After a 50% Drop, Will POPCAT Return to Its All-Time High ?

After a staggering 50% drop, POPCAT is struggling to recover from this brutal correction. However, could its recent listing on Robinhood serve as the catalyst for a much-needed rebound?

After a staggering 50% drop, POPCAT is struggling to recover from this brutal correction. However, could its recent listing on Robinhood serve as the catalyst for a much-needed rebound?

Since the beginning of February, POPCAT has been experiencing serious difficulties. Despite some attempts to bounce back, the memecoin has failed to recover its losses, heavily enduring a 50% drop.

While the token still tries to recover, the lack of solid support and optimism in the market is delaying any significant comeback. However, POPCAT has recently experienced a key bullish moment.

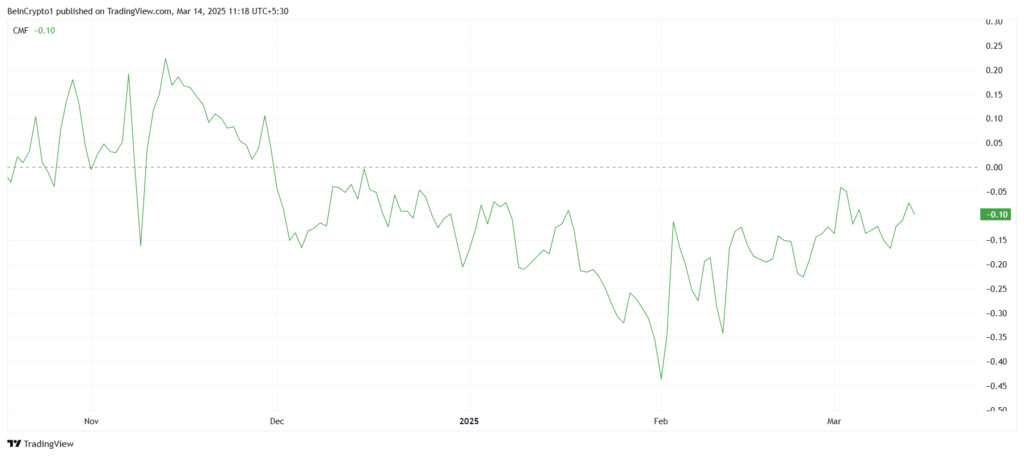

The Chaikin Money Flow (CMF) indicator has remained stuck below the zero line for the past three and a half months. This suggests that fund inflows into POPCAT have been low since early December 2024, with little buyer interest. The lack of conviction due to investor loss aversion has contributed to a lack of momentum, preventing the memecoin from experiencing a recovery.

This low CMF reading indicates that investors are not rushing into POPCAT, hindering any significant price increase. This has led to the token’s struggle to maintain any positive momentum, further delaying its recovery.

Over the past four days, POPCAT has surged by nearly 20%, currently trading at $0.180. A key factor has been the POPCAT’s listing on Robinhood on Thursday, which is expected to attract more investments to this asset and expose it to a wider range of investors.

The altcoin has bounced off the $0.140 support and is now below the $0.203 resistance. Although this recent recovery is promising, it will face significant challenges in breaking through this $0.203 barrier.

Given the weak market conditions and investor sentiment, POPCAT may struggle to surpass this $0.203 resistance. It is more likely that the altcoin will consolidate in the range of $0.140 to $0.203, at least until stronger market signals emerge. This could further delay any potential recovery.

However, if market conditions and investor behavior improve, POPCAT could surpass this $0.203 resistance. A successful breakthrough of this level could see the altcoin testing $0.238, thus invalidating the current bearish outlook. This would indicate a change in market sentiment and could set the stage for a more sustainable recovery.

Despite ongoing challenges, the Robinhood listing of POPCAT offers a glimmer of hope for this struggling memecoin. With increased support from investors, POPCAT could finally find the momentum needed to bounce back from this 48% drop and kickstart a lasting recovery. Informed investors should closely monitor the evolution of this altcoin in the weeks ahead.

Gaston has been a writer for over 7 years and a passionate cryptocurrency enthusiast since 2020. He loves exploring the crypto ecosystem and is now dedicated to sharing his insights and discoveries through InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.