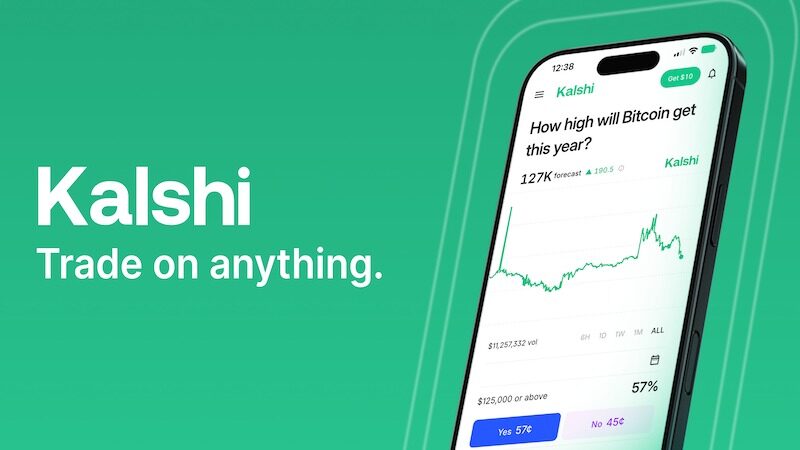

Kalshi, Polymarket’s main competitor

In the prediction markets arena, two names stand out: Polymarket and Kalshi. While their objective is similar allowing users to bet on the outcome of future events their philosophy and structure are radically different.

Polymarket, a flagship player in decentralized finance (DeFi), operates on the Polygon blockchain and uses stablecoins like USDC. This approach gives it global flexibility and accessibility, but exposes it to a lack of regulation, particularly in the United States where access has long been restricted. Kalshi, on the other hand, has made the strategic choice of compliance. Based in New York, the platform is regulated by the Commodity Futures Trading Commission (CFTC), one of America’s main financial regulators.

This official recognition allows it to operate legally on American soil and offer services in US dollars, which provides a guarantee of security and credibility for many investors. However, this regulation comes at a cost: accessibility that is currently largely limited to the American market, leaving European users in a complex situation and often on the sidelines.

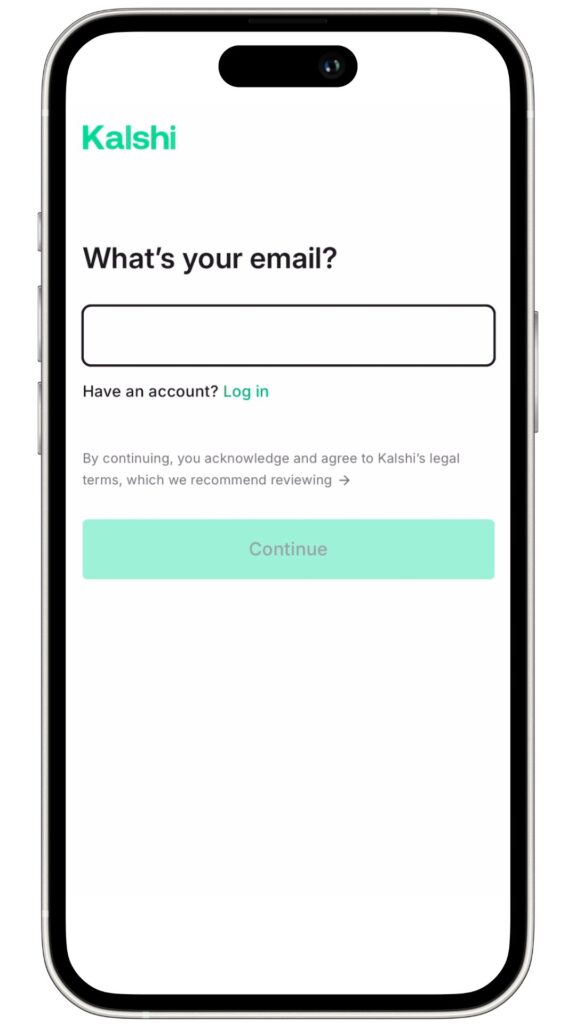

Step 1: Create an account and verify your identity on Kalshi

For eligible users, the first step to getting started on Kalshi is creating an account. The process is designed to be simple while meeting regulatory requirements. Here are the steps to follow:

- Visit the official website: Go to Kalshi’s official website and click on the registration button.

