What is FTMO ?

FTMO is a company categorized as a prop firm, an increasingly popular trend. Prop firms are comparable to investment brokers that offer investors the opportunity to trade with their capital.

Typically, traditional brokers act as intermediaries between financial asset markets and investors. The investor registers on the platform, which then sells them contracts allowing the trader to open positions on financial asset prices (such as Forex, for example). The trader then trades with their own capital, and all risks are assumed by them.

The platform is available via its website and mobile app (Android and iOS) in 18 languages including English, with customer support available via WhatsApp, Live Chat, email, and phone.

What is a prop firm ?

A prop firm operates differently from traditional trading brokers. It recruits traders through a challenge they must pass. Then, the company provides them with capital that belongs to the firm.

The trader trades this capital across various markets and collects a portion of the profits they generate. Some prop firms, like SabioTrade, OneFunded or FTMO, offer trading across multiple markets, while others specialize in a single market, like Breakout and cryptocurrencies.

The latter offers a wider range of cryptocurrencies than all multi-market prop firms. Breakout features more than one hundred different assets, but it’s particularly notable as the first company of its kind to provide direct access to the liquidity of centralized exchanges.

The history of FTMO

FTMO is a company registered in the Czech Republic and launched in 2014 by two young day traders. Their team is young, dynamic, and the company operates from modern, spacious offices located in Prague. The platform positions itself as one of the best prop firms in the market due to its reliability and positive user feedback.

FTMO made headlines in 2022 when it was placed on the AMF blacklist. This list includes financial market and investment players that are not recommended according to the regulatory body.

Numerous misunderstandings followed this blacklisting, as it was completely unexplained. The prop firm was finally removed from the list a few weeks later.

How to become a trader on FTMO ?

The operation of all prop firms is similar : anyone can try their luck to become part of the company’s traders by passing a test or challenge. To take the test, the trader pays a fee that allows them to begin.

According to the terms established by the company, the test lasts for a certain period. If the trader achieves good results, the prop firm selects them for its trading program. If not, they cannot access the allocated funds.

If selected and they become a trader, their account is credited with capital they can trade while receiving a portion of the profits they generate.

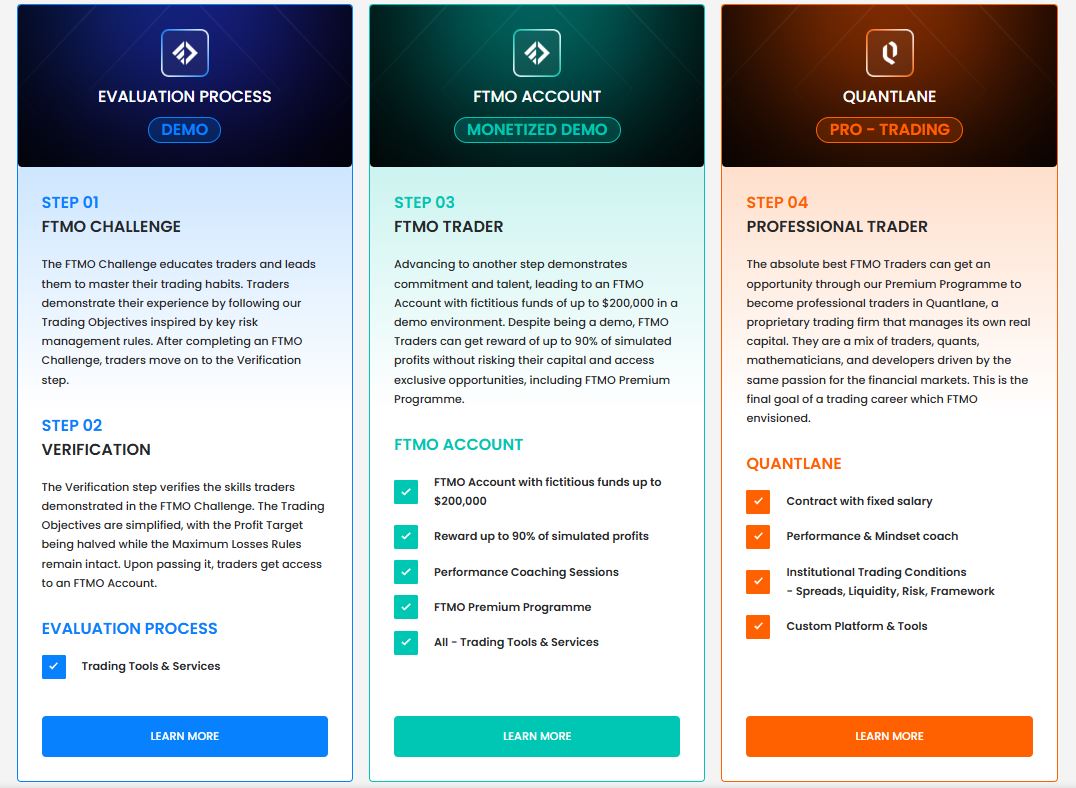

In FTMO’s case, there are 3 tests to pass to become a trader on their platform :

