Unveiling Why Solana (SOL) May Continue Its Downward Spiral

Solana retraces by 6% following a 22% surge, with emerging bearish signals. Will the $175 support hold ? Explore the outlook and key levels to watch.

Solana retraces by 6% following a 22% surge, with emerging bearish signals. Will the $175 support hold ? Explore the outlook and key levels to watch.

The price surge of Solana appears to be taking a pause. Despite impressive gains of over 22% last month, the trend has significantly cooled in recent days. The token has fallen nearly 6%, now trading around $180, well below its recent highs.

While this could simply be a healthy pullback, certain on-chain and sentiment indicators suggest this correction might last longer than expected. Let’s analyze the situation.

One of the main signs of a potentially prolonged downtrend comes from the SOPR, or “Spent Output Profit Ratio.” This indicator tracks whether SOL holders are realizing profits or losses when selling.

Solana’s SOPR has dropped from 1.04 to nearly 1.00 over the past week. This means wallets that are currently selling are hardly making any profit. In other words, fewer investors are cashing in gains, which often signals the beginning of waning confidence in the market. This phenomenon is particularly concerning as the SOPR is declining alongside prices.

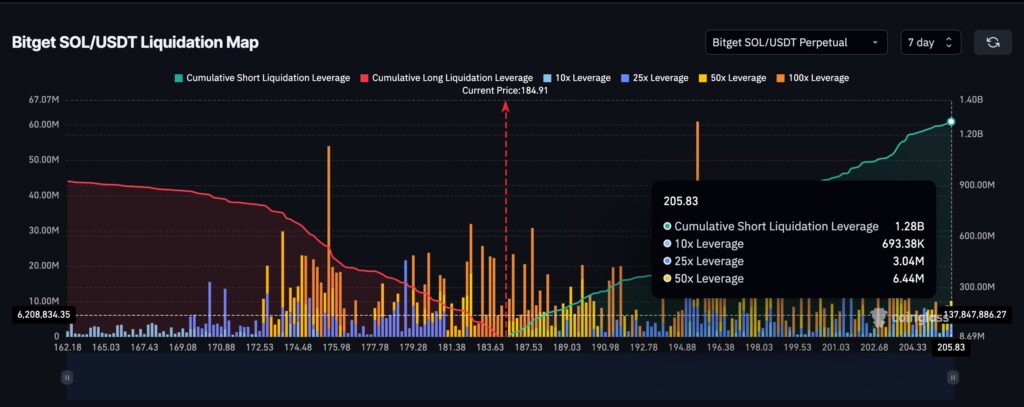

Liquidation data confirms this weakness. Over the last 7 days, short positions on Solana total $1.28 billion, compared to only $924 million for long positions. Traders are therefore betting heavily on a continued short-term decline.

Another concerning indicator is the relative strength index between buyers and sellers (Bull-Bear Power Index). This tool, which measures the respective power of both camps, is continuously declining. It shows that buyers are progressively losing control as the correction deepens.

A weakening bullish momentum means that dip-buying is becoming less aggressive, limiting the chances of a quick rebound. Without a new wave of enthusiastic buying, prices could remain flat or continue to erode before an eventual recovery.

On the other hand, numerous shorts are positioned for liquidation to the north. While the dominance of shorts indicates bearish sentiment, smart money could push the price higher after forcing investors to capitulate.

From a technical perspective, Solana has retreated from its recent high of $206 to hover around $180. Applying a Fibonacci retracement from the low at $125 to the peak at $206, the crucial support level to watch sits between $173 and $175. This represents a classic 38.2% retracement zone, generally considered a first “serious” support in a healthy uptrend.

If Solana manages to hold above this threshold, it could stabilize within a range before attempting a new upward phase. But a break below $173 would pave the way for a deeper correction, confirming the bearish signals observed in the SOPR, liquidations, and waning bullish momentum.

Solana could therefore return to $167 if this zone isn’t maintained. Nevertheless, the negative 4-hour CMF could indicate that selling pressure is about to fade. To confirm this trend reversal, SOL will need to break through resistances at $186 and $191 subsequently.

In summary, Solana’s price has dropped 6% this week, with a declining SOPR and significantly increasing bearish bets. While the long-term bullish trend isn’t necessarily in question, these indicators suggest a possible continuation of the short-term correction. The key level of $175 will be decisive for the future price direction.

SOL nonetheless remains bullish in the long term. To invest in this promising blockchain, here’s a guide to easily obtain the token on Bitget :

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.