- Complete the registration form: You will be asked to provide basic personal information, such as your name, email address, and date of birth.

- Complete identity verification (KYC): This is a crucial and mandatory step. Prepare a photo of your identity document (passport, ID card) and a recent proof of address.

- Submit your documents: Follow the instructions to upload your documents securely. Validation can take anywhere from a few minutes to a few hours.

This procedure, known as KYC (Know Your Customer), aims to fight fraud and money laundering and is a pillar of the security offered by Kalshi.

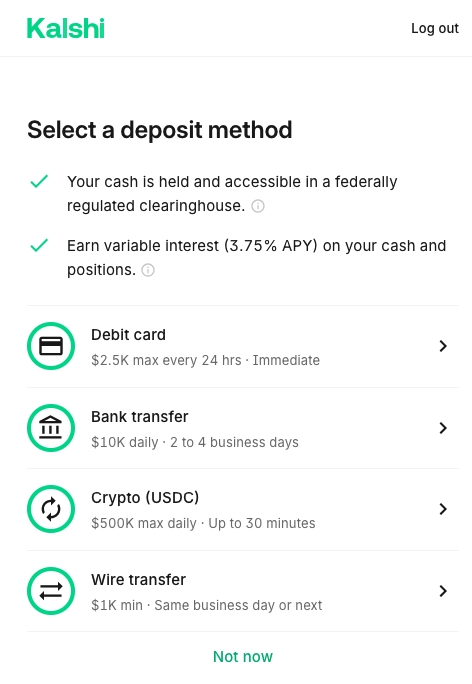

Step 2: Deposit funds on Kalshi

Once your account is validated, the next step is to fund it so you can start betting. Kalshi stands out for the variety of deposit options offered. Here’s how to proceed:

- Access the “Deposit” section: In your dashboard, locate the “Add Funds” or “Deposit” button.

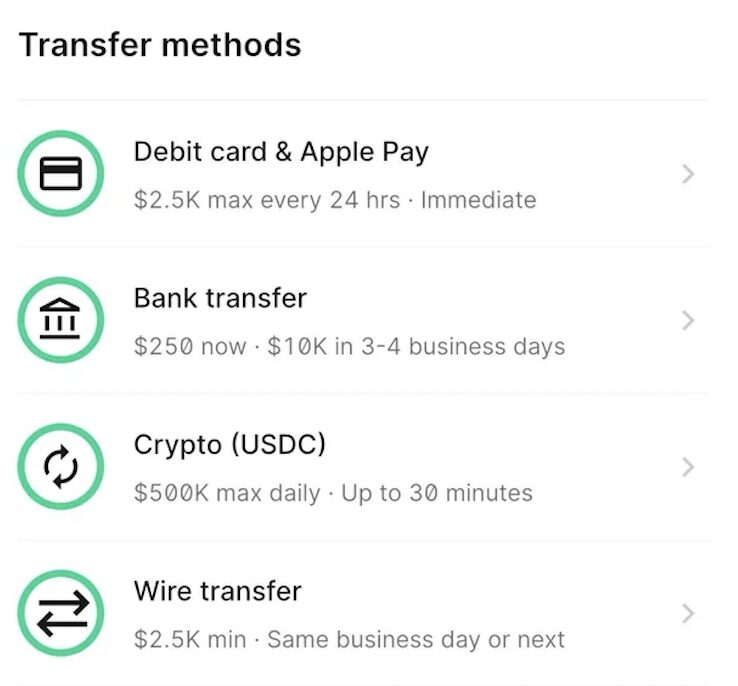

- Choose your deposit method: You’ll have a choice between several options, mainly bank transfer (ACH), debit or credit card, and crypto deposit via Zero Hash.

- Link your account (if necessary): For a bank transfer, you will be invited to link your account via a secure service like Plaid.

- Enter the amount and confirm: Enter the dollar amount you wish to deposit and confirm the transaction.

This flexibility demonstrates Kalshi’s willingness to appeal to a broad audience, while still respecting its strict regulatory framework.

Step 3: Betting on Kalshi

The heart of the Kalshi experience lies in trading event contracts. The principle is that of a binary market: for each event, you can buy “Yes” contracts if you think the event will occur, or “No” contracts if you think otherwise. The price of a contract, which ranges from $0.01 to $0.99, reflects the market’s perceived probability that the event will occur.