- FTMO Challenge

- Verification

- FTMO Trader

FTMO offers several trading platforms to its users. You can choose to trade on your favorite platforms such as MetaTrader 4, MetaTrader 5, cTrader, or DX Trade.

Quantlane Trader represents the ultimate step for FTMO’s best traders. Through the Premium Program, the top-performing traders can join Quantlane, a proprietary trading company that offers the opportunity to manage real capital. This program is designed for experienced traders who want to evolve in an institutional trading environment.

How does the FTMO Challenge work ?

This challenge is the first step to becoming an FTMO trader. Anyone can register at any time by paying the required fee.

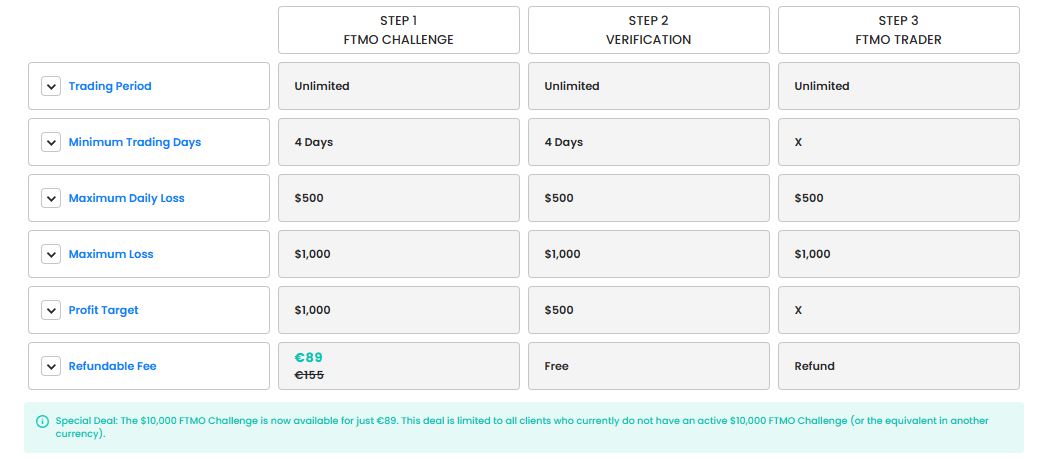

The price of the FTMO challenge depends on the capital you want to have available for trading. The minimum amount is €155 for $10,000 capital with normal risk. The platform provides up to $200,000 on an FTMO account!

The FTMO challenge now has no time limit, offering traders the opportunity to progress at their own pace. However, it remains mandatory to trade for at least 4 minimum days, actually opening and closing positions to validate each phase of the evaluation.

The guidelines provided by FTMO at the start are :

- Maximum daily loss : 5% of the initial capital

- Maximum total loss : 10% of the initial capital

- Profit target : 10% of the initial capital

The trader can choose the amount of capital made available to them; the cost of participating in the challenge depends on the chosen amount (prices for the “normal” risk selection) :

- $10,000 Capital = €155

- $25,000 Capital = €250

- $50,000 Capital = €345

- $100,000 Capital = €540

- $200,000 Capital = €1080

The amount invested by the trader to take the challenge is fully refunded by FTMO if they become a trader.

Two types of accounts are offered for the challenge with different leverage effects. The “normal” account offers 1 : 100 leverage. The FTMO Swing account offers 1 : 30 leverage and allows the trader to keep positions open overnight and over weekends (including weekends).

Verification

Verification is the second phase of the challenge. As its name suggests, it’s the phase during which the trader confirms their aptitude and skills in trading.

This phase remains similar to the first in terms of expected results, without being more difficult. The only difference is that there is now no time limit to achieve the set objectives.

