Bitcoin Whales Are Taking Profits : Should You Follow ?

Top Bitcoin holders are quietly exiting the market, signaling a shift. Meanwhile, institutional investors are capitalizing on the dip, hinting at a supply squeeze. Is this the peak?

Top Bitcoin holders are quietly exiting the market, signaling a shift. Meanwhile, institutional investors are capitalizing on the dip, hinting at a supply squeeze. Is this the peak?

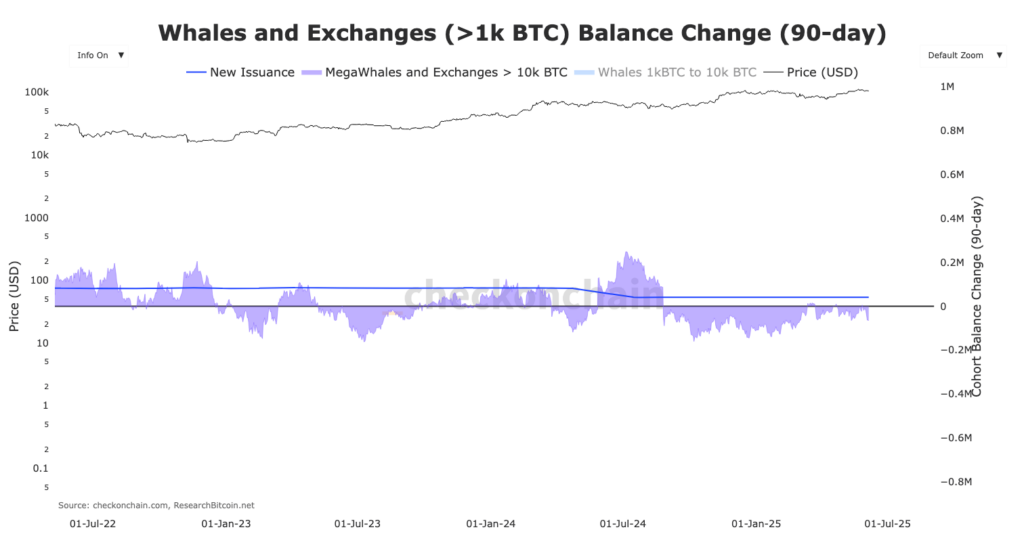

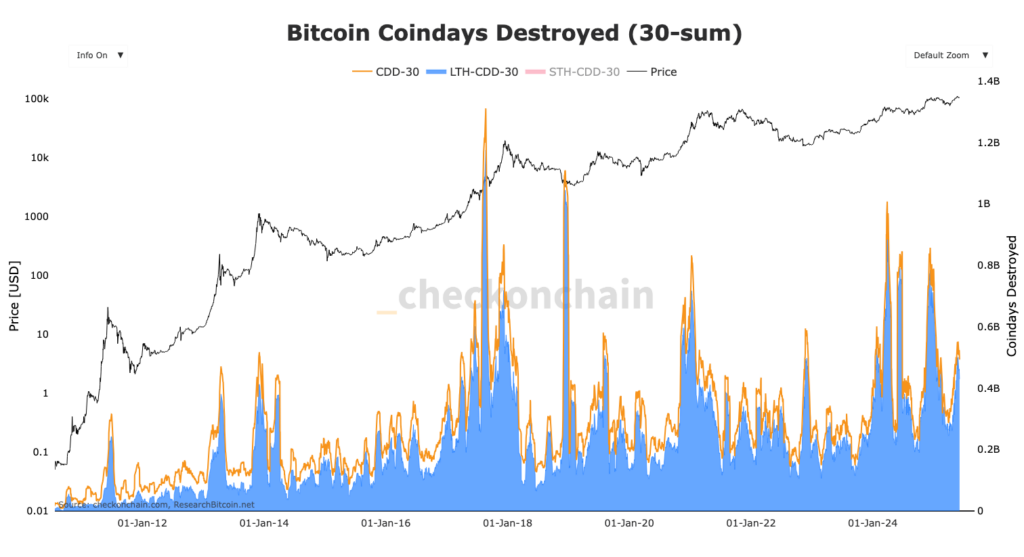

The “mega whales” in Bitcoin have been gradually reducing their holdings since 2017, even as the price reached tens of thousands of dollars. This is not irrational behavior but a long-awaited profit-taking.

Most of these Bitcoins were accumulated when the price was between 0 and 700$. Today, after holding for 8 to 16 years, these long-term holders are deciding to exit the market. These are not panicked sales but disciplined exits.

This movement does not signify a market peak but rather a shift in ownership – from cypherpunks to companies, from early believers to institutional investors.

As old investors exit, ETF data also reveals fear of a deeper correction. Over the past month, Bitcoin ETFs have seen consistent weekly inflows, with a recent net inflow of 110.52 million dollars.

However, ETFs are starting to withdraw as evidenced by the massive BlackRock sales in recent hours.

Meanwhile, exchange net flows have turned strongly negative, with over 11.4K BTC withdrawn from exchanges in a single day, indicating a growing reluctance to sell. Coin Days Destroyed has also remained moderate, suggesting long-term holders are not rushing to offload their holdings.

The result? A classic supply squeeze in the making.

The recent drop of Bitcoin around $106,000 is starting to reveal cracks in the bullish structure. The steady decline in open interest and a positive yet moderate funding rate suggest traders’ hesitation rather than strengthening of their positions.

With the price remaining in a range, the lack of increase in open interest implies weak conviction. If buyers do not step in promptly, this could mark a local peak before a deeper decline.

The cryptocurrency market is ever-evolving, and in this phase of transition between historical players and new institutions, significant adjustments are taking place. The recent trends indicate strategic moves rather than panic signals. Informed investors should remain vigilant and deeply informed before making investment decisions.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.