Bitcoin dips to $70,000: What’s happening with Bitcoin ETFs?

Bitcoin ETF inflows saw a sharp reversal after a surge. Discover the factors behind the price drop and the impact on BTC.

Bitcoin ETF inflows saw a sharp reversal after a surge. Discover the factors behind the price drop and the impact on BTC.

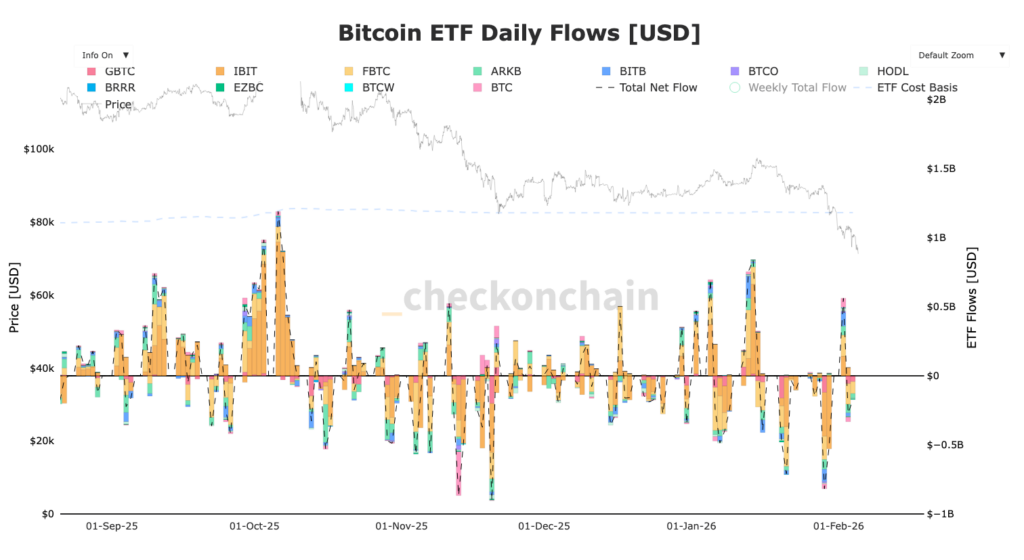

February 2026 had started off with a bang. After a brutal end to January, institutional investors finally seemed ready to buy the dip. On Monday, February 2nd, US Spot Bitcoin ETFs recorded a spectacular net inflow of $561.9 million, ending a four-day streak of outflows. Fidelity (FBTC) led the charge with over $153 million, closely followed by giant BlackRock (IBIT).

But the euphoria was short-lived. The very next day, the trend violently reversed. On Tuesday, February 3rd, these same financial products suffered a hemorrhage of $272 million. Notably, Fidelity, which had massively accumulated the day before, saw nearly $148 million flow out, almost entirely erasing its previous day’s gains. This “revolving door” movement suggests that even whales and asset managers are navigating blindly, favoring short-term tactical trading strategies over strategic accumulation.

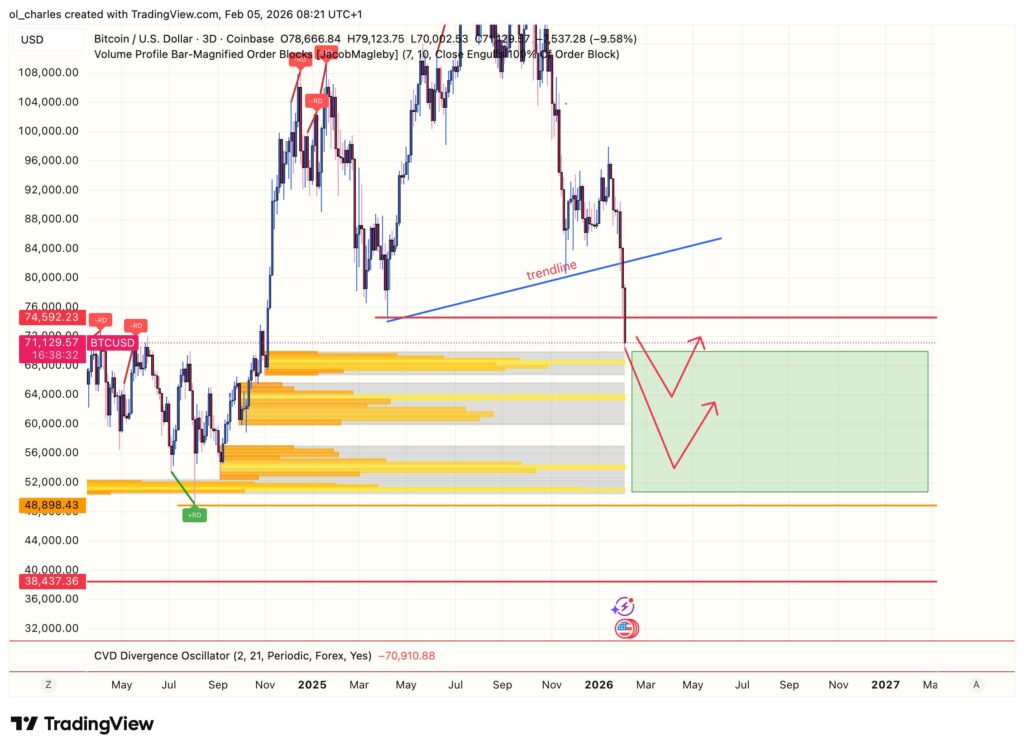

The impact on price was immediate. This institutional indecision acted as a bearish catalyst, pushing Bitcoin’s price below the psychological barrier of $71,000 on February 4th, a level not seen since November 2024. We are now far from the October 2025 ATH of $126,000, with the market showing a correction of over 40%.

From a technical perspective, the situation is concerning. BTC is now trading below its key moving averages, confirming an intermediate bearish trend. It has also decisively broken the $74,000 low, confirming that the decline should continue lower.

However, the numerous order blocks formed over 3 days between $50,000 and $70,000 provide a perfect foundation for Bitcoin to prepare its bottom and rebound. Several support levels are worth watching, notably $67,000, $63,000, and $53,000 for BTC.

This brutal reversal in ETF flows sends a contradictory signal. On one hand, the massive inflow on February 2nd proves there’s latent demand ready to step in at these price levels. On the other hand, the speed of the outflows shows extreme nervousness in the face of macroeconomic uncertainties (Fed policy, delayed US employment data). The crypto market currently seems correlated with traditional risk assets, struggling to play its role as a safe haven.

For traders, caution is warranted. According to NoLimit, insiders are selling massively in the stock market and a bear market is brewing there.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.