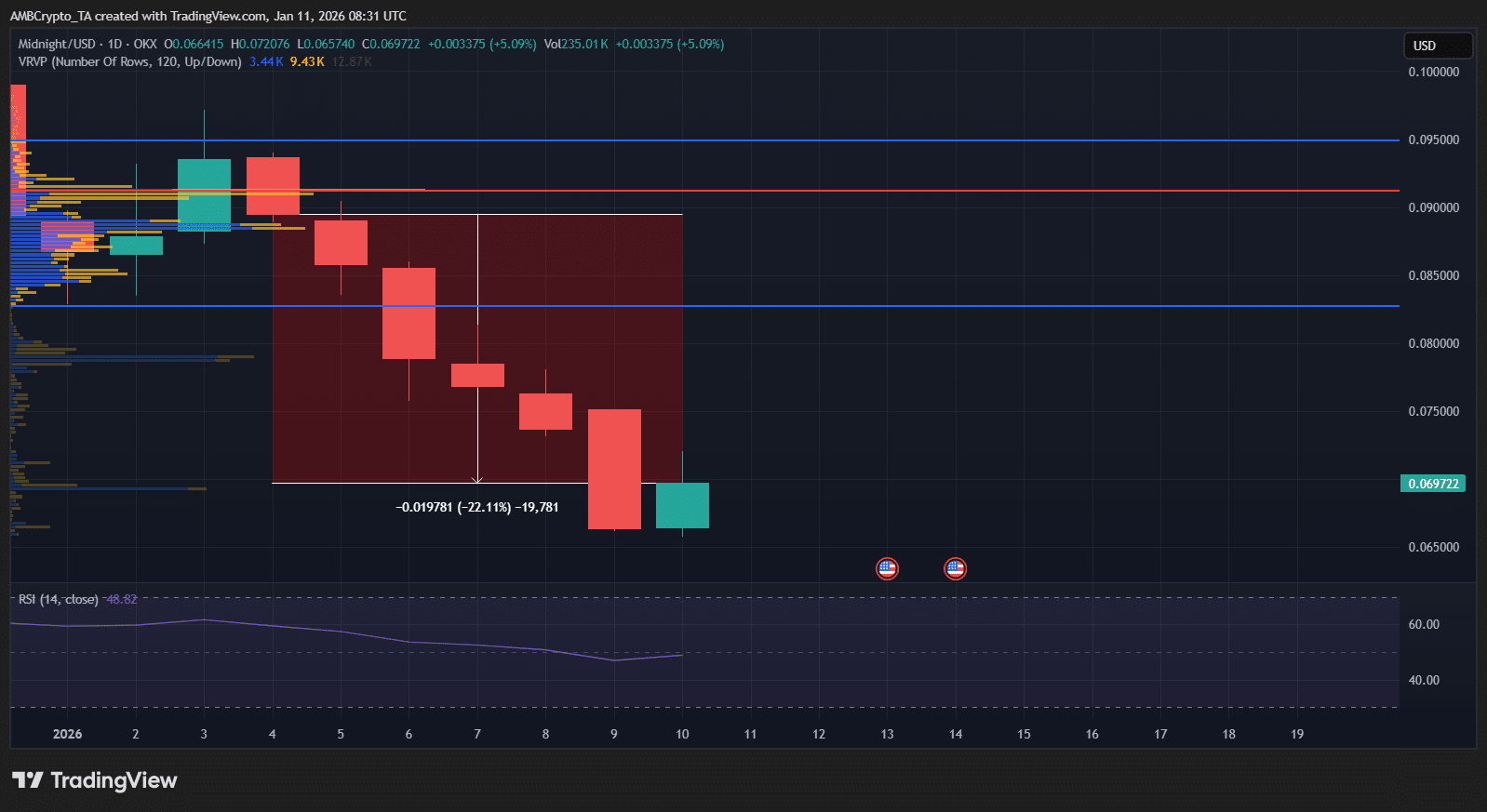

Finally, Midnight (NIGHT) shows a weekly decline of approximately 22% after a sharp rejection around $0.09. Here, the correction appears more related to buyer exhaustion than a fundamental shock. The $0.067 level becomes crucial: its defense will determine the ability of bulls to avoid another phase of weakness.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.