Why Are Bitcoin, XRP, and Ethereum Dropping Today?

Crypto market correction! Bitcoin dips, Ethereum & XRP fall. Explore the reasons behind the price decline: ETFs, Fed rates, and profit-taking.

Crypto market correction! Bitcoin dips, Ethereum & XRP fall. Explore the reasons behind the price decline: ETFs, Fed rates, and profit-taking.

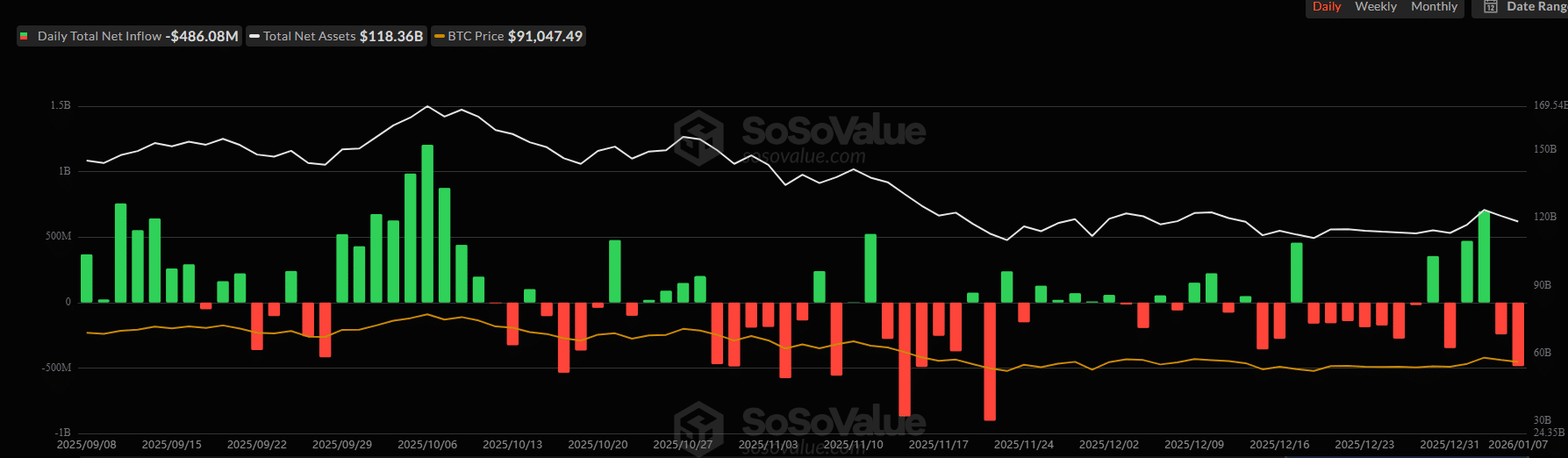

This is the most alarming factor of the last 24 hours: institutional flows have brutally reversed. While the start of the year raised hopes for an explosive “January Effect,” on-chain data reveals a much darker reality. Spot Bitcoin ETFs recorded massive net outflows, totaling nearly $486 million in a single day — a record since last November.

This panic movement spares no one. Even giants like BlackRock (IBIT) and Fidelity (FBTC), usually accustomed to absorbing liquidity, are seeing their reserves erode. For Ethereum, the situation is similar. After a brief streak of inflows, ETH ETFs suffered approximately $98 million in withdrawals. This institutional disengagement acts as a strong sell signal for retail traders, amplifying selling pressure across the market.

Market sentiment has clearly shifted to fear. Institutional investors appear to be moving into risk-off mode amid macroeconomic uncertainty. As a result, Bitcoin is now dangerously testing the $90,000 level. If this psychological support breaks, the path toward a deeper correction near $84,000 could quickly open up.

US monetary policy continues to weigh on the markets. Despite a rate cut in December, the Fed’s hawkish tone is cooling expectations for rapid easing in 2026. The prospect of a prolonged pause supports the dollar and tightens liquidity, pushing investors to take profits after the late-2025 rally in a classic “sell the news” scenario.

In this environment, XRP shows a notable divergence, with ETFs still seeing inflows but failing to reverse the price trend. Pressure remains elevated, reinforced by Bitcoin sales from miners. BTC around $90,000 is now a critical level: holding it could reignite momentum, while a break would open the door to a move toward $80,000, signaling a deeper short-term correction.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.