What is Staking ?

Staking refers to the process where cryptocurrency holders lock or “commit” their digital assets in a wallet or smart contract to participate in the Proof-of-Stake (PoS) consensus mechanism of a blockchain. This active participation allows users to receive rewards in the form of new tokens.

Unlike Bitcoin mining which requires considerable computational power and high energy consumption, staking represents a more eco-friendly and accessible alternative. You simply need to hold the specific cryptocurrency and lock it for a predetermined period to participate in the transaction validation process.

How Does It Work ?

The staking mechanism revolves around several sophisticated technical processes. When a user decides to stake their cryptocurrencies, their tokens are transferred to a specialized smart contract that temporarily immobilizes them. These locked tokens serve as economic collateral to ensure the integrity of the network.

The validation process works on a weighted random selection principle. Validators are chosen to propose new blocks based on their stake. Often, the more staked tokens a validator possesses, the higher their chances of being selected. Once selected, the validator proposes a new block that is verified by other validators in the network.

The system also incorporates penalty mechanisms called “slashing” to deter malicious behavior. If a validator acts dishonestly, a portion of their staked tokens can be destroyed, creating a strong economic incentive to maintain network integrity.

Different Types of Crypto Staking

The staking ecosystem has diversified considerably, now offering a multitude of options suited to different investor profiles.

- Flexible staking allows users to withdraw their funds at any time without a fixed commitment period. This flexibility typically results in lower returns compared to other forms of staking.

- Locked staking requires a longer time commitment, typically ranging from a few weeks to several months. This liquidity constraint is compensated by significantly higher returns.

- Delegated staking allows token holders to delegate their assets to professional validators without losing ownership of their cryptocurrencies. Validators handle the technical complexity while delegators receive a portion of the rewards.

- Liquid staking represents the most recent innovation. Protocols like Lido Finance allow users to receive derivative tokens in exchange for their staked assets. These tokens can be freely traded while continuing to generate staking rewards.

How to Stake Cryptocurrencies ?

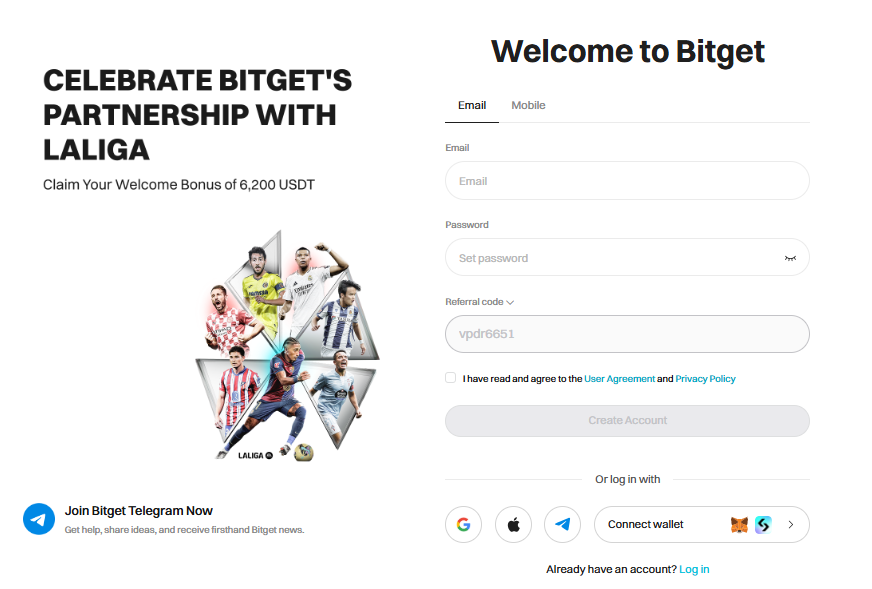

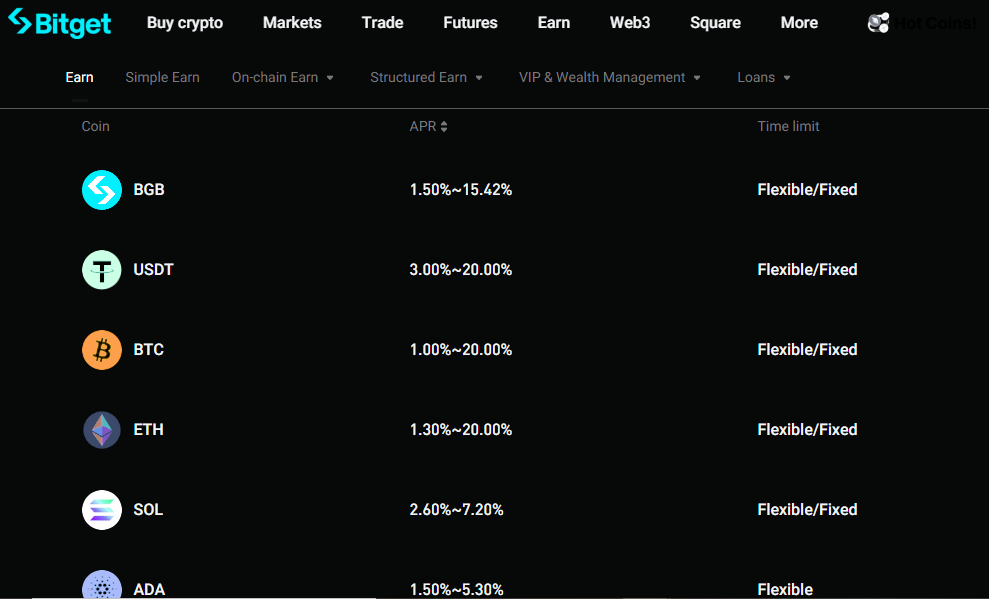

To get started with crypto staking, Bitget represents one of the most accessible platforms in the market. This platform offers competitive yields ranging from 4% to 22% APR depending on the selected cryptocurrencies.

