Bitcoin’s February 5th crash: Jeff Park’s theory on BlackRock’s hidden role

Discover why the Bitcoin dip wasn't a typical crypto crash. Jeff Park reveals BlackRock's potential role in the February 5th market movement.

Discover why the Bitcoin dip wasn't a typical crypto crash. Jeff Park reveals BlackRock's potential role in the February 5th market movement.

The cryptocurrency market is accustomed to volatility, but the February 5th crash had a particular flavor. Typically, a dump of this magnitude is triggered by disastrous macroeconomic news, a major hack, or punitive regulatory announcements. Yet that day, the news flow was relatively calm. This is where Jeff Park’s analysis comes in to shed light on the gray areas.

According to him, this sudden bearish movement didn’t originate from native crypto holders, but from the very structure of traditional financial markets (TradFi). Park emphasizes that the collapse looked more like a margin and derivatives problem than genuine negative sentiment on the asset. In short, Bitcoin fell victim to its own institutionalization.

On-chain data showed no massive outflows justifying such a price drop. This indicates that selling pressure was synthetic or forced by leverage mechanisms, rather than by fundamental loss of confidence in BTC. This is a crucial distinction for understanding what happened next.

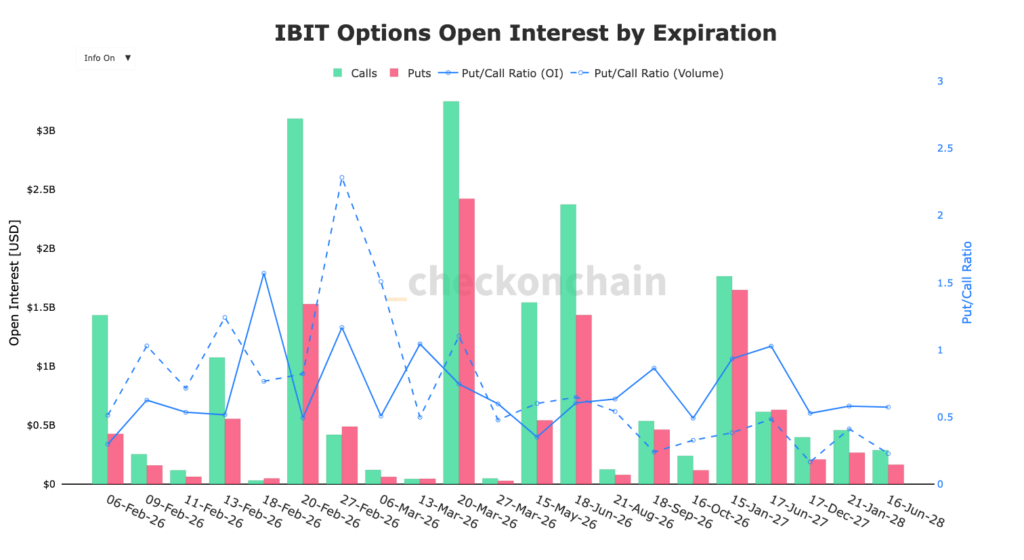

The central point of Jeff Park’s theory rests on the role of Spot ETFs, and particularly BlackRock (IBIT). Bitcoin’s integration into traditional finance through these investment vehicles has created new bridges, but also new vulnerabilities. Park speaks of “TradFi plumbing”: margin mechanisms, derivatives products, and liquidity management within ETFs.

It appears that leveraged positions, using the IBIT ETF as collateral or as a hedging instrument, triggered a cascade of liquidations. When volatility increases, margin calls in traditional finance force algorithms to sell the underlying asset — here Bitcoin — to cover losses, regardless of the token’s fundamental value.

This phenomenon creates a temporary disconnect between price and demand reality. While inflows appeared normal, the internal mechanics of ETFs and associated derivative products caused a bottleneck, forcing the price to retrace violently. It’s a brutal reminder that Bitcoin is no longer isolated from Wall Street’s systemic risks.

If Jeff Park’s theory proves correct, it radically changes the perspective on this crash. If this is a purely mechanical event linked to market structure and not to deteriorating Bitcoin fundamentals, then this dip could represent a massive buying opportunity for savvy investors.

Leverage liquidations often have the effect of “cleaning” the market, removing excess speculation and allowing for a restart on healthier foundations. Once the “plumbing” is fixed and forced positions are closed, artificial selling pressure disappears, giving way to organic demand which hasn’t weakened.

However, caution remains warranted. The growing interconnection between Bitcoin and complex financial instruments means we could see more episodes of this type. The question now is whether whale support will hold firm against Wall Street algorithms. Furthermore, nearly 5 billion dollars in options on IBIT ETFs are set to expire on February 20th and March 20th. These dates will therefore need to be closely monitored.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.