Ripple partners with Saudi Arabian giant bank: Will XRP explode?

Ripple teams up with Riyad Bank in Saudi Arabia! Discover the impact on XRP's price and the details of this groundbreaking partnership. Click to learn more!

Ripple teams up with Riyad Bank in Saudi Arabia! Discover the impact on XRP's price and the details of this groundbreaking partnership. Click to learn more!

Ripple is taking a major step forward by partnering with Jeel, integrating directly into the Saudi banking ecosystem at the heart of the Vision 2030 program. This partnership goes far beyond a simple technology test. It positions Ripple as a key player in the Kingdom’s financial modernization. With the goal of supporting the digital economy and reducing dependence on oil.

The agreement operates within a regulatory sandbox framework, offering Ripple a secure environment to deploy its solutions without excessive regulatory pressure. This approach contrasts sharply with the American climate and significantly reduces regulatory FUD. For Ripple, this represents strong institutional validation of its blockchain infrastructure.

Three pillars structure this partnership: Cross-border payments, the tokenization of real-world assets (RWA), and custody solutions. If these tests prove successful, other financial institutions in the Gulf could follow suit. Paving the way for large-scale regional adoption and increased structural demand for the Ripple ecosystem.

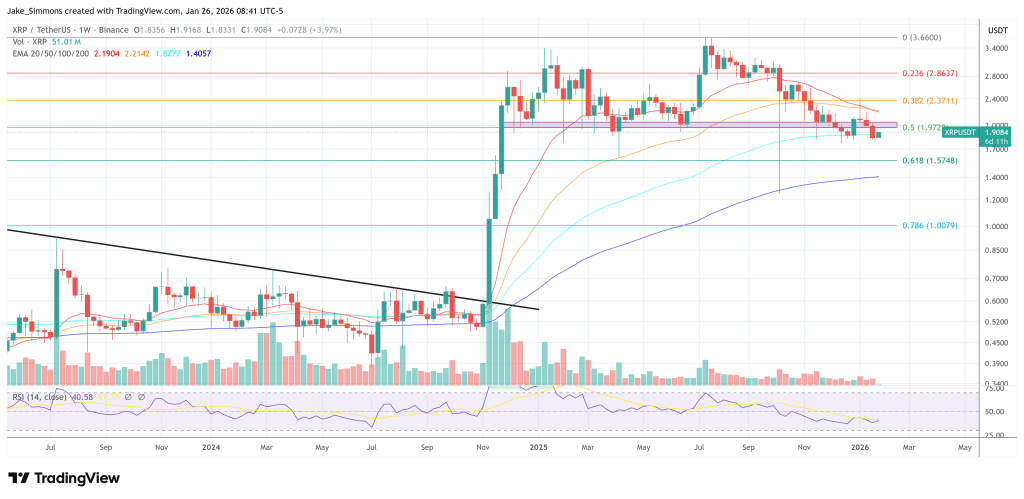

Despite these very solid fundamentals, the XRP price is still hovering around the $1.90 zone, showing a slight short-term correction in a globally hesitant market. This lack of immediate reaction may be surprising. But it often corresponds to phases of institutional accumulation before a more pronounced move.

Technically, XRP remains above key support levels and appears to be building a bullish consolidation structure. Analysts are closely monitoring the psychological resistance at $2.00, whose break with volume could trigger a breakout toward much higher levels.

Conversely, a loss of the $1.85 support would open the door to a deeper retracement toward $1.70, without necessarily invalidating the underlying trend. The question remains open: Will this partnership be the catalyst that finally allows XRP to transform its solid fundamentals into a sustainable bullish impulse?

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.