Stellar (XLM) Faces Critical Bearish Signal : Will It Break Down ?

Stellar (XLM) is on the verge of confirming a critical bearish indicator, casting doubt on a potential recovery. Is the altcoin set for a deeper decline ?

Stellar (XLM) is on the verge of confirming a critical bearish indicator, casting doubt on a potential recovery. Is the altcoin set for a deeper decline ?

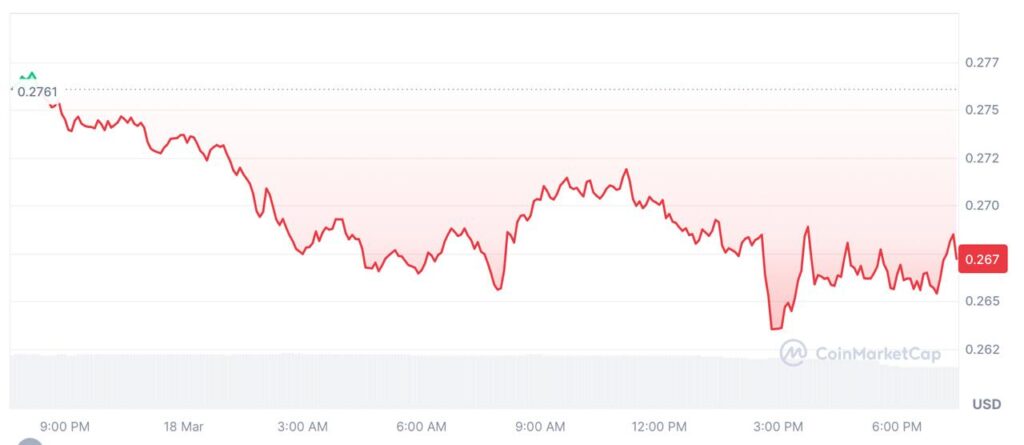

Stellar (XLM) continues to experience strong bearish momentum, currently priced at $0.272. Over the past three months, XLM has repeatedly failed to break above crucial resistance levels.

Now, a critical bearish crossover involving the 200-day Exponential Moving Average (EMA) and the 50-day EMA is imminent, potentially intensifying selling pressure.

Historically, this bearish EMA crossover signals increased negative sentiment and a rise in selling activity. If this scenario unfolds, Stellar may find it increasingly challenging to surpass resistance at $0.299 and $0.325. Without breaching these critical levels, XLM risks significant price depreciation.

Investor confidence in Stellar has weakened significantly, reflected clearly by the persistent negative reading on the Chaikin Money Flow (CMF) indicator. This measure, indicating capital inflow and outflow, remains solidly negative, underscoring significant investor withdrawal from XLM.

Persistent negative sentiment combined with bearish technical signals creates a difficult environment for Stellar. Without renewed buying momentum, price movements may remain restricted, further increasing downside risks.

Currently trading at $0.272, Stellar stands precariously close to critical support at $0.259. Traders should carefully watch this level; a breakdown could lead to further declines toward $0.231 or even lower.

Conversely, a bullish reversal would require Stellar to decisively overcome the immediate resistance at $0.299, followed by breaking the major hurdle at $0.325. Successfully surpassing these levels could indicate returning investor confidence, potentially targeting higher levels around $0.355.

Traders aiming to capitalize on these pivotal market shifts can securely trade XLM through Bitget Exchange, a trusted cryptocurrency trading platform.

Léa is a member of the InvestX team, dedicated to guiding users through their learning journey. Passionate about cryptocurrencies, she closely follows market trends. On InvestX.fr, Léa writes articles to help readers decode the latest news and stay informed about the ever-evolving blockchain world.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.