Trump Media: Could a crypto airdrop send DJT shares soaring?

Trump Media (DJT) is considering a crypto airdrop for shareholders. Could this blockchain strategy ignite a surge in the stock price? Find out now!

Trump Media (DJT) is considering a crypto airdrop for shareholders. Could this blockchain strategy ignite a surge in the stock price? Find out now!

Trump Media & Technology Group (TMTG), the parent company of Truth Social, is clearly displaying its crypto ambitions. According to an S-1 filing with the SEC, the company is exploring the launch of a crypto payment service integrated into the platform. With the added possibility of a token airdrop aimed at shareholders. An announcement that immediately captured the attention of the crypto sphere.

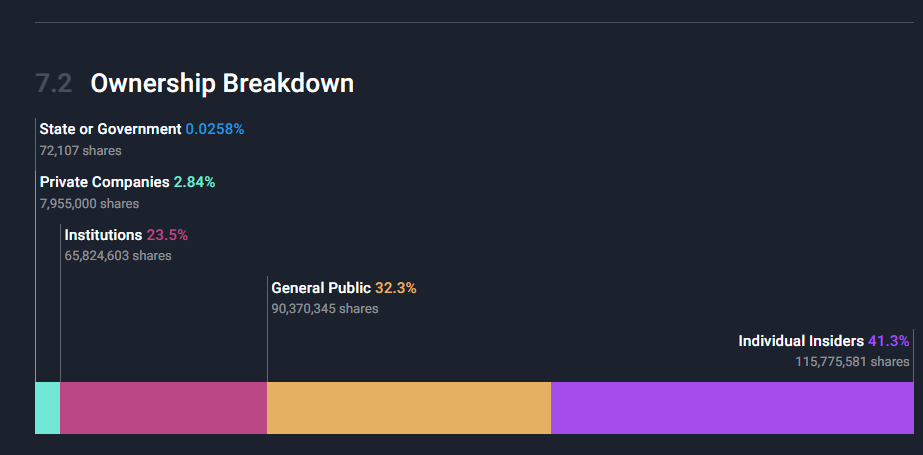

This project comes amid a context of high volatility for DJT stock, marked by correction phases and speculative rebounds. With a shareholder base largely dominated by retail and insiders, Trump Media appears to be seeking to retain its investor base by introducing a blockchain dimension capable of reinforcing the HODL sentiment.

If this token comes to fruition, it would not be a simple bonus, but rather a tool integrated into a DeFi ecosystem, with potential utility for payments, community engagement, or even governance. A way to transform passive shareholders into active network participants.

The mechanism mentioned recalls previous digital dividend precedents, but with a more modern approach focused on gamification. Tokens could be distributed based on share holding duration or activity on Truth Social, creating a direct incentive to hold shares and limit selling pressure.

This strategy fits into a broader context, with possible links between TMTG and the World Liberty Financial (WLFI) project backed by the Trump family. An airdrop could thus serve as a bridge between Wall Street and DeFi, facilitating the adoption of new crypto financial products among an uninitiated audience.

However, caution remains warranted. The SEC is closely monitoring any initiative that could be considered a securities issuance. If the regulatory framework is validated, the signal would be extremely bullish, paving the way for a breakout and potentially a new ATH for DJT stock. Conversely, a vague or purely opportunistic execution could trigger a brutal market rejection.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.