US Bitcoin Reserve: When Will the Government Start Buying?

The US government stopped selling Bitcoin. Discover when they might start buying, and what this means for the crypto market. Read now!

The US government stopped selling Bitcoin. Discover when they might start buying, and what this means for the crypto market. Read now!

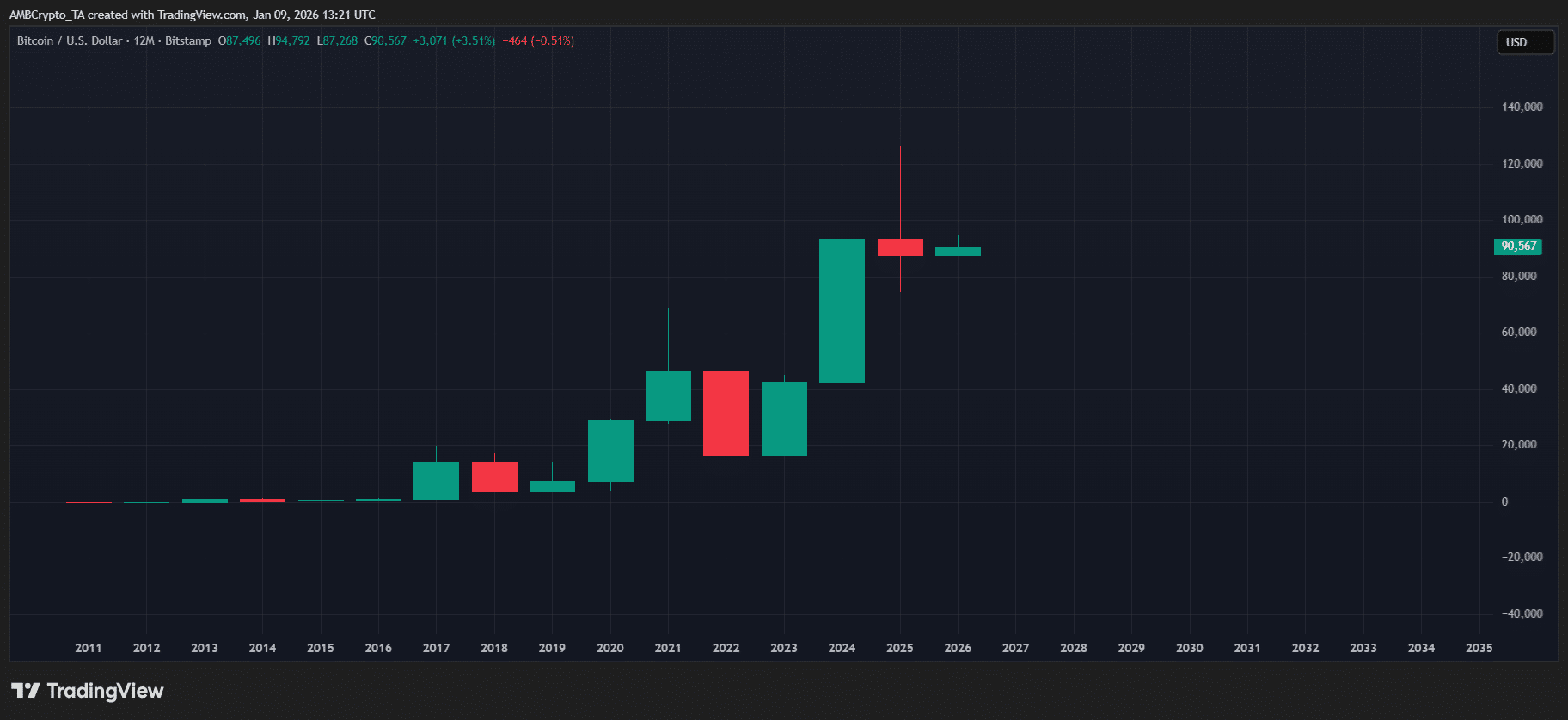

The year 2025 marked a transitional phase for Bitcoin. The executive order signed by Donald Trump halted the sale of seized BTC by the US government, putting an end to latent selling pressure. But this decision was merely the first step.

The real stakes now lie in the shift from passive HODLing to active accumulation. The proposal championed by Cynthia Lummis, targeting up to 1 million BTC, represents a historic paradigm shift. Even without immediate adoption, the mere fact that this scenario is being debated at the legislative level keeps a lasting bullish sentiment alive.

This anticipation acts as a psychological floor for the market. Despite indicators occasionally overheating, no major correction is taking hold, with investors preferring to remain positioned in the face of a potential, unprecedented state-level catalyst.

The macro backdrop of early 2026 reinforces this explosive scenario. Private players like MicroStrategy are continuing their aggressive accumulation, while regulatory clarity progresses, strengthening Bitcoin’s status as an institutional reserve asset.

If the US government were to enter the market, an immediate supply shock would become inevitable. Reserves on exchanges are already at historic lows, and demand via spot ETFs continues to absorb available liquidity. Sovereign buying pressure could be enough to propel the price to a new ATH within a matter of weeks.

Hovering around the $90,000 mark, the $100,000 resistance level appears more fragile than ever. The key question remains: should one anticipate state intervention or wait for official confirmation? One certainty dominates the market, however: volatility in the coming weeks will be extreme, and the time factor is becoming central.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.