Bitcoin: 5 Signals that could trigger a bear market

Is a Bitcoin bear market on the horizon? Discover 5 key signals, from technical analysis to on-chain data, that could signal a price drop. Read now!

Is a Bitcoin bear market on the horizon? Discover 5 key signals, from technical analysis to on-chain data, that could signal a price drop. Read now!

The macroeconomic climate has darkened sharply over the past 24 hours. The announcement by President Trump of new punitive tariffs against several European Union countries has sent shockwaves through financial markets. Bitcoin (BTC), often correlated with risk-on assets, has not been spared, recording a drop of nearly 2.5% to touch $92,663.

This correction comes as the market is still digesting massive liquidations of long positions—over $680 million wiped out in a single day. Investors appear to be retreating to cash and gold, temporarily abandoning digital assets. However, the current decline could be the prelude to a deeper move, justified by five worrying technical signals.

This is arguably the most closely watched technical signal by Ichimoku traders. A bearish “Kumo Twist” is forming on the weekly timeframe. This phenomenon occurs when the two leading lines of the Ichimoku cloud (Senkou Span A and B) cross, indicating a potential reversal of the underlying trend.

Historically, this signal should not be taken lightly. During previous cycles, similar twists have preceded brutal corrective phases, sometimes leading to drawdowns of up to 60 or 70%. If this signal confirms on the weekly close, it would validate a transition from a bullish structure to bear dominance.

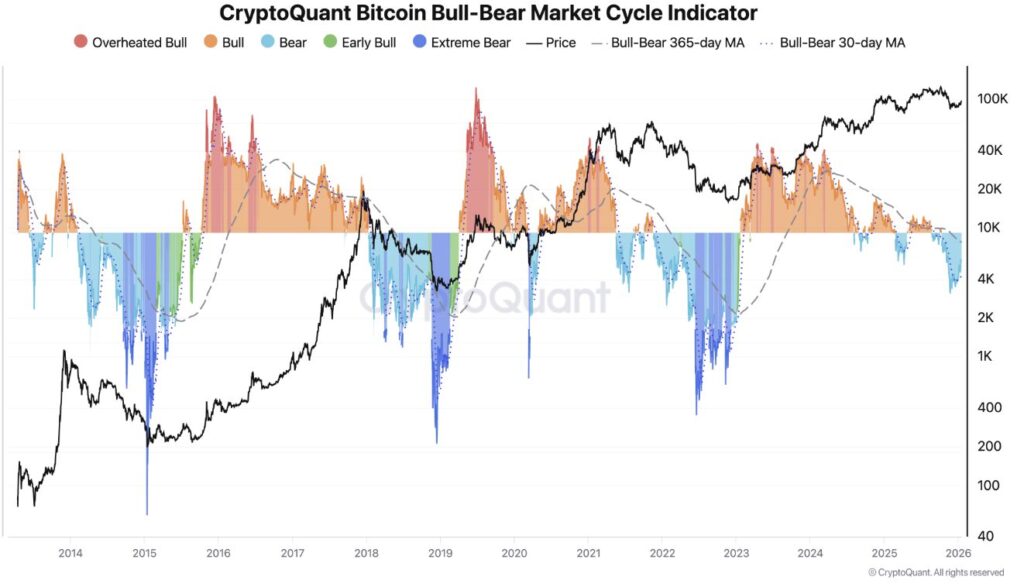

Another pillar of long-term technical analysis: the 365-day moving average. This indicator often acts as the ultimate line of demarcation between a Bull Run and a Bear Market. For the first time since early 2022, Bitcoin’s price threatens to settle durably below this critical level.

A confirmed break of this dynamic support suggests that the underlying trend, which has carried the market for two years, is broken. As long as the price does not move back above this average with volume, any bounce risks being considered a “Dead Cat Bounce” before another bearish leg.

On-chain data reveals a structural anomaly: while BTC’s price remains historically elevated (close to $90k-100k), actual demand is collapsing. The “visible demand” indicator shows that new buyers are becoming scarce.

This divergence is typical of distribution phases. The market rises or stagnates thanks to inertia and leverage, but without fresh capital flows (Spot) to support prices. When this divergence reaches its peak, the market often corrects violently to find a price level where organic demand reappears. For now, Bitcoin is still firmly in bear market territory.

The fourth signal concerns institutional flows. The American Spot Bitcoin ETFs, which have been the main driver of the rally in 2024 and 2025, are showing worrying signs of exhaustion. After accelerating in late 2025, net inflows are slowing considerably, even reversing on certain days.

Finally, overall crypto market liquidity is contracting. Altcoins, being more volatile, suffer more from this liquidity withdrawal, making the market particularly vulnerable to liquidation cascades. Without institutional support via ETFs, Bitcoin finds itself exposed to retail trader nervousness and macroeconomic shocks.

The convergence of these five signals—Kumo Twist, break of the 365MA, demand divergence, ETF fatigue, and liquidity crisis—paints a cautious picture for late January 2026. The $90,000 level now appears as the last psychological and technical rampart before a potential bearish acceleration toward the $80,000 zone. The bullish trendline increases the chances of Bitcoin returning to the order block and POC at $87,000 while numerous longs are to be liquidated below.

However, the crypto market remains unpredictable. A geopolitical détente or a surprise announcement from a central bank could invalidate this bearish scenario. Traders will closely monitor the weekly close: can Bitcoin save its trend or are we officially entering the crypto winter of 2026?

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.