Bitcoin: Why BTC needs to drop to $54k before exploding

Will Bitcoin's price fall to $54,000 before soaring? Experts predict a potential dip before the next bull run. Find out why!

Will Bitcoin's price fall to $54,000 before soaring? Experts predict a potential dip before the next bull run. Find out why!

The crypto market is currently caught in a vice. On one side, investors hope for an immediate rebound, on the other, on-chain data tells a much more cautious story. Ki Young Ju, a respected figure in crypto analysis, recently shared a stark assessment: we are in a well-defined bearish cycle, not just a temporary correction.

The fundamental problem lies in the imbalance of capital flows. Currently, selling pressure is completely overwhelming new capital inflows. Simply put, there are more whales and institutions looking to reduce their exposure or take profits than new entrants ready to buy at high prices. This phenomenon of “institutional unwinding” prevents any attempt at an upward breakout.

For Ki Young Ju, the absence of significant buying interest at these price levels is a warning signal. As long as this imbalance persists, imagining an immediate return to the ATH is more wishful thinking than rational analysis. The market needs to “breathe,” and paradoxically, this could mean an additional drop to clean up positions.

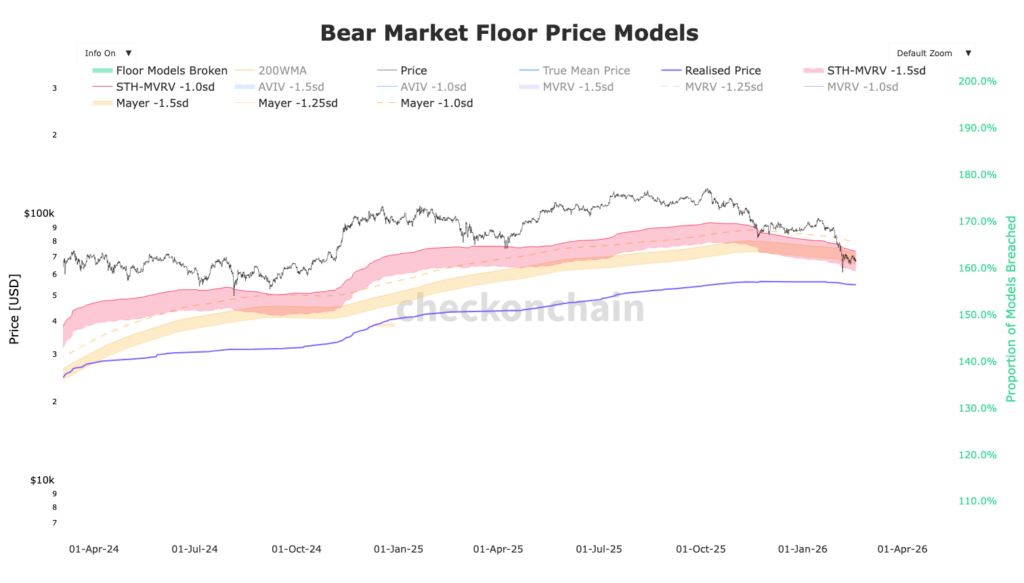

The CryptoQuant analyst points to a precise technical and psychological level: $54,000. This figure isn’t pulled out of thin air. It often corresponds to major support zones based on the “Realized Price” of investor cohorts. Historically, true market bottoms form when Bitcoin’s price comes to test, or even break below, the average purchase price of holders.

Currently, Bitcoin has not yet shown signs of total capitulation. Capitulation is that moment of panic when the last uncertain holders sell at a loss, transferring their assets to stronger hands (the “Diamond Hands”). Without this purging event, the market remains in limbo, unable to build a solid foundation for the next rally.

If BTC were to fall toward $54,000, it would represent a painful but potentially healing correction. This level could act as a liquidity magnet, triggering the massive buy orders needed to reverse the trend. Ki Young Ju warns that this healing process could take months. Patience is therefore essential for traders monitoring charts in search of an optimal entry point.

Another key factor in this analysis rests on institutional behavior, particularly through Bitcoin Spot ETFs. After driving the market during previous phases, these flows seem to have dried up or are no longer sufficient to offset selling. CryptoQuant’s analysis suggests that without a massive resurgence of institutional liquidity, momentum will remain bearish.

The crypto market can no longer rely solely on retail investor “hype.” The current market structure requires massive volumes to move the needle. The absence of “buying interest” currently confirms that large portfolios are waiting for more attractive price levels to reposition themselves. They won’t FOMO at current levels.

This “cleanup” phase is typical of market cycles. It separates solid projects and convinced investors from short-term speculators. If Ki Young Ju’s prediction materializes, the coming months will be a resilience test for the entire ecosystem, but they could also offer one of the best accumulation opportunities of the year.

Faced with this analysis, the question for any investor is how to react. Should one sell now to buy back lower, or engage in DCA (Dollar Cost Averaging) hoping the support holds? If $54,000 is touched, will it constitute the starting point of the next Bull run or simply a step toward even deeper lows? The answer will depend on the reaction of buying volumes once this critical threshold is reached.

For many traders, like Killa, a descent between $47,000 and $54,000 is a generational opportunity to DCA for the long term. According to him, the bottom should arrive by August of this year with a first low point between March.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.