Top crypto performers this week: M and MYX Soar, BNB and XMR Dip

Crypto market volatility! M (MemeCore) and MYX Finance are up, while Bitcoin consolidates. Get the latest on BNB and XMR's performance.

Crypto market volatility! M (MemeCore) and MYX Finance are up, while Bitcoin consolidates. Get the latest on BNB and XMR's performance.

While overall sentiment remains cautious, two assets have particularly captured investors’ attention this week: M (MemeCore) and MYX Finance (MYX). Contrary to the gloomy trend among major cryptocurrencies, these tokens have shown resilience and even impressive relative strength.

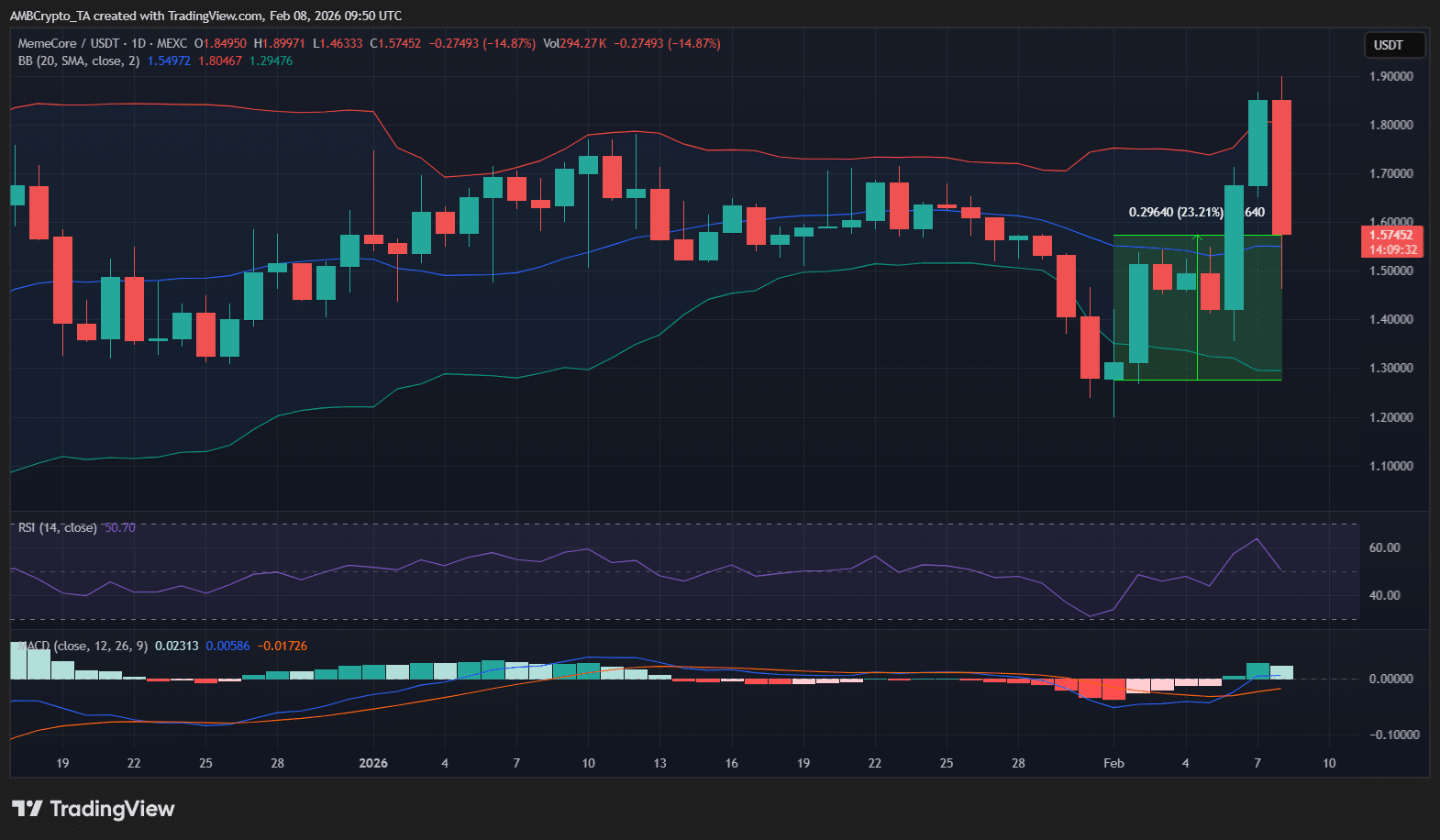

For MemeCore (M), the week has been synonymous with extreme volatility, a true paradise for scalpers. After hitting a concerning low around $1.28, the token orchestrated a massive rebound of nearly 23%, propelling its price toward the $1.58 zone. Although sellers regained control approaching $1.90, this buying reaction at support levels proves that interest in this Layer 1 dedicated to “Meme Culture 2.0” remains strong. Currently, the price is stabilizing, but indicators like the RSI suggest that the battle between bulls and bears is far from over.

Meanwhile, MYX Finance (MYX) has played the card of bullish stability. The decentralized exchange token climbed more organically, rising from $5.40 to a local peak around $6.44, representing a +18% performance from weekly lows. The fact that MYX manages to maintain itself above the key support of $6.50 in a turbulent market is a strong bullish signal. Volumes are supporting this movement, suggesting continuation if Bitcoin doesn’t spoil the party.

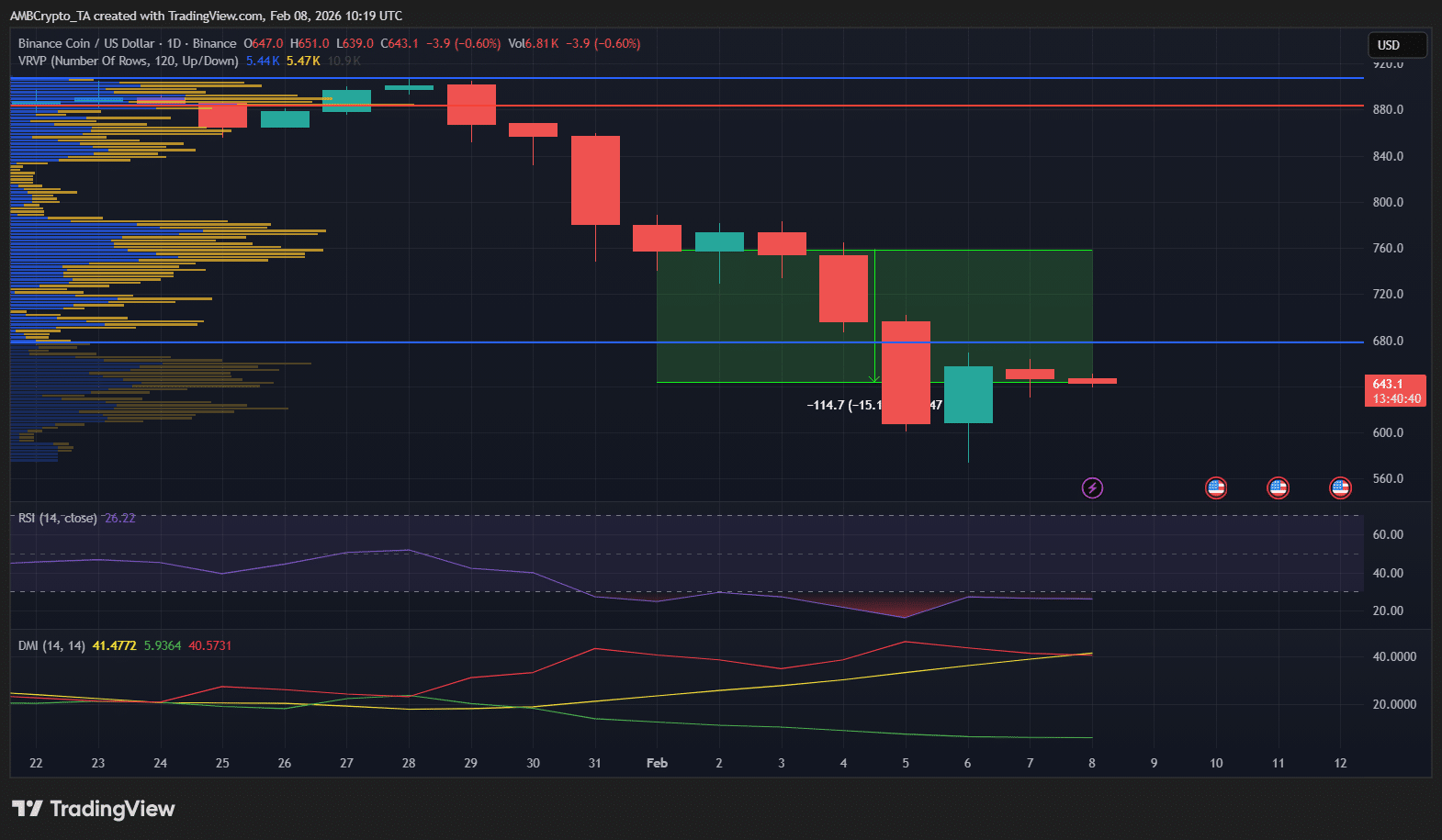

In contrast to the explosive performances of mid-caps, market veterans seem to be suffering from structural fatigue. The case of Binance Coin (BNB) is particularly watched by technical analysts. The token of the exchange world’s number one is struggling to regain a clear bullish dynamic, showing a slight decline for the week and dangerously flirting with critical support zones around $640. A confirmed break below this level could trigger a wave of liquidations and a retracement deeper pullback.

As for Monero (XMR), the king of privacy coins, it seems to be suffering the market rather than leading it. Despite a slight technical rebound due to oversold conditions, XMR is significantly underperforming the rest of the sector. Its current movement is primarily driven by Bitcoin beta (it follows BTC but with less strength) rather than by catalysts specific to the project. Without major announcements or renewed interest in on-chain privacy, XMR risks continuing to oscillate in a narrow range, or even revisiting its lower supports around $300.

Everything now depends on Bitcoin’s ability to transform the $70,000 – $71,000 zone into an unshakeable support. The divergence between altcoins that are exploding (like MYX) and those stagnating (like XMR) shows we’re in a “stock pickers” market: liquidity no longer lifts all boats simultaneously.

Traders must now monitor two scenarios: a BTC consolidation that would allow a selective altseason on strong narratives (DeFi, Meme 2.0), or a violent rejection that would drag the entire market down, including this week’s winners. With lukewarm volumes on majors, caution is warranted: is this the calm before the storm or the beginning of a genuine recovery?

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.