Unveiling the Secret Behind BTC’s Recent Surge to All-Time Highs

Bitcoin, at $122,500, is gaining stability with a 35% volatility, driven by ETFs and institutional adoption. Will it lead to a sustainable future or risky centralization ?

Bitcoin, at $122,500, is gaining stability with a 35% volatility, driven by ETFs and institutional adoption. Will it lead to a sustainable future or risky centralization ?

After years of volatility, Bitcoin is entering a new era of institutional adoption. This evolution brings welcome stability and significantly broadens Bitcoin’s accessibility, paving the way for its use as a long-term medium of exchange.

Long considered a high-risk, speculative asset, Bitcoin has gained the trust of institutional investors. The approval of spot Bitcoin ETFs in the United States in 2024 marked a major turning point, now allowing pension funds, hedge funds, and asset managers to easily access this asset class.

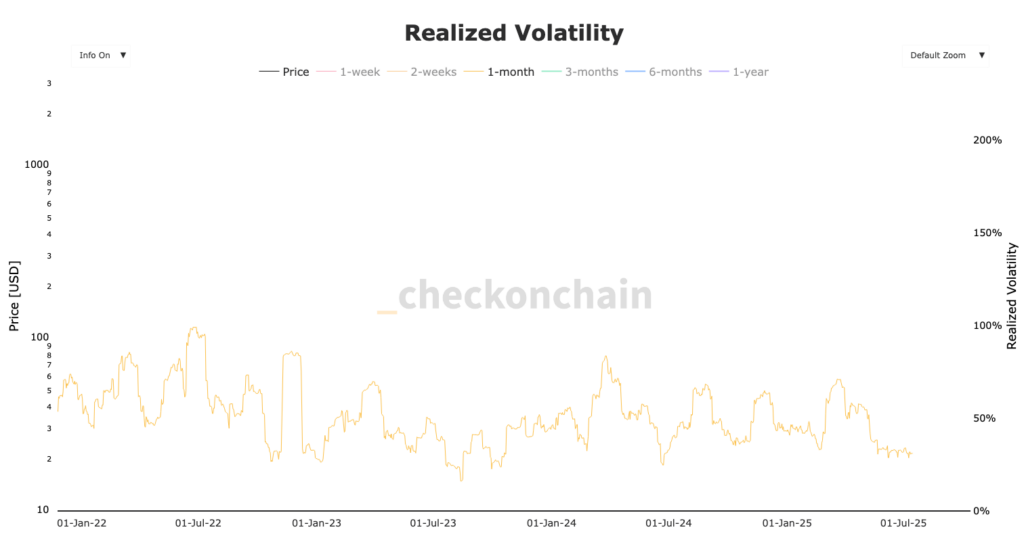

This influx of institutional capital has had a notable stabilizing effect on Bitcoin’s volatility. While previous cycles experienced volatility spikes of up to 158%, the current cycle is much calmer, with annualized volatility around 50% since 2024 and even 35% recently—a level comparable to gold or the S&P 500.

This reduction in volatility greatly improves Bitcoin’s viability as a medium of exchange. From merchants to end users, everyone now benefits from more predictable pricing, which could encourage broader transactional adoption in the future. Although on-chain activity still shows a predominance of storage and speculation, BTC‘s role seems to be evolving from simple “digital gold” to a genuine alternative financial system.

But this evolution is not without risk. The influx of institutional capital comes with increasing centralization, custody risks, and greater regulatory influence—all factors that could threaten the independence and decentralization that have been BTC’s strengths.

Thus, Bitcoin’s future will depend on how it navigates between these competing forces. If it can preserve its decentralized essence while leveraging institutional adoption, BTC could well establish itself as the new base layer of our financial system. If not, it risks losing what makes it unique.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.