Market Structure : The Foundation of Technical Analysis

Understanding market structure is the fundamental pillar of any effective trading strategy. This structure articulates price movements in financial markets and reveals the intentions of participants, whether they’re retail investors or financial institutions. Market structure operates according to a principle of alternating phases that follow each other cyclically : impulse and retracement.

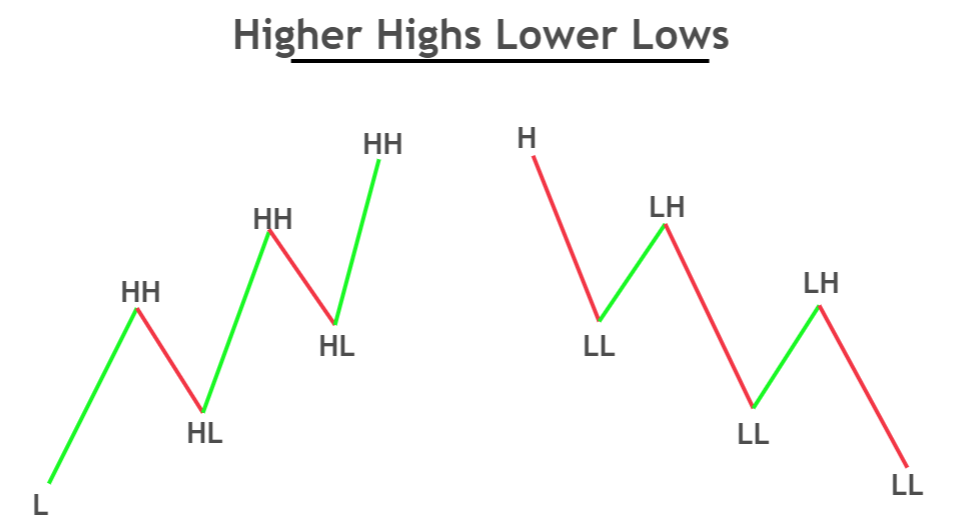

Bullish Trends

In a bullish trend, market structure presents higher highs (HH) and higher lows (HL). The intensity of the impulse consistently exceeds that of the following retracement. For example, if a bullish impulse generates a movement of 10 pips, the bearish retracement should ideally not exceed this number of pips to maintain the integrity of the bullish structure.

Bearish Trends

Conversely, a bearish trend presents a structure where retracements exceed impulses in intensity. This reversal in the balance of power signals that sellers have taken control of the market. The bearish structure is characterized by the formation of lower lows (LL) and lower highs (LH).

What is a BOS ?

