Bitcoin Ready to Skyrocket : Here’s Why

As Bitcoin continues its ascent to new highs, long-term investors remain unfazed. However, the increasing leverage positions hint at an imminent break in the status quo. Beware of the impending explosion !

As Bitcoin continues its ascent to new highs, long-term investors remain unfazed. However, the increasing leverage positions hint at an imminent break in the status quo. Beware of the impending explosion !

As Asian stock markets open this Wednesday, Bitcoin (BTC) remains firmly anchored above $105,000. This represents a slight correction from the $107,000 reached the previous day in the United States, but it does nothing to diminish the resilience displayed by the world’s leading cryptocurrency in recent weeks. In fact, BTC bounced back to more than $106,800 this morning.

Despite geopolitical upheavals—including the US strike in Iran—BTC has once again demonstrated its ability to establish itself as a safe-haven asset. According to market data, the asset recorded a 2% increase over the past month.

But this upward movement, which is dangerously approaching the previous record of $111,000 established last May, seems to be happening with more restraint than exuberance. Unlike the breaking of the $100,000 barrier in December 2024, which triggered a wave of profit-taking, long-term investors now appear determined to hold onto their gains.

As Glassnode analysts highlight in their latest weekly report, “HODLing” seems to be becoming the dominant market mechanic. This is evidenced by the increase in the volume of unspent BTC to 14.7 million tokens, as well as historically low realized profits.

Indicators such as the adjusted Spent Output Profit Ratio (aSOPR) also reflect this restraint, maintaining just above the break-even threshold. This situation suggests that the coins in movement correspond more to tactical operations than to widespread distribution.

This patience from long-term holders echoes persistent institutional demand. According to market data, net flows to Bitcoin exchange-traded funds (ETFs) reached $2.2 billion last week. This appetite shows no signs of weakening, with players like Strategy and Metaplanet continuing to accumulate.

These regular inflows are gently reshaping the market structure, as evidenced by the growth of Bitcoin’s realized cap, an indicator measuring the price at which coins were last exchanged. This signals that “real” capital, not just speculative money, is flowing into the asset.

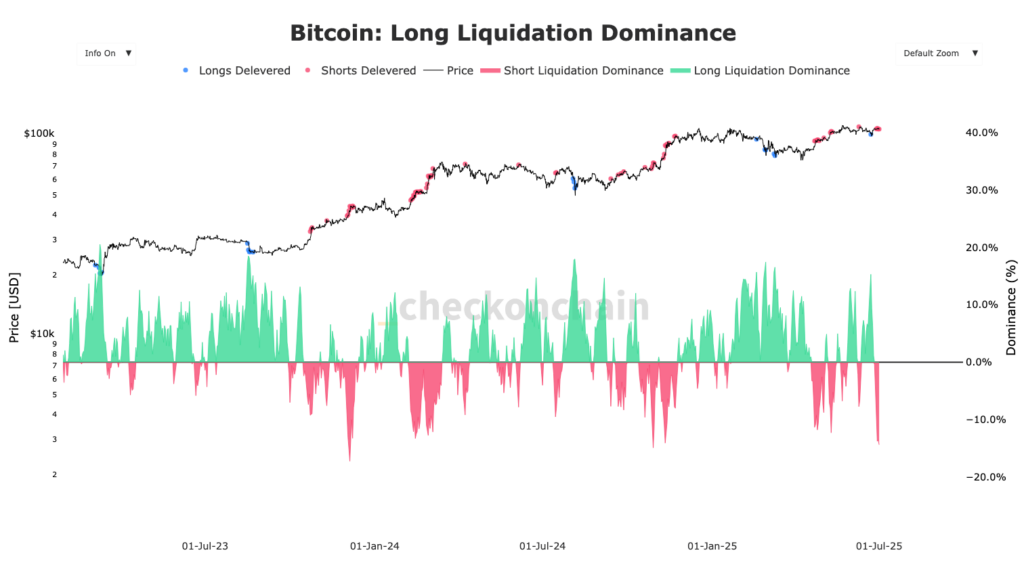

But beneath this apparent serenity, warning signals are not lacking. Glassnode observes an increase in leveraged long positions, with funding rates turning positive again on the main perpetual futures markets. Indeed, the dominance of short liquidations may indicate that a local top has been reached.

According to analysts, this situation could well destabilize the fragile balance between the conviction of long-term holders and the appetite of short-term traders. This suggests a possible upcoming phase of high volatility for Bitcoin.

As the market seems to oscillate between caution and impatience, the question of the next catalyst remains unresolved. Will it be able to trigger the next explosive movement for Bitcoin ? The answer could well shake things up in the coming months.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.