Chainlink: Can the Nasdaq-CME Announcement Ignite a Surge to $15?

Chainlink's integration with the Nasdaq-CME index could boost LINK. Will $13 support hold, targeting $15? Find out now!

Chainlink's integration with the Nasdaq-CME index could boost LINK. Will $13 support hold, targeting $15? Find out now!

This is news that could redefine how institutional investors perceive Chainlink. Nasdaq and the CME Group have announced the launch of the Nasdaq CME Crypto Index, a benchmark index incorporating a handful of elite digital assets, including Bitcoin, Ethereum, and Chainlink. For LINK, this inclusion is far from trivial: it places the token at the heart of regulated finance, transforming its narrative from experimental altcoin to critical infrastructure of the crypto market.

Despite this fundamentally bullish announcement, LINK’s price is navigating through a technically delicate phase. At the time of writing, the token is trading around $13.22, showing a slight increase over the past 24 hours. The market appears hesitant, digesting the news before choosing a clear direction. This institutional integration comes at a crucial time, as the price tests a critical demand zone.

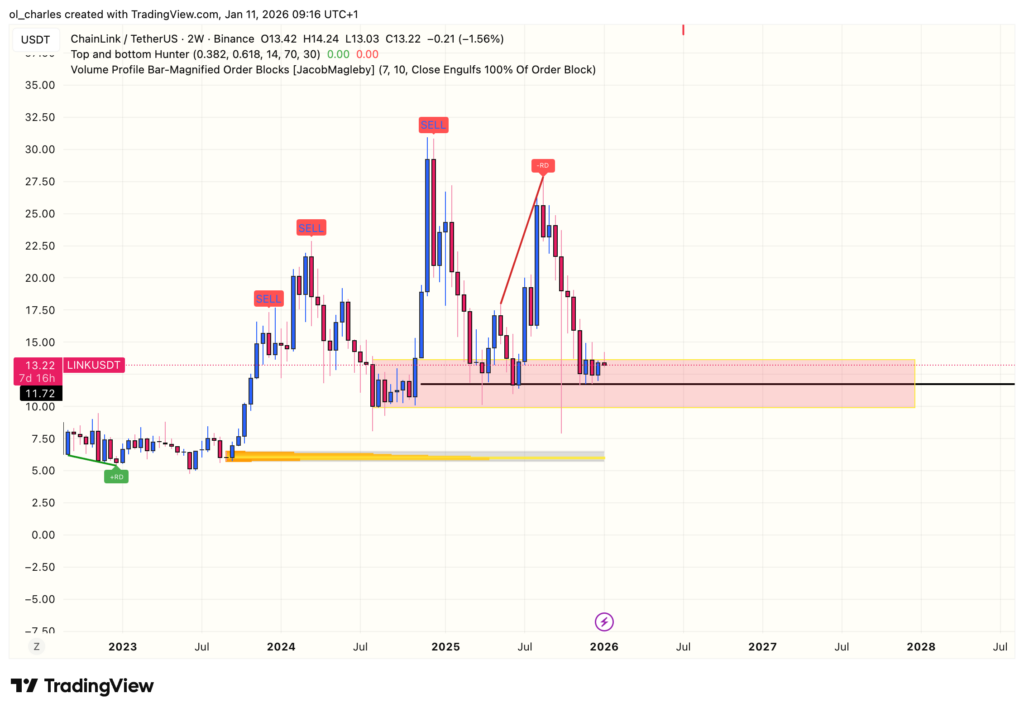

From a chart perspective, taking a step back on the 2-week timeframe, LINK is currently in a tight range between $13.70 and $11.70. If the $11 level is lost, LINK will return to the danger zone down to $9.40. A breakdown below this support would send LINK toward $6.60, representing a drop of more than 50%.

This scenario would require Bitcoin to plunge to the $60,000-$55,000 range. For now, in the short term, the danger seems to have been averted for LINK. The historical strength of the $12 level, combined with bullish RSI divergences on higher timeframes, supports a short-term bounce.

Nevertheless, an order block has formed on the 12H chart above the current price up to $14.17. Smart money took profits on the range breakout, which could slow LINK’s rise during the next rally.

If the $13 support holds firm, the target is clearly identified. Analysis of liquidity heatmaps reveals a massive cluster of approximately $1.32 million located near the $15 level. In trading, these high liquidity zones often act as magnets for price action. If buying momentum confirms, an acceleration toward this psychological threshold is the favored scenario.

However, caution remains warranted. To validate this bullish scenario, LINK must absolutely maintain itself above its daily imbalance zone. A clean break below $13 would invalidate the bounce structure and could trigger a deeper correction toward lower supports. The market is therefore at a crossroads: healthy consolidation before the breakout or a bearish trap?

With fundamentals strengthened by the Nasdaq-CME alliance and technical signals indicating seller exhaustion, Chainlink appears armed for a recovery in the coming weeks. The defense of the $13 level will be the decisive arbiter of the next few days. If volumes follow, the path to $15 and potentially beyond appears open.

Related Articles:

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.