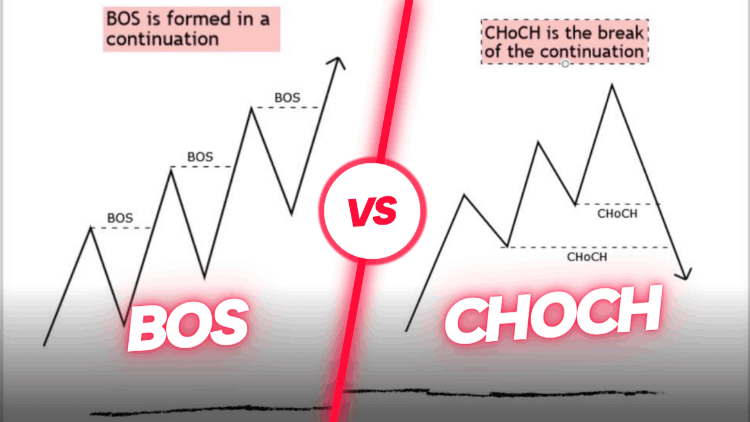

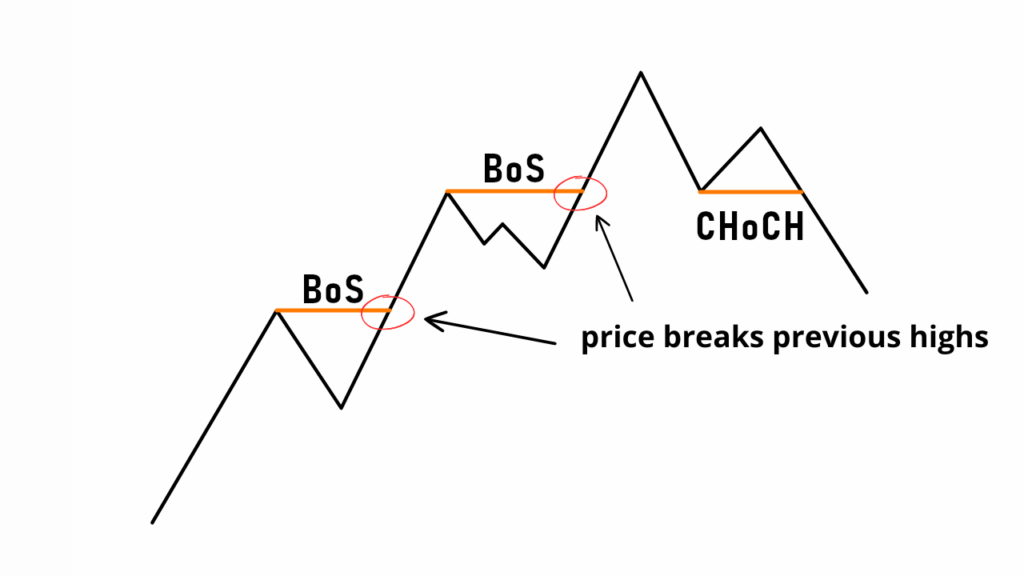

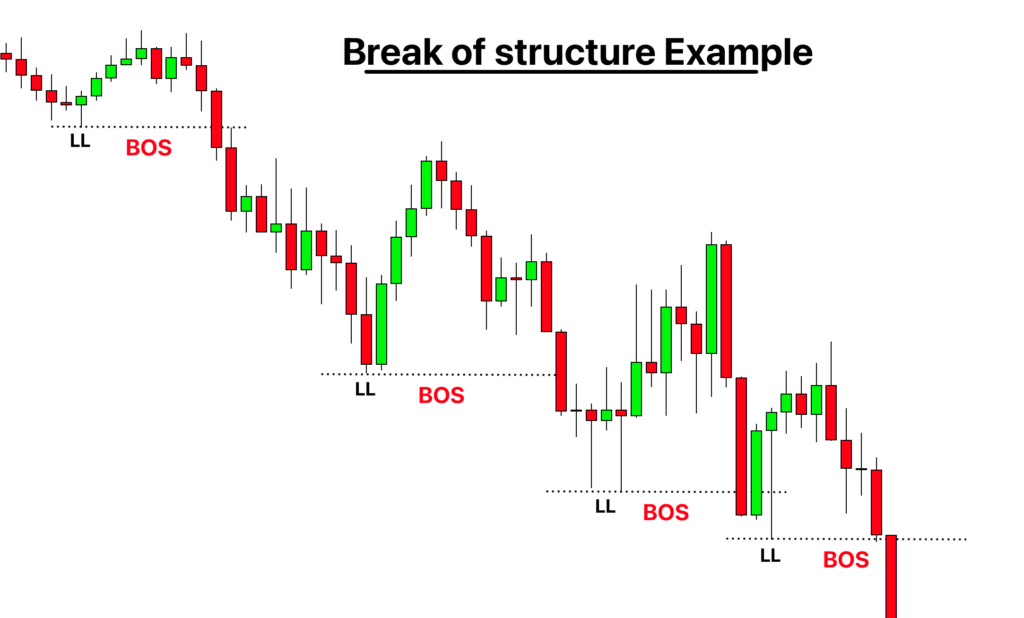

The Break of Structure or BOS refers to the precise moment when the price of an asset crosses a significant structural level, thus confirming the continuation of the current trend. More specifically, a BOS materializes when the price breaks the highest point of a bullish structure without having previously broken the lowest point, or vice versa.

A Signal of Trend Continuation

The Break of Structure functions as a confirmation indicator that validates the continuation of the existing trend. In a bullish trend, a BOS occurs when the price breaks above the last significant peak in the structure. This breakout confirms that buyers maintain their dominance and that buying pressure remains strong enough to propel prices to new highs.

Fundamental Distinction : BOS versus ChoCh

Understanding the BOS imperatively requires distinguishing it from its counterpart, the Change of Character or ChoCh. The ChoCh differs from the BOS and manifests when the market structure undergoes a reversal rather than a continuation. In a bullish trend, a ChoCh occurs when the price breaks the last low point before breaking the last high point.

Integrating BOS into Smart Money Concepts

The Break of Structure fits perfectly into the philosophy of Smart Money Concepts, an approach that aims to understand and follow the movements of institutional investors. In this context, the BOS reveals the intentions of smart money and allows retail traders to align with institutional movements.

How to Identify a BOS ?

Identifying a Break of Structure relies primarily on a simple and visual approach: following charts and plotting levels methodically. This accessible method allows any trader to effectively spot structural breakouts without resorting to complex tools. The key to success lies in consistent plotting and patience to wait for the right opportunities.

