Bitcoin: Trump’s announcements and $10 billion in IBIT options expiring this Friday

Bitcoin faces pressure. Will Trump's 10% credit cap boost demand? Plus, $10 billion in IBIT options expire this Friday. Read more!

Bitcoin faces pressure. Will Trump's 10% credit cap boost demand? Plus, $10 billion in IBIT options expire this Friday. Read more!

This is a market anomaly that whales are watching like hawks. According to the latest on-chain data, the average cost to mine one Bitcoin now stands at approximately $101,600. Yet, the current price is hovering around $91,900.

In concrete terms, BTC is trading at a loss for a large portion of the industry. Historically, when the price falls below the production cost, miners stop selling to avoid realizing their losses, creating a supply retention (supply shock). This level often acts as a major support, or “floor,” limiting the risk of further decline. Analyst Willy Woo has noted that capital outflows appear to have bottomed out in late December, suggesting that selling pressure is exhausting itself.

Beyond technicals, it’s macroeconomics that could serve as the trigger. Donald Trump’s proposal to cap credit card interest rates at 10% threatens to upend the traditional banking landscape (TradFi). While this measure aims to relieve consumers, it will mechanically force banks to tighten their lending criteria, excluding borrowers with scores below 780.

The direct consequence? A significant portion of the population could find themselves deprived of banking liquidity and turn to decentralized alternatives. Bitcoin and DeFi protocols, which require no credit score, would then become the big winners of this financial exodus. This liquidity transfer could act as a powerful demand driver for the crypto market in the coming months.

From a technical perspective, Bitcoin is in a consolidation phase. The market is testing buyer resilience in the $89,000 – $91,000 zone. As long as the price holds above this support, the structure remains potentially bullish in the medium term, fueled by the absence of miner capitulation.

However, momentum indicators remain fragile. To validate a bullish reversal and target a new rally, BTC must imperatively reclaim the $94,000 zone with volume. Conversely, a clean break below $89,000 could trigger cascading liquidations toward the next technical supports at $87,000. Caution is warranted, but the risk/reward ratio appears to be improving for long-term investors.

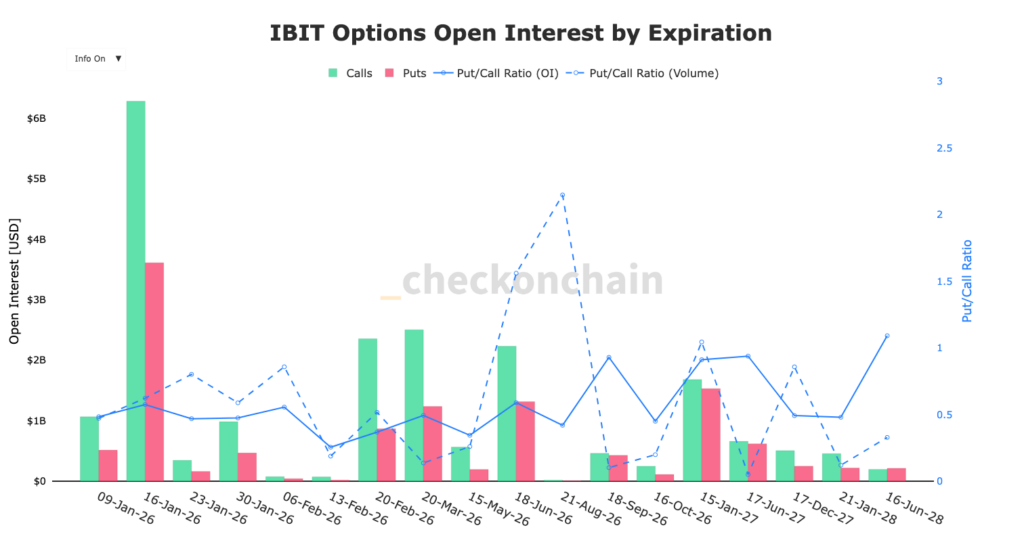

Furthermore, Bitcoin has, for several months, dropped approximately 1 to 4% after the 14th of each month. This would push Bitcoin toward $87,000 by Friday. Additionally, Friday is a day when nearly $10 billion in IBIT ETF options expire. This week could therefore still see a bearish reversal before attempting to reach the resistance at $95k.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.