For example, if a “Yes” contract for “The Fed will raise rates in 2026“ is trading at $0.70, this means the market estimates a 70% probability that this will happen. If the event occurs, each “Yes” contract you hold will pay you $1. If the event does not occur, the contract expires worthless.

The Kalshi platform offers a clear interface to navigate between different event categories (economy, politics, weather, etc.), analyze price charts, and place orders in just a few clicks.

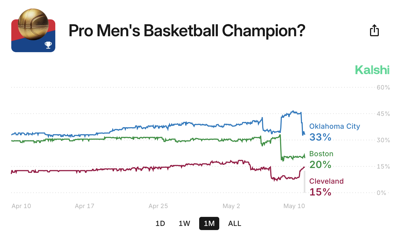

Step 4: Track your bets on Kalshi

Once your bets are placed, it is essential to be able to monitor them closely. Kalshi offers a personal dashboard where all your current contracts are listed. For each position, you can view the purchase price, the current value of the contract, and therefore your unrealized gain or loss.

This interface allows you to track probability changes in real time and make informed decisions. You can choose to keep your contracts until expiration to receive the full payout of $1 (or $0), or sell them on the market before expiration to secure a profit or limit a loss.

This ability to “exit” a position before the end is a key feature of trading on Kalshi, offering much greater flexibility than a simple traditional bet (even though cash-out functions exist today).

Step 5: Withdraw your winnings on Kalshi

The long-awaited moment for any bettor is of course withdrawing winnings. On Kalshi, the process is as secure and regulated as deposits. To transfer your winnings to your bank account, follow these steps:

- Go to the “Withdrawal” section: From your dashboard, find the “Withdraw” option.

- Select the destination account: Choose the bank account you previously linked to the platform.

- Enter the withdrawal amount: Specify the dollar amount you wish to withdraw from your Kalshi balance.

- Confirm the transaction: Review the information and validate your withdrawal request.

Processing times may vary, but CFTC regulation ensures that your funds are segregated and protected. It is important to note that withdrawals are made exclusively in US dollars.

Tips for getting started with betting on Kalshi

Getting started on prediction markets can be intimidating. Here are five essential tips for getting started on Kalshi.

First, start small. Only invest amounts you are willing to lose and gradually increase the size of your positions as you gain confidence. Second, do your own research. Don’t rely solely on market opinion. Analyze the event in depth to form your own conviction. Third, diversify your bets. Don’t put all your eggs in one basket. Spread your investments across different types of events to smooth out your risk.

Fourth, understand the notion of implied price. The price of a contract on Kalshi is a probability. Learn to identify situations where you believe the market is undervaluing or overvaluing a probability. Finally, know how to cut your losses. Don’t hesitate to sell a contract before its expiration if you realize your initial analysis was wrong. Ego is the trader’s worst enemy.

Do you need to pay taxes on winnings?

The question of taxation on prediction market gains is particularly complex in Europe, as there is no unified regulatory and tax framework. The situation on Kalshi is all the more theoretical for European residents as the platform is not officially open to them.

However, if a European user managed to make gains there, they would most likely be required to declare them to the tax authorities of their country of residence. In Europe, these gains could be treated as income from movable capital or capital gains on digital assets, and therefore subject to taxation.

In the absence of clear case law, the greatest caution is advised. It is strongly recommended to consult a tax lawyer to obtain personalized advice and ensure compliance with reporting obligations. The current regulatory opacity in Europe makes any generalization risky.

Why use Kalshi today?

Despite its current geographic restrictions, Kalshi represents a major evolution in the investment world and deserves our full attention. The first undeniable advantage of Kalshi is its CFTC regulation. This backing by a leading financial authority offers an unparalleled level of security and trust in the still young prediction markets sector. Users know their funds are protected and that the platform operates according to strict rules.

Kalshi’s second major asset is offering a new asset class. The platform literally transforms any quantifiable event into an investment opportunity. This allows traders to hedge specific risks or speculate on areas they are passionate about, from politics to science.

Finally, Kalshi acts as a powerful information tool. Contract prices on the platform reflect in real time the collective expectations of a large number of informed participants. By observing price movements on Kalshi, one can obtain an often very accurate measure of the probability of an event, acting as a kind of collective “super-forecast.” It is an alternative and valuable source of information, whether for journalists, analysts, or the simply curious.