The 5 most memorable predictions on Polymarket

Polymarket has captured the attention of traders and prediction enthusiasts by offering markets on a multitude of events. Here’s a selection of the bets that have generated the most volume and debate.

President Trump’s 2024 election

The 2024 U.S. presidential election was one of the most closely watched events on Polymarket, with bets exceeding $3 billion in volume. The prediction of the winner between Donald Trump and Kamala Harris attracted tens of thousands of traders, transforming the platform into a genuine political barometer. Another notable prediction market was the “Joe Biden withdrawal” market, which also generated millions of dollars in volume, illustrating the platform’s ability to react in real time to political news.

This Biden withdrawal market experienced particularly interesting dynamics, with probabilities evolving rapidly in the weeks leading up to the election. In July 2024, following the presidential debates, activity on the platform exploded with nearly 40,000 traders simultaneously betting more than $300 million across various political markets.

This massive concentration of volume on a single political event demonstrates how Polymarket has become an essential platform for investors seeking to monetize their political analyses and intuitions about the outcome of the presidential race.

The tragic story of the Titan submersible

In June 2023, the world held its breath following the disappearance of the Titan submersible during an expedition to the Titanic wreck. On Polymarket, a prediction market was created to determine whether the submersible would be found before a deadline. This bet, which attracted hundreds of thousands of dollars, was updated and saw probabilities reverse moments before the official announcement of debris discovery, demonstrating the speed of information on these markets.

What makes this bet particularly memorable is how the odds evolved in real time. Before official confirmation, traders on Polymarket had already integrated information about the discovery, reversing probabilities from 90% against discovery to 10% in favor within moments. Two savvy users even managed to generate thousands of dollars in profit by intelligently playing this extreme volatility. However, this incident raised ethical questions about the appropriateness of betting on tragic events involving human lives.

Bitcoin’s price before year end

Cryptocurrencies are a favorite topic on Polymarket, attracting a global community of specialized traders. The prediction market on what price Bitcoin will reach in 2025 has attracted over $80 million in volume alone, making it one of the most liquid markets on the platform. This type of bet is extremely popular and illustrates users’ interest in the future of digital assets, with price predictions ranging from $50,000 to $150,000 for Bitcoin.

The popularity of this market reflects Bitcoin’s growing importance in both institutional and retail investment portfolios. Traders use Polymarket to validate their investment theses and to understand market consensus on Bitcoin price prospects. Beyond simple betting, these prediction markets serve as leading indicators for actual price movements, allowing participants to benefit from an overview of the crypto community’s collective expectations.

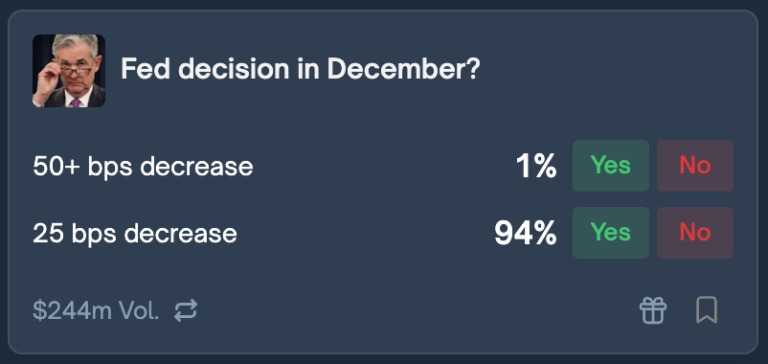

Federal Reserve decisions

Federal Reserve (Fed) announcements regarding interest rates are crucial moments for global financial markets. On Polymarket, these decisions are the subject of bets that attract hundreds of millions of dollars throughout the year, particularly around Federal Open Market Committee (FOMC) meetings. Traders attempt to predict rate hikes, cuts, or holds, making these events moments of intense speculation.

Polymarket even offers a dedicated dashboard for Fed decisions, allowing users to track real-time predictions on interest rates for the coming months. These markets reflect market expectations regarding the rate trajectory, often before traditional economists even publish their analyses.

Bets on Fed decisions are particularly important because they directly influence asset valuations, from bonds to stocks to cryptocurrencies, making them a central element of trading strategy for many investors. Currently, more than $240 million has transacted on the December prediction alone.

Sports competitions

Sports aren’t left behind on Polymarket, with bets on the world’s biggest competitions. Events like the UEFA Champions League final, the Super Bowl, the Formula 1 championship, and the NBA season generate millions of dollars in volume.

These sports markets attract a different demographic than political or financial betting, creating a unique dynamic on the platform. Sports enthusiasts find in Polymarket a legitimate opportunity to transform their expertise into financial gains, without being limited by the geographical restrictions of traditional bookmakers.

Here are some examples to give you an idea of the gigantic volumes:

- 2025 Super Bowl Winner = $610 million

- F1 Champion = $152 million

- Champions League Winner = $104 million

- NBA Champion = $68 million

Key takeaways from all these predictions

These examples show that prediction markets like Polymarket have become powerful tools for aggregating information and collective wisdom. The diversity of topics, ranging from politics to finance to sports, and the volumes of bets placed, testify to the growing interest in these platforms.

They offer an alternative to traditional polls and allow real-time measurement of public sentiment on a wide variety of topics. The speed at which information is integrated into betting odds is also a key element of their success.

Limits and controversies of prediction markets

Despite their popularity, prediction markets are not without limits or controversies. The question of ethics arises particularly when it comes to betting on tragic events like the Titan incident. Additionally, regulation of these platforms remains a major issue, as evidenced by Polymarket’s ban in the United States for a certain period. Finally, market volatility and the risk of manipulation are factors to consider for users engaging in bets on these platforms.

However, despite these challenges, prediction markets continue to impress and demonstrate their value in aggregating collective information and offering valuable perspectives on the future. This makes them essential tools for modern investors and analysts.