3 Disturbing Signals About Bitcoin This Week

As Bitcoin navigates a triple warning signal, investors are on edge. Uncover the key indicators foreshadowing a turbulent period for the leading cryptocurrency.

As Bitcoin navigates a triple warning signal, investors are on edge. Uncover the key indicators foreshadowing a turbulent period for the leading cryptocurrency.

September has always been a challenging month for Bitcoin. This year seems to be no exception, with the appearance of three “death cross” signals on major technical indicators. These patterns, often precursors to volatility and corrections, cast a shadow over the short-term outlook for the cryptocurrency.

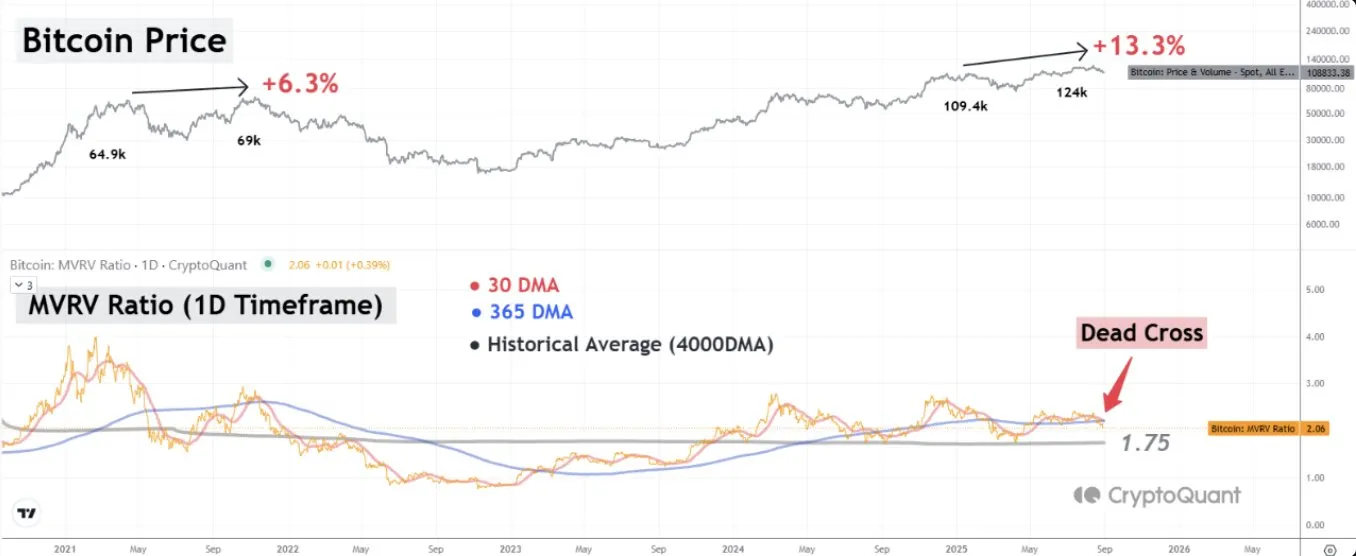

The first warning comes from the Market Value to Realized Value (MVRV) ratio, an on-chain metric closely monitored by crypto analysts. According to Yonsei_dent, the MVRV has just formed a “death cross” with the 30-day moving average crossing below the 365-day moving average. Historically, such crossovers have often preceded significant corrections in Bitcoin’s price.

“This doesn’t necessarily mean the same scenario will repeat itself Bitcoin ETFs have brought more structural stability to the market. But history doesn’t repeat itself, it rhymes. The MVRV signals deserve our attention,” emphasizes Yonsei_dent.

The second concerning signal comes from Bitcoin’s weekly MACD indicator. This momentum measurement tool shows that the MACD line has just crossed below the signal line, a pattern often interpreted as a sign of weakening buying pressure and downside risk.

The third warning comes from analyst Deezy, who focuses on Bitcoin’s Exponential Moving Averages (EMA). He noted that the 20-day average has just crossed below the 50-day average a classic “death cross” pattern.

“The last time this happened in February 2025, BTC fell an additional 23%. A 23% drop from here would put Bitcoin at $86,000,” he predicted.

These three “death cross” signals converge in September 2025, painting a concerning picture for Bitcoin. While these indicators have often been followed by volatility in the past, it’s important to note that they can sometimes prove to be false signals, especially during strong bull markets.

This time, the stakes are high as investors await the U.S. Federal Reserve’s decision on interest rate cuts, a measure expected to strengthen sentiment toward cryptocurrencies. Vigilance is therefore essential for Bitcoin in September, despite potentially stabilizing factors in place.

Related articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.