Reasons Why PEPE Price Could Skyrocket in the Coming Days

The iconic memecoin PEPE appears poised for a comeback. With positive technical indicators and a surge in long positions, PEPE could be on the brink of sparking a new bullish trend.

The iconic memecoin PEPE appears poised for a comeback. With positive technical indicators and a surge in long positions, PEPE could be on the brink of sparking a new bullish trend.

The PEPE, the famous memecoin, has recently displayed encouraging technical signals indicating a possible short and medium-term upward trend. Indeed, the analysis of on-chain data and technical indicators reveals several positive elements:

However, the long-term moving averages are still downward, indicating that PEPE’s bullish momentum remains fragile in the long run.

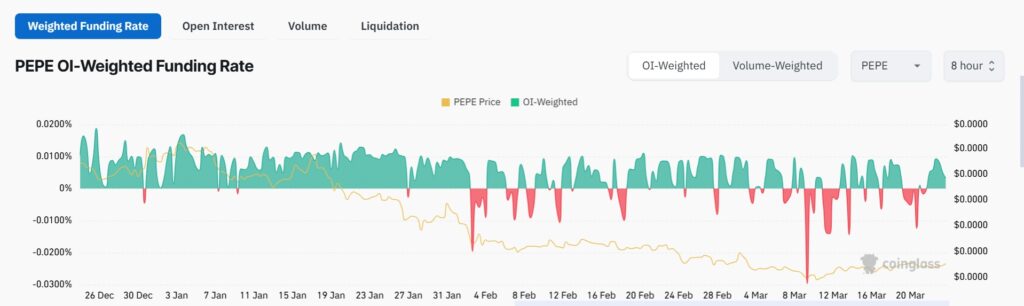

Parallelly, derived data from PEPE also shows promising signs:

However, the highly speculative nature of the memecoin market implies that this bullish momentum remains fragile and subject to significant short-term volatility fluctuations.

PEPE’s technical signals and on-chain data suggest that the memecoin could be on the verge of starting a new phase of growth. With the confirmation of breaking the resistance at $0.00000780, PEPE could target a medium-term goal around $0.00000850.

Nevertheless, investors need to exercise caution due to the inherent volatility in the memecoin market. PEPE will need to demonstrate its ability to sustain its bullish momentum in the long run to convince the most skeptical investors. Only time will tell if this new dynamic will be sufficient to sustainably boost PEPE’s price.

Gaston has been a writer for over 7 years and a passionate cryptocurrency enthusiast since 2020. He loves exploring the crypto ecosystem and is now dedicated to sharing his insights and discoveries through InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.