Bitcoin: Why a lack of euphoria in 2025 could reshape the 2026 bottom

Bitcoin hits $70k! But why might the absence of a 2025 'blow-off top' redefine the 2026 bottom? Discover the analysis.

Bitcoin hits $70k! But why might the absence of a 2025 'blow-off top' redefine the 2026 bottom? Discover the analysis.

Bitcoin continues to struggle to maintain its momentum. Stuck below the psychological resistance of $72,000, the king of cryptos faces persistent selling pressure that stifles every rally attempt. As we reach mid-February 2026, the market seems to hesitate between capitulation and accumulation, leaving investors in limbo. The bulls’ inability to regain control worries analysts, who now warn that a break below $60,000 is an increasingly credible scenario.

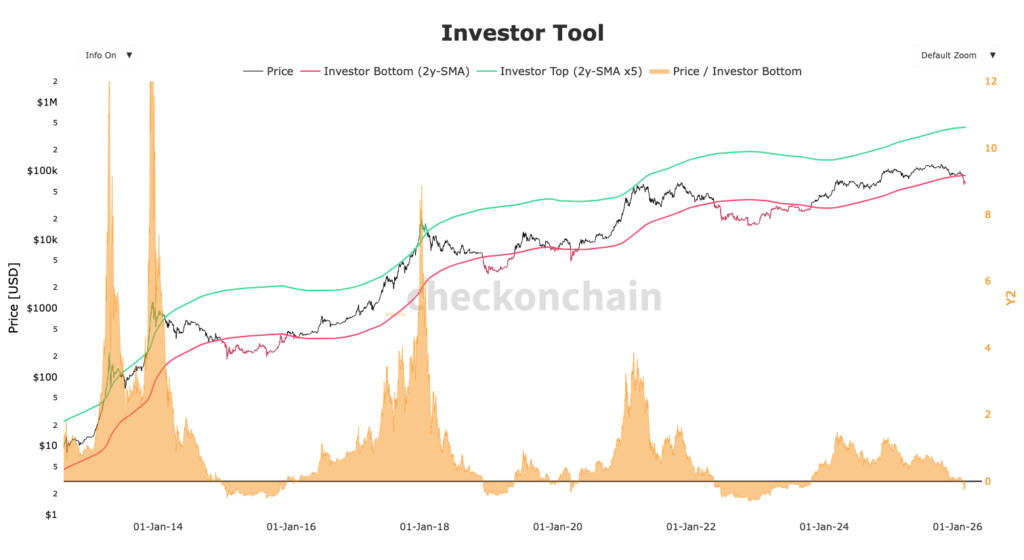

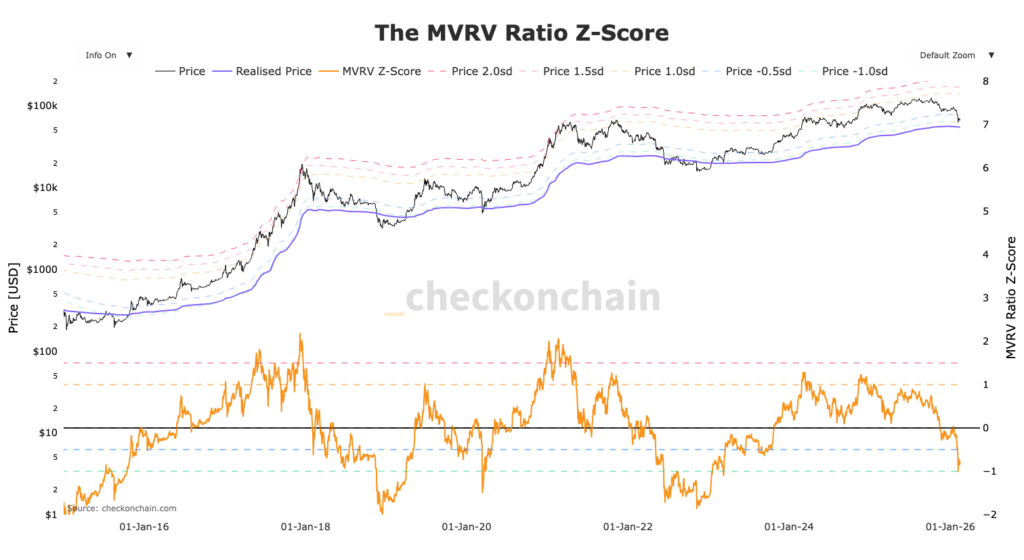

But beyond short-term volatility, one theory is gaining traction: the “no-ceiling cycle.” Unlike previous cycles marked by excessive euphoria, the late 2025 peak (around $126,000) didn’t deliver the expected fireworks. This “missing” top could paradoxically cushion the current decline, thus redefining the depth of the 2026 Bear Market.

Bitcoin history has accustomed us to binary cycles: a vertical (parabolic) explosion followed by a brutal 80% crash. However, the 2024-2025 cycle defied predictions. While the new ATH (All-Time High) was indeed reached, it wasn’t accompanied by the speculative frenzy typical of a “blow-off top.” This absence of euphoric ceiling suggests the market didn’t reach its usual overheating level, which could theoretically limit the severity of the current retracement.

On-chain analysts emphasize that the market structure is different. Liquidity, while scarcer in recent weeks, hasn’t evaporated like in 2018 or 2022. The “no-ceiling cycle” concept implies that without massive upside excess, the downward correction (the bottom) could be less deep than the -85% feared by purists. We could witness a softer landing, where price oscillates in a broad distribution zone rather than collapsing vertically.

However, this atypical structure traps many traders. The absence of clear end-of-cycle signals left many investors exposed, waiting for a final bullish leg that never came. Today, the market must digest this unrealized excess optimism, which explains the slowness and painfulness of the current correction.

Technically, the situation is tightening. The $60,000 level is identified by most chartists as the critical support that must be defended at all costs. A weekly close below this threshold would validate a long-term bearish structure, opening the door to a drop toward the $48,000 – $52,000 liquidity zone below the Realized price at $54,000. Volatility has spiked in recent days, a sign that weak hands are beginning to let go in the face of uncertainty.

Recent data also shows liquidity drying up in order books, making price more sensitive to whale movements. If macroeconomic conditions don’t improve quickly, the risk of a flash crash to hunt stops below $60k is real. It’s often in these zones of maximum pain that true market bottoms form.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.