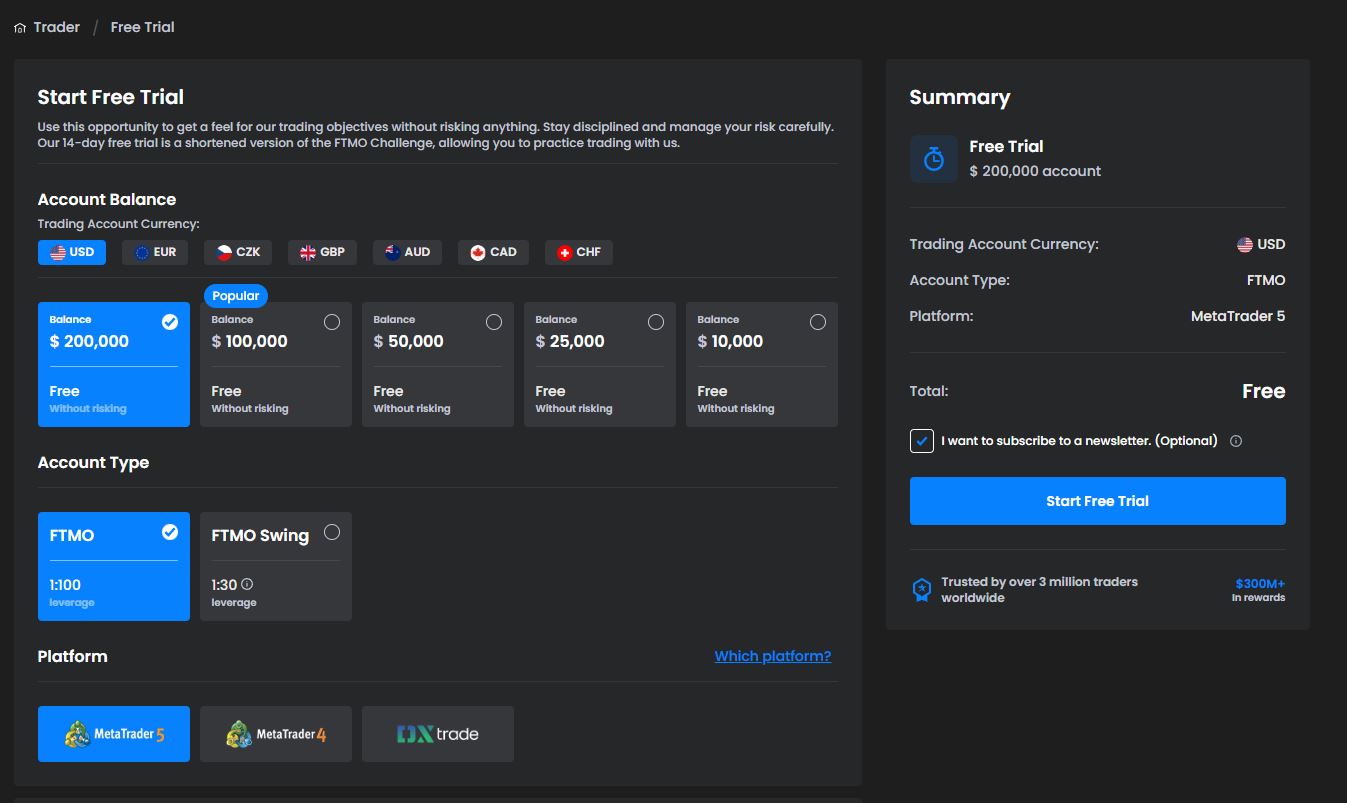

In addition to the FTMO challenge, it’s possible to take a trial after registering. Indeed, when you complete your FTMO registration, you can choose the “Free trial” option to start a 14-day trial.

This trial will allow you to familiarize yourself with the platform and FTMO tools without being directly in the challenge phase. The option is comparable to a demo account with a traditional broker. You have access to the platform and can trade without risk.

If you’re not comfortable with FTMO and prefer to test the platform, you can start with this trial.

What can you trade on FTMO ?

FTMO offers access to a wide range of financial markets, allowing traders to diversify their strategies. The platform supports several types of assets, each with its own characteristics in terms of volatility, spreads, and trading conditions.

- Forex : Major pairs (EUR/USD, GBP/USD, USD/JPY), more exotic pairs. Ideal for traders specializing in the currency market.

- Stock indices : Access to major global indices such as the S&P 500 (US500), NASDAQ 100 (US100), DAX 40 (GER40), or FTSE 100 (UK100). These assets are prized for their liquidity and directional movements.

- Stocks (CFDs) : Traders can speculate on major stocks via CFD contracts, without having to directly own the securities.

- Commodities : Trading of oil (WTI, Brent), gold (XAU/USD), silver (XAG/USD), and other commodities sought after by investors during periods of volatility.

- Cryptocurrencies : FTMO allows trading of popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and other altcoins depending on market conditions and available liquidity.