Tutorial for Staking Cryptos on Bitget :

Step 1 : Create an account on Bitget and activate two-factor authentication. Deposit your cryptocurrencies using the available methods.

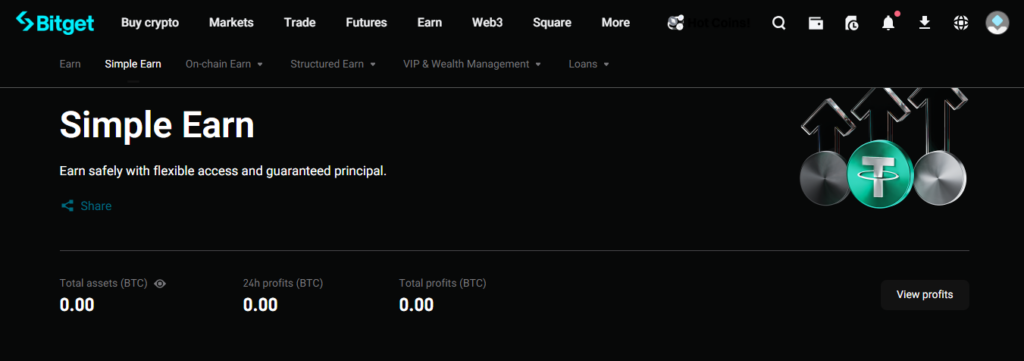

Step 2 : Open the Bitget app, tap on “More” and select “Earn” in the navigation bar.

Step 3 : Choose “Staking” from the available options to access available cryptocurrencies with their respective yields.

Step 4 : Select your desired cryptocurrency and choose between flexible or locked staking based on your goals. Define the amount to allocate.

Step 5 : Review the conditions (duration, APR, terms) and confirm the transaction. Your rewards will begin accumulating from the following day.

Step 6 : Track the progress of your rewards in the “My Investments” section of your Bitget account.

What Are the Best Cryptocurrencies for Staking ?

Choosing cryptocurrencies for staking in 2025 should be based on an analysis combining potential yield, project stability, and development prospects. Here are some examples of relevant cryptocurrencies for staking:

- Ethereum (ETH) remains the benchmark with stabilized yields between 3% and 7% APY. The transition to Proof-of-Stake ensures sustained institutional adoption.

- Binance Coin (BNB) offers the most attractive returns with APYs from 7.27% in flexible to 14.4% in locked staking. Binance’s dominant position provides additional stability.

- Cardano (ADA) offers yields from 3% to 6% APY with the advantage of not requiring a lock-up period, providing valuable flexibility.

- Solana (SOL) maintains attractive yields of 6% to 8% APY thanks to its high performance and minimal transaction costs.

- Cosmos (ATOM) stands out with yields of 6.95% APY on average, potentially reaching up to 12-17% thanks to its interoperability ecosystem.

Finally, to maximize returns on “idle” money, some people don’t hesitate to convert their savings into stablecoins, such as USDT or USDC, and stake them.

Why Stake Stablecoins ?

Staking stablecoins like USDT (Tether) and USDC (USD Coin) offers several advantages :

- High yields (up to 10% APY on certain platforms)

- Limited risk thanks to the price stability of these tokens

- Possibility to generate passive income without exposure to cryptocurrency volatility

With low risk and attractive returns, stablecoin staking is an excellent entry point for beginners or passive income enthusiasts.

What Are the Risks of Crypto Staking ?

Staking presents several significant risks that every investor should understand before diving in:

- Slashing risk : Partial or total destruction of staked tokens when a validator adopts malicious behavior. While generally low with reputable validators, this risk can have dramatic consequences.

- Price volatility : Exposure to market fluctuations while tokens are locked. A significant drop can cancel out gains generated by rewards.

- Lock-up periods : Liquidity risk created by the immobilization of funds, which can extend over several months, problematic in case of urgent need for liquidity.

- Technical risks : Bugs in smart contracts that could lead to total loss of staked funds. Newer protocols present higher risks.

- Counterparty risk : Concerns staking via centralized platforms that may go bankrupt or be hacked.

- Regulatory uncertainty : Can impact staking profitability or impose retroactive tax obligations depending on legislative developments.

Our Recommendations for Staking

Diversification constitutes the fundamental pillar of a successful staking strategy. Spread your investments across multiple assets and platforms to reduce risks.

For beginners, start with flexible staking on reputable platforms with modest amounts. Gradually increase your exposure once you’ve mastered the concepts. Keep in mind that thorough research of projects and validators is essential. Analyze technical fundamentals, performance history, and community reputation.

Finally, actively monitor your positions by regularly checking yield rates and validator performance. Adjust your strategy if necessary.

Continuous innovation is transforming the staking landscape in 2026, notably with liquid staking reaching remarkable maturity and the emergence of restaking opening new frontiers. Regulatory clarification in many jurisdictions creates a more predictable framework, facilitating institutional adoption. These developments position staking as a highly attractive practice.

Our opinion is decidedly positive regarding crypto staking. We anticipate sustained growth in staked assets in 2025, driven by institutional adoption and continued technical innovation. However, caution remains essential: staking should represent only part of a diversified portfolio, and investors must maintain a clear understanding of associated risks to successfully navigate this ecosystem.