Pi Network (PI) Skyrockets Again : Will the Rally Continue This Week ?

The Pi Network has broken out of a seven-week consolidation, surging by a solid 16% today. As PI outperforms the market, a bullish trend reversal appears to be on the horizon.

The Pi Network has broken out of a seven-week consolidation, surging by a solid 16% today. As PI outperforms the market, a bullish trend reversal appears to be on the horizon.

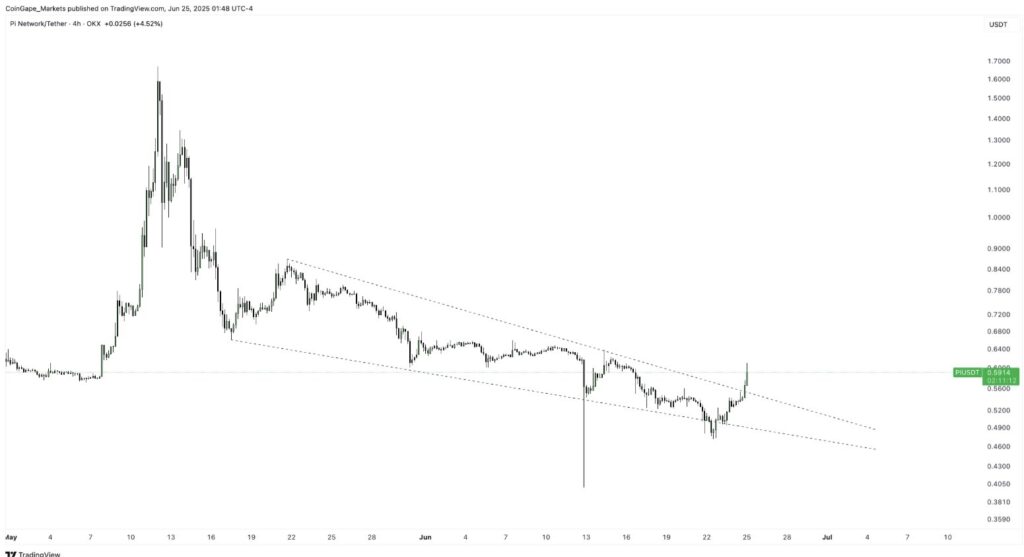

After experiencing a downtrend for several weeks, the price of PI Network has finally managed to break out of a descending wedge pattern. Within three days, the price soared from a low of $0.47 to a weekly high of $0.62. This marks a massive 16% increase. This bullish breakout above the upper resistance of the descending wedge pattern is a clear sign that buyers have regained control of the market.

The height of the descending wedge pattern, which is the difference between the May 17th low of $0.66 and the May 21st high of $0.86, suggests that PI could surge by about 30% in the short term. This would place the target price around $0.78, a key level to watch in the coming weeks.

Furthermore, a rounding bottom pattern has also formed on the 4-hour chart. This confirms the bullish momentum. Again, the height of this pattern indicates a potential 28% rise for PI.

The positive technical signals surrounding PI confirm that the trend reversal is indeed underway. After sellers were exhausted following the recent decline, buyers have taken charge. They are now pushing prices higher.

The next logical step for PI would be to surpass the symbolic $1 mark. If buyers maintain their momentum and traders looking for quick profits stay on the sidelines, such a progression is entirely feasible in the coming weeks.

Gaston has been a writer for over 7 years and a passionate cryptocurrency enthusiast since 2020. He loves exploring the crypto ecosystem and is now dedicated to sharing his insights and discoveries through InvestX.

DISCLAIMER

This article is for informational purposes only and should not be considered as investment advice. Trading cryptocurrencies involves risks, and it is important not to invest more than you can afford to lose.

InvestX is not responsible for the quality of the products or services presented on this page and cannot be held liable, directly or indirectly, for any damage or loss caused by the use of any product or service featured in this article. Investments in crypto assets are inherently risky; readers should conduct their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

Risk Warning : Trading financial instruments and/or cryptocurrencies carries a high level of risk, including the possibility of losing all or part of your investment. It may not be suitable for all investors. Cryptocurrency prices are highly volatile and can be influenced by external factors such as financial, regulatory, or political events. Margin trading increases financial risks.

CFDs (Contracts for Difference) are complex instruments with a high risk of rapid capital loss due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should assess whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Before engaging in financial or cryptocurrency trading, you must be fully informed about the associated risks and fees, carefully evaluate your investment objectives, level of experience, and risk tolerance, and seek professional advice if needed. InvestX.fr and the InvestX application may provide general market commentary, which does not constitute investment advice and should not be interpreted as such. Please consult an independent financial advisor for any investment-related questions. InvestX.fr disclaims any liability for errors, misinvestments, inaccuracies, or omissions and does not guarantee the accuracy or completeness of the information, texts, graphics, links, or other materials provided.

Some of the partners featured on this site may not be regulated in your country. It is your responsibility to verify the compliance of these services with local regulations before using them.