Note : Trading conditions vary according to the leverage chosen and the platform used (MT4, MT5, or cTrader). Each asset has its own spreads and opening hours, so it’s essential to check the conditions on the FTMO website before establishing a strategy.

The prop firm thus offers great flexibility to traders, allowing them to choose the markets most suited to their trading style and risk management.

How to register for the FTMO challenge ?

Before diving into the FTMO Challenge, make sure you’re well prepared to optimize your chances of success and avoid unnecessary expenses.

Follow our step-by-step guide for a smooth and efficient registration.

1. Access the FTMO website

- Go to the official website.

- Click on “FTMO Challenge” to start the registration process.

- Complete the form with your personal data.

- Once registered, you’ll access your client area.

3. Choose your FTMO Challenge plan

- Select the amount of trading capital you want ($10,000, $25,000, $50,000, $100,000, or $200,000).

- Choose normal or aggressive risk depending on your trader profile.

- Select your trading platform (MetaTrader 4, MetaTrader 5, or cTrader).

4. Launch the Challenge

- In your client area, click on “Start FTMO Challenge” to configure your challenge.

- Make the payment of the registration fee to validate your participation.

- Once the challenge starts, respect the FTMO rules to reach the next stage.

5. Verification and activation of the trader account

- After successfully completing the challenge, you need to verify your identity.

- Once validated, you access your FTMO trader account and can start managing funds and withdrawing profits.

You must choose between many options :

- Currencies : USD, EUR, CZK, GBP, AUD, CAD, CHF

- Risk version : Normal, aggressive

- Account capital : $10,000, $25,000, $50,000, $100,000, and $250,000 (for aggressive risk, maximum $100,000)

- Account type : Classic (1 : 100 leverage) or Swing (1 : 30 leverage). If you choose swing, you can trade at night, on weekends, and during economic announcements

- Platform : MT4, MT5, or cTrader

The price of the FTMO challenge will depend on the parameters chosen and varies from €89 (2025 promo) to €1080

You then proceed to payment and your challenge begins. As a reminder, the first part of the challenge now has no time limit. If you succeed, you will then need to validate the verification phase, also with no time limit to achieve your objectives.

Successfully registering with FTMO

To maximize your chances of success on FTMO and avoid errors from registration, it’s important to prepare each step well. Here’s what you need to know :

1. Choose the right capital and risk level

FTMO offers several account sizes : $10,000, $25,000, $50,000, $100,000, and $200,000. Before diving in, determine your risk level :

- A normal risk for a balanced challenge.

- An aggressive risk for higher leverage, but with a more demanding challenge.

FTMO supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Choose the one you’re most comfortable with to avoid errors related to inexperience.

3. Understand the essential rules of the challenge

To succeed, you must :

- Not exceed a maximum daily loss of 5%.

- Respect a maximum total loss of 10%.

- Reach a profit target of 10%.

- Have at least 4 active trading days.

4. Respect trading restrictions

Certain strategies are prohibited, such as martingale or arbitrage. Additionally, it’s advisable to avoid trading during major economic announcements.

A free 14-day trial is available to discover the platform without financial commitment.

6. Finalize your registration

Once the parameters are chosen, simply validate your registration and proceed to payment. If you pass the challenge, the registration fee will be fully refunded.

Tip : Practice on a demo account and apply strict risk management before attempting the FTMO challenge.

Withdrawals and rewards on FTMO

Once you have passed both phases of FTMO’s evaluation process, you obtain an FTMO Account. Although it is a demonstration account with fictitious funds, you can receive a real financial reward based on the simulated profits you generate. The capital of your account will correspond to that of your initial challenge, so it’s wise to choose the starting amount carefully.

Profit sharing

- Initial distribution : You receive 80% of the profits made, with FTMO retaining the remaining 20%.

- Scaling Plan : If you meet the conditions of FTMO’s scaling plan, your capital can increase by 25%, and your share of profits can reach 90%

Scaling Plan Conditions

To benefit from the scaling plan, you must :

- Have a trading cycle of at least 4 months.

- Achieve a total net profit of at least 10%.

- Have processed at least 2 profit withdrawals.

- Maintain a positive account balance at the time of the scaling request.

Withdrawal Process

- Withdrawal methods : Profits can be withdrawn via bank transfer, Skrill, or cryptocurrencies.

- Processing time : Payments are generally processed within 1 to 2 business days after invoice confirmation.

- Fees : FTMO does not charge any commission for withdrawals. However, minimum amounts apply: $20 for bank transfers and $50 for cryptocurrency payments.

Additionally, the amount invested for the initial challenge is fully refunded during your first profit sharing.

