Understanding Today’s Crypto Market Dip : What’s Behind the Plunge ?

Investors are pulling back from speculative positions on Bitcoin and Solana, with Ethereum and XRP seeing increased leverage demand. A contrasting market dynamic unfolds.

Investors are pulling back from speculative positions on Bitcoin and Solana, with Ethereum and XRP seeing increased leverage demand. A contrasting market dynamic unfolds.

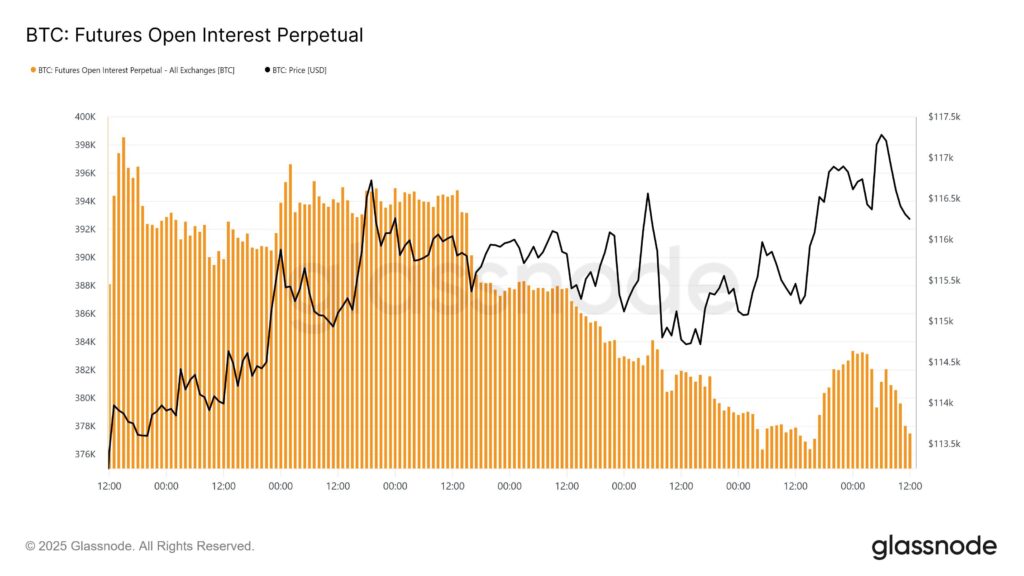

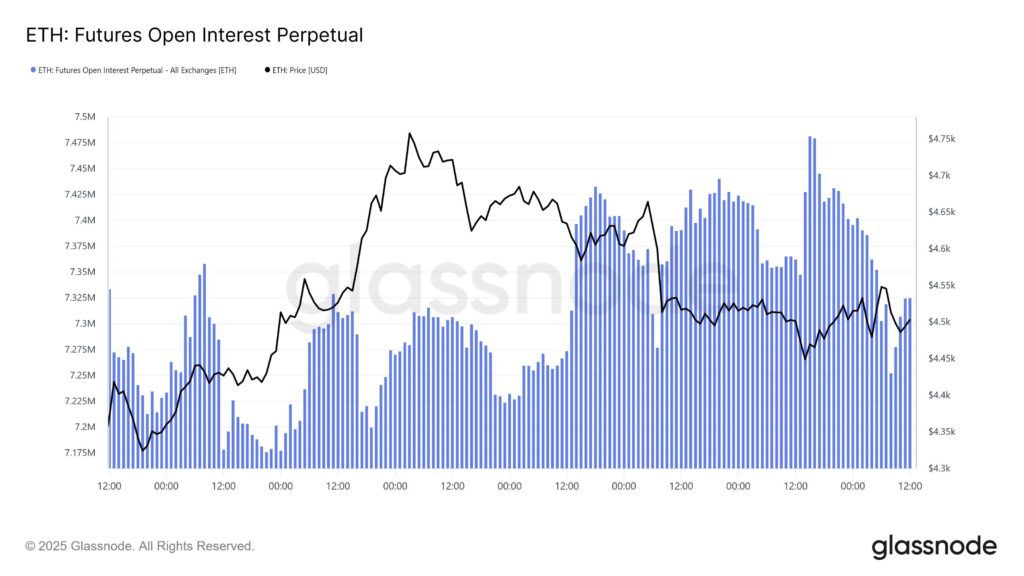

According to the latest Glassnode analysis, the crypto futures market has experienced mixed trends in recent days. The Open Interest indicator, which measures the total number of open positions in derivatives markets, has followed divergent trajectories across major assets.

For Bitcoin, Open Interest has generally decreased over the past week. This downward trend coincides with BTC’s price rebound to $117,900, suggesting a certain disengagement from speculative activities despite the price increase. A similar phenomenon was observed for Solana, the sixth-largest cryptocurrency by market capitalization, with reduced leveraged activity.

In contrast, the second-largest cryptocurrency, Ethereum, has recorded a significant increase in its Open Interest. This demonstrates growing demand among investors for leveraged positions on ETH.

This upward trend in Open Interest is also evident with XRP and BNB, highlighting a marked divergence from the patterns observed for Bitcoin and Solana. This contrast could signal potentially higher volatility for Ethereum and altcoins in the coming periods.

Although Bitcoin’s price recently reached $117,900, a slight correction has brought it back to $116,600. This price volatility, combined with futures market trends, suggests interesting movements ahead in the crypto market.

For now, Bitcoin needs to maintain above $116,200 to potentially reach prices beyond $118,000 in the coming days.

The analysis of leveraged positions in the futures market reveals contrasting dynamics among major cryptocurrencies. While Bitcoin and Solana face speculative disengagement, Ethereum and XRP are attracting increasing demand for leveraged positions.

These divergences could have a significant impact on future price volatility. Keep a close eye on these trends to make informed decisions in this complex crypto landscape.

Charles Ledoux is a Bitcoin and blockchain technology specialist. A graduate of the Crypto Academy, he has been a Bitcoin miner for over a year. He has written numerous masterclasses to educate newcomers to the industry and has authored over 2,000 articles on cryptocurrency. Now, he aims to share his passion for crypto through his articles for InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.