Bitcoin dips below $108,000 – Here’s Why It’s a Positive Development

Despite Bitcoin's price drop below $108,000, on-chain and trading data indicates a resilient market with significant institutional demand and promising technical signals.

Despite Bitcoin's price drop below $108,000, on-chain and trading data indicates a resilient market with significant institutional demand and promising technical signals.

Bitcoin (BTC) has fallen below the $108,000 mark, but investors can take comfort: on-chain data and technical indicators reveal a resilient market configuration, suggesting new bullish movements are on the horizon.

According to CryptoQuant’s analysis, two key structural metrics, the Delta Cap and the Coinbase premium gap, continue to reinforce Bitcoin’s underlying strength. The Delta Cap, currently at $739.4 billion, has historically served as a cycle floor, while Coinbase’s positive premium of +11.6 suggests strong demand from American institutional investors.

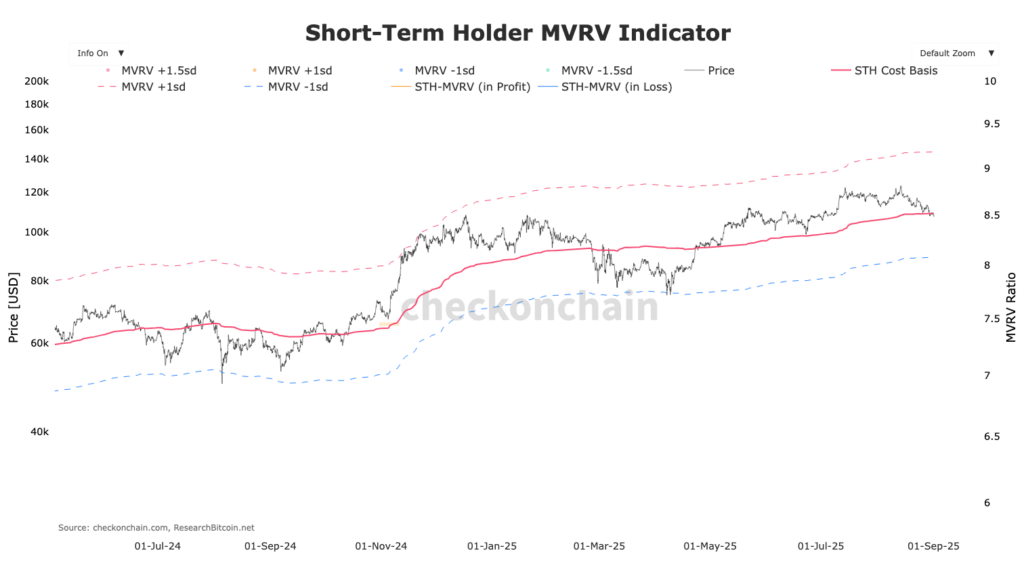

Additionally, Bitcoin currently remains above the STH MVRV resistance. This level pushes short-term holders into the red and forces them to panic sell, which smart money can use as counterparty to accumulate.

Although Bitcoin’s price is moving close to a psychological support at $107,000, technical indicators point to short-term oversold conditions. The RSI near neutrality and a MACD in reversal phase suggest a potential rebound. A sustained rise above $110,000 could pave the way to $113,000 and then $118,000.

On the other hand, the support at $105,146 must be defended by the bulls. But the bullish RSI divergence on the 12H timeframe reinforces an imminent rebound. If BTC fails to break through the zone between $110,000 and $112,600, it could still fall to $106,000 before rebounding explosively.

Despite the recent price decline, on-chain signals and technical analyses demonstrate that Bitcoin maintains a solid foundation. With sustained institutional demand and encouraging technical indicators, investors can remain confident about the continuation of the medium-term rally.

On the same topic:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.