Gold’s 55.58% Surge in 2025: A Potential Insight Into Bitcoin’s Price Movement

According to analysts, the rise in the price of gold in 2025 could anticipate the next rise in Bitcoin...

According to analysts, the rise in the price of gold in 2025 could anticipate the next rise in Bitcoin...

Key highlights:

The price of gold has surged more than 55% this year, reaching approximately $4,350 per ounce, its highest level ever recorded. The precious metal has significantly outperformed Bitcoin, which has increased by about 18% in 2025 and has fallen approximately 10% in recent weeks due to intensifying trade tensions between the United States and China.

The contrast between the two assets is striking. Gold continues to reach new heights, while Bitcoin struggles to stay above $110,000, even after reaching $126,000 earlier this year.

For investors who once labeled Bitcoin as “digital gold,” this contrast is frustrating. Yet, some analysts claim that gold’s rise could actually be a preview of what awaits Bitcoin.

“Don’t look at gold’s meteoric rise with envy, but with anticipation,” wrote Matt Hougan, Chief Investment Officer at Bitwise, in an investor note dated October 21. “It might end up showing us where Bitcoin is headed.”

According to Hougan, gold’s rise didn’t happen overnight. Central banks began buying heavily in 2022, but the real breakthrough only came this year. Bitcoin’s institutional wave started later, with the launch of spot Bitcoin ETFs in 2024. If the same pattern repeats, Bitcoin could still experience a major breakthrough.

Standard Chartered predicts that Bitcoin could reach $200,000, while 10xResearch estimates it has about a 50% chance of reaching $140,000 before year-end. According to CoinCodex’s Bitcoin price forecasts, new institutional inflows could trigger a fresh bull phase for Bitcoin.

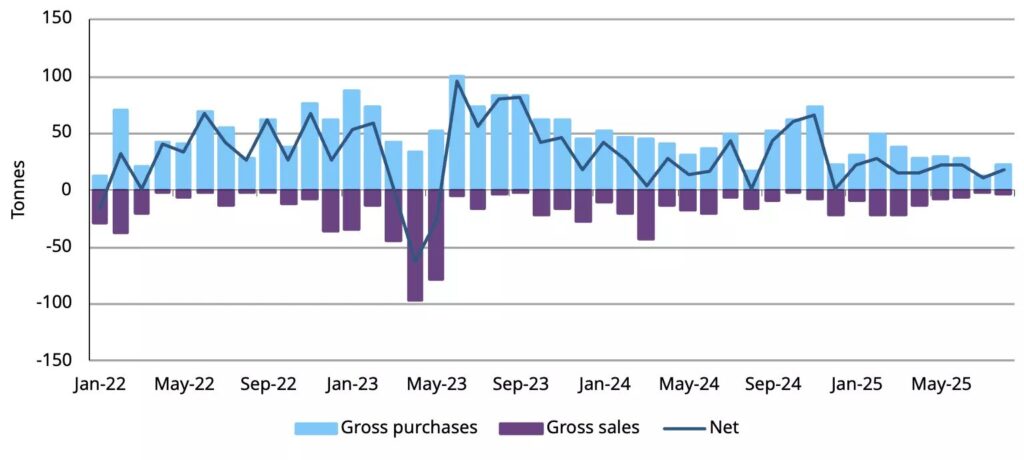

Central banks have been one of the driving forces behind gold’s price surge. After the US froze Russian Treasury bond assets in 2022, official gold purchases nearly doubled from about 467 tonnes per year to nearly 1,000 tonnes, according to Metals Focus. This represents approximately twice as much as gold-linked exchange-traded products purchased annually.

Bitcoin doesn’t yet benefit from such official support. ETFs now hold more than 6% of the total bitcoin supply, and corporate treasuries control over one million BTC, but central banks remain largely absent from the cryptocurrency market.

According to CoinCodex’s gold price forecasts, the precious metal could continue its upward trajectory, with central bank demand remaining strong, potentially gaining an additional 34% over the next three months.

Hougan points out that gold didn’t take off when central banks first started buying. It gradually moved from $1,800 in 2022 to $2,386 in 2024, and it was only this year that prices surged beyond $4,350.

He believes that as central banks continued to accumulate reserves, early sellers eventually exhausted their supply. Once this happened, prices increased dramatically.

Bitcoin could experience the same situation. Since the launch of ETFs in early 2024, institutions have purchased approximately 1.39 million BTC, more than four times miners’ production. Bitcoin has gained about 135% since then.

If this trend continues, short-term sellers could soon be exhausted. “As long as the combination of ETF and corporate buying persists, Bitcoin will experience its ‘Gold 2025’ moment,” wrote Hougan.

Not everyone sees gold’s rise as good news.

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, said that gold’s rally looked “simply scary.”

“The speed of this rally – +60% in one year – hasn’t been seen since 1979,” McGlone said on The Deep Dive podcast.

That previous surge had preceded a major reversal when Fed Chairman Paul Volcker raised interest rates to curb inflation.

“When all major risk assets underperform gold, that ancient store of value, it’s not a good sign,” McGlone added.

Gold’s breakthrough in 2025 has left Bitcoin lagging, but not necessarily out of the game. Analysts see parallels between gold’s slow build-up and Bitcoin’s current accumulation phase among ETFs and corporations.

If the trend holds, Bitcoin might simply be following gold’s curve with a one or two-year lag, rather than losing its edge as a store of value. For long-term holders, gold’s performance may not be a warning but rather a preview of what awaits Bitcoin.

Patrick est rédacteur spécialisé dans les cryptomonnaies depuis 2018, notamment dans les domaines de la DeFi, du minage de cryptomonnaies et de la technologie blockchain. Fort d'une formation en informatique et en finance, il apporte son expertise sur les échanges décentralisés et la gestion des actifs cryptos. Reconnu pour son approche pratique et à long terme, Patrick reste concentré sur la durabilité dans le domaine des du Web3. Pendant son temps libre, il aime jouer au volley-ball et collectionner les cartes Magic: The Gathering.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.