The platform offers an attractive reward structure for high-performing traders, with opportunities to increase allocated capital and profit share through their scaling plan.

Advantages and disadvantages of FTMO

FTMO has established itself as a global reference among prop firms, with over 20,000 funded traders since 2014. Based in Prague and regulated by the Czech National Bank (CNB), it offers trading accounts up to €400,000 and profit sharing up to 90%.

FTMO stands out with its proprietary technology, high-performance mobile application, and advanced analysis tools. It also guarantees rigorous payment tracking, with over 60 million euros paid to traders.

✅ Advantages of FTMO

- Regulated and reliable company, recognized by the CNB

- Guaranteed payments and bi-monthly payouts for funded traders

- Scaling plan allowing capital increase up to €2M

- Advanced analysis tools and high-performance mobile application

- Multilingual customer support, responsive and available 24/5

- Structured challenge with only 4 minimum trading days to validate

❌ Disadvantages of FTMO

- High challenge prices compared to other prop firms

- Demanding objectives, requiring rigorous risk management

- Minimum duration of 14 days for the challenge, limiting ultra-fast scalpers

- Strict daily limits, with a maximum drawdown of 5% per day

- Trading prohibited during certain major economic announcements

FTMO remains a top-tier prop firm, but access requires strict discipline and mastered risk management. For serious traders, it offers a solid opportunity with advantageous conditions once funded.

Why was FTMO placed on the AMF blacklist in France ?

In October 2022, FTMO was added to the much-dreaded AMF (Autorité des Marchés Financiers) blacklist. This news created an outcry of incomprehension in the community.

Companies on the blacklist are often avoided by investors, as they are considered unreliable and risky for users.

That’s where the misunderstanding about FTMO lies. In reality, when the AMF blacklists a platform, it warns of financial risks that users incur when registering on the platform.

In FTMO’s case, as we’ve just seen how it works, there is absolutely no risk since there is never a transfer of value. When the user registers and decides to attempt the challenge, they pay their participation in a single payment. It’s as if they were paying for a service.

Then, if accepted as a trader, they trade the company’s capital, not their own. There is therefore no risk of loss or scam since their money is never at stake.

Since 2023, the FTMO prop firm is now off the AMF blacklist, without having communicated any official information. Unexpectedly, the prop firm was placed on this list by mistake and due to lack of knowledge.

What customers think : FTMO Trustpilot reviews

Customer FTMO reviews on the famous Trustpilot platform are excellent. The prop firm garners a rating of 4.8/5 from 19,347 reviews, with 94% giving the maximum rating.

It’s rare to find a platform with any investment relationship that has such a high rating. Reading the comments, they are all praising.

You can read that payments are always made when needed, that the customer service is very responsive and excellent. Many comments assert that FTMO is the best prop firm company in the market.

Here are some examples of positive FTMO reviews :

Super Follow-up, super clear platform, super fast response from FTMO team.

You want to start a PropFirm, only one choice FTMO

Greg – Trustpilot

I appreciate their leadership in the profirm field. I also validated my FTMO challenge after 3 attempts. I also find that the spread is satisfactory. They are also prompt to help you.

Oumasaore – Trustpilot

The negative FTMO reviews are mostly from users who failed to pass the tests and are complaining about their non-acceptance. It’s difficult to know the exact reasons for their rejection and if the fault lies with the platform.

Here are some examples of negative FTMO reviews :

Why do I give 3 stars? Because I find the daily loss system misleading. Let me explain : one of my positions closed on a stop loss, indeed, but it was in profit. Regarding the imputed drawdown value, they apparently calculate the maximum authorized that I could have gained and deduct it as a loss from me.

If your drawdown is, for example, too large, even if you have recorded a profit, you can lose your account. It’s very unhealthy.

Ludo – Trustpilot

FTMO review : The best prop firm in the market ?

The FTMO concept remains solid : it allows anyone to get into trading without risking their own capital. Traders can access substantial funds and earn up to 90% of the profits generated, while limiting risks. It’s a real opportunity for those looking to trade in a serious framework without having to invest huge sums upfront.

That said, not everything is perfect, and it’s worth keeping an eye on emerging alternatives like OneFunded and SabioTrade. Registering for the FTMO Challenge requires an initial investment that depends on the chosen capital, for example, €540 for a $100,000 account. Even though this sum can be refunded from the first profit sharing, the risk of never reaching this stage exists, especially given the rigorous selection.

Despite this, FTMO remains one of the best prop firms in the market, with fast payments and a professional framework that attracts many ambitious traders.