Level Plotting : Fundamental Method

The first step in identifying a BOS is to plot important structural levels on your charts. These levels correspond to the last significant highs and lows of the current structure. In a bullish trend, you need to identify and plot the last peak reached by the price. In a bearish trend, it’s the last trough that must be marked.

This visual approach allows for clearly materializing the critical thresholds that the price must cross to confirm a BOS. Then, simply monitor the chart and wait for the price to approach these plotted levels. This simple but effective method avoids over-analysis and keeps the trader focused on the essentials: real price movements.

Regular monitoring of charts then becomes a daily habit. By updating your levels as the market evolves, you maintain a clear vision of the current structure and remain ready to identify BOS as soon as they appear.

The Two Schools of BOS Confirmation

The trading community is divided into two main schools regarding the validation of a BOS, each with its advantages and disadvantages depending on the trader’s profile and objectives.

The first school favors confirmation by closing. These traders wait for a candle to close completely beyond the structural level to validate the BOS. This conservative approach significantly reduces the risks of false breakouts, as a close beyond the level demonstrates real market conviction. This method is particularly suitable for traders who prioritize signal quality over frequency.

The second school adopts a more aggressive approach by considering that a BOS is validated as soon as the price breaks the level, even temporarily, or when a simple wick crosses the threshold. This method allows entering movements earlier and capturing more potential profit. However, it also exposes traders to a higher risk of false breakouts and requires stricter risk management.

Choosing Your Approach Based on Your Profile

The choice between these two approaches largely depends on your trader profile and risk tolerance. Beginning traders will benefit from adopting the conservative approach to develop their understanding of BOS without suffering too many losses due to false breakouts. Experienced traders can explore the aggressive approach by adapting their risk management accordingly.

Some traders combine both approaches by using the simple breakout as an alert signal and the candle close as entry confirmation. This hybrid method allows mentally preparing for the trade while maintaining an acceptable level of security.

How to Use BOS in Trading ?

The practical exploitation of Break of Structure in a trading strategy requires a methodical and disciplined approach. This utilization involves building a complete trading system integrating entry points, risk management, and profit objectives.

Optimized Entry Strategy

Determining the optimal entry point constitutes the most critical element in using BOS. The most effective approach is to wait for breakout confirmation before initiating a position. This confirmation materializes through a candle close beyond the structural level (if you’re conservative), accompanied by significant volume.

The retest of the broken level often offers an even more favorable entry opportunity. After a bullish breakout, the former resistance level becomes a new support. This retest phase allows entering with a particularly attractive risk/reward ratio.

Risk Management and Stop Loss Placement

Risk management in BOS trading relies on judicious placement of stop losses that protect capital while leaving sufficient room for the trade to develop. For a bullish BOS, the stop loss is generally placed below the newly formed support level.

Defining Profit Objectives

Determining profit objectives in BOS trading relies on the analysis of historical resistance and support levels. The multiple objectives approach proves particularly effective, consisting of defining several profit-taking levels. The minimum recommended risk/reward ratio is around 1:3, but again, this varies depending on your strategy.

Why Integrate BOS into Your Trading ?

Integrating Break of Structure into a trading strategy brings considerable advantages that transform the traditional approach to technical analysis. This methodology offers a structural vision of the market that goes beyond simple buy or sell signals.

Improved Signal Accuracy

One of the main advantages of BOS lies in their ability to provide high-quality signals with a reduced rate of false alerts. The structural confirmation that a BOS brings eliminates much of the uncertainty inherent in trading.

Synchronization with Institutional Movements

Integrating BOS allows alignment with institutional investor movements. This synchronization offers a major competitive advantage to retail traders who can thus benefit from the firepower of institutions.

Versatility and Adaptability

BOS present the remarkable advantage of being universally applicable to all financial markets and timeframes. This versatility allows traders to develop a coherent methodology applicable to stocks, Forex, or cryptocurrencies.

In 2024, Break of Structure stands as one of the most relevant technical analysis tools. The growing adoption of Smart Money Concepts by retail traders democratizes this institutional approach and levels the playing field. The increasing sophistication of markets makes this methodology even more valuable for identifying genuine opportunities.

The integration of artificial intelligence and trading algorithms into the financial ecosystem paradoxically reinforces the importance of BOS. These automated tools excel at identifying structural patterns, amplifying the effectiveness of authentic BOS signals. Traders who master this approach thus benefit from a competitive advantage against purely algorithmic strategies.

Our recommendation for 2024 is to progressively integrate BOS into your trading arsenal, starting with higher timeframes to develop your structural understanding. The patience and discipline required by this approach constitute a long-term investment that will transform your market vision. The future of trading belongs to those who understand institutional logic, and BOS represents the key to this understanding.