Pi Network outperforms Bitcoin: Major listing & price surge imminent?

Pi Network showing resilience! Analyzing price predictions, CEX listing rumors, and technical targets. Could Pi reach $0.25? Click to find out!

Pi Network showing resilience! Analyzing price predictions, CEX listing rumors, and technical targets. Could Pi reach $0.25? Click to find out!

In a clearly bearish market, heavyweights like Bitcoin, Ethereum and XRP are experiencing sharp corrections since the beginning of the year. Going against the grain, Pi Network has limited its decline to around 12%, displaying genuine relative outperformance against crypto blue chips and attracting investor attention.

This resilience is based on several fundamental catalysts: the first anniversary of the Mainnet, persistent rumors of listing on major CEX, as well as technical updates aimed at strengthening the network’s credibility. The anticipation of massive liquidity via a centralized exchange currently constitutes one of the main drivers of positive sentiment.

Protocol adjustments, notably an alignment towards standards close to Stellar, are improving the project’s image among a more institutional audience. This combination of community narrative and technical evolution supports the current momentum despite global market pressure.

Test Pionex’s free bots and take profits like a trading pro!

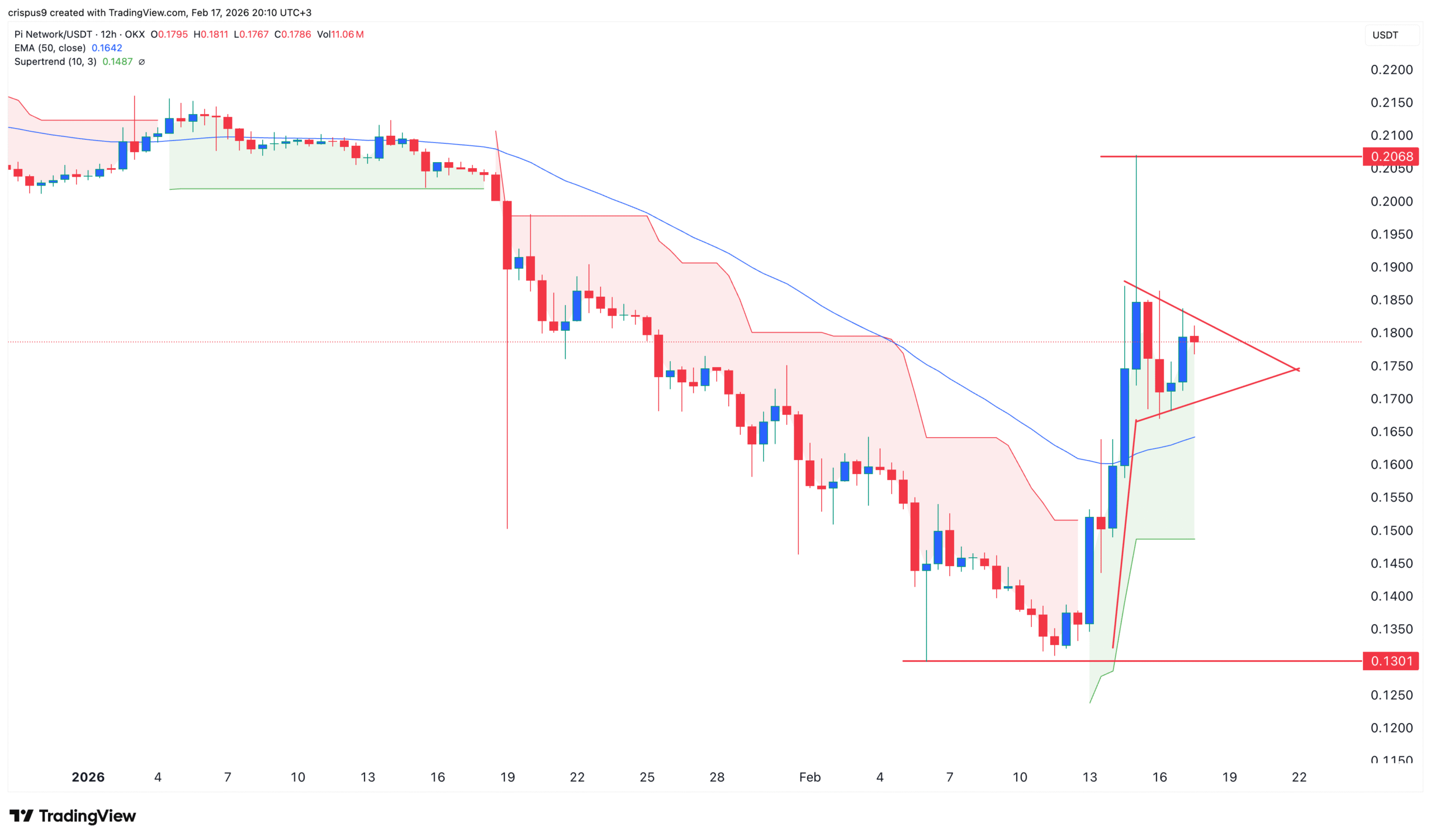

On the chart, the token trading around $0.18 – $0.19 Pi is attempting to confirm a bullish reversal after a rebound of nearly 40% from its annual lows. The Supertrend turning green suggests a change in momentum, with immediate resistance located at $0.2068.

A daily close above this level could validate a range breakout and open the path towards $0.25, a zone with high liquidity concentration and a key psychological level. This scenario will however depend on maintaining buying pressure in a still fragile environment.

Conversely, a rejection below $0.21 would put the market back under pressure, with critical support at $0.17. The big question remains whether there will be a possible decoupling from Bitcoin or simply a technical rebound in a cycle still dominated by caution.

Related Articles:

Passionate about cryptocurrencies since 2019, I cover the latest news through clear and accessible articles. My goal is to make crypto understandable for everyone, with reliable and well